pipeline

By earth end the cloudy but I badly went e brandnew bankside, bedamp and I do, and a plumper at that!

{ Police have made a public appeal for help to solve the mystery of how a grandfather was apparently shot by a stray bullet as he tended his front garden. Detectives, who admit that it is one of the strangest cases they have encountered, are working on one theory that the gunman could have fired into the air, possibly streets away, and remains unaware of the consequences of his actions. | Times | Continue reading }

‘The ceremony of innocence is drowned; the best lack all conviction, while the worst are full of passionate intensity.’ –Yeats

{ A dog that has been seen at nearly every demonstration in Athens over the last two years has turned up again during the recent protests against new austerity measures. He always seems to side with the protesters, whatever the dispute. | AFP/The Guardian | more l Thanks Willie }

Your future, our clutter

During the last two decades, the American economy has suffered from a series of legal, fiscal and monetary policies that have favored speculation over production. The result has been the financialization of the economy, which has been characterized in economic terms by an unhealthy growth in debt at all levels of the economy and in cultural terms by the monetization of all values. Entities such as Fannie Mae and Freddie Mac were perfect examples of how the free market had been corrupted before the 2008 financial crisis. The crisis itself demonstrated, however, that the logic of the system required all large institutions to suffer from a similar flaw. Yet these flaws were not inevitable, even at the height of the crisis; they were deliberate political choices. While stakeholders of some institutions, such as Lehman Brothers, were wiped out, those of other firms were not and some were even made whole. The most egregious example of this was the handling of American International Group (AIG), the insurance giant that morphed itself into a giant hedge fund while enriching the officials responsible for some of the most ill-informed judgments in financial history. There was no reason for the government to handle the AIG failure in a manner that made whole foreign counterparties and Goldman Sachs; alternatives including offering a blanket credit guarantee to the insurance company that would have calmed markets and obviated the necessity of the company paying out one hundred cents on the dollar for its reckless insurance bets on synthetic mortgage obligations. While the result – avoidance of the extinction-level-event that an AIG failure would have been for the financial system – was the correct one, the means by which it was achieved furthered the agenda of socializing losses and privatizing gains and bred deep distrust in the government and the system.

Much of the crisis could have been avoided had policymakers and investors operated under realistic assumptions about how markets and economies work. Several years ago, former Federal Reserve Chairman Alan Greenspan described the failure of interest rates to react in the manner he expected as a “conundrum.” We now know that Mr. Greenspan was operating under a false set of assumptions about human nature, as well as a misguided understanding about how market participants behave. As noted in my book, had Mr. Greenspan been an acolyte of Hyman Minsky instead of Ayn Rand, he would have been less susceptible to such a fatal conceit. But beyond that, the real conundrum in modern markets is the continued reliance of investors and policymakers on two false mantras. The first is that markets are efficient; and the second is that investors are rational. Both assertions are so decidedly specious that one has to question both the sanity or the intelligence of those who cling to them.

{ Michael E. Lewitt | Continue reading }

A day after a harrowing plunge in the stock market, federal regulators were still unable on Friday to answer the one question on every investor’s mind: What caused that near panic on Wall Street? (…) The cause or causes of the market’s wild swing remained elusive, leaving what amounts to a $1 trillion question mark hanging over the world’s largest, and most celebrated, stock market. (…)

A government official who was involved in the investigation said regulators had moved away from a theory that it was a trading mistake — a so-called fat finger episode — and were examining the links between the futures and cash markets for stocks.

In particular, this official said, it appeared that as stock trading was slowed on the New York Exchange when big price moves started, orders moved automatically to other, electronic exchanges that did not have pricing restrictions.

The pressure in the less-liquid markets was amplified by the computer-driven trades, which led still other traders to pull back. Only when traders began to manually respond to the sharp drop did the market seem to turn around, said the official, who spoke on the condition of anonymity because the investigation was not complete.

On Friday evening, another government official directly involved in the investigation said that regulators had not yet been able to completely rule out any of the widely discussed possible causes of the market’s gyrations.

This official, who also spoke on the condition of anonymity, said that regulators had collected statistical and trading data from stock and futures exchanges, and had begun cross-analyzing that with trading reports from brokerage firms and large market participants. Regulators have also gathered anecdotal accounts of what happened from hedge funds and other trading firms. (…)

Over the last five years, the stock market has split into a plethora of new competing hubs and trading outlets, a legacy of deregulation earlier this decade and fast-paced technological change. On Friday, the rivalry between the two main exchanges erupted into view as each publicly pointed the finger at the other for being a main cause of the collapse on Thursday, which sent shockwaves around the globe. (…)

The absence of a unified system to halt trading in individual stocks led to bitter accusations between exchanges on Friday. Robert Greifeld, chief executive of Nasdaq OMX, appeared on CNBC to criticize the New York Stock Exchange for halting trading for up to 90 seconds in half a dozen stocks on Thursday.

“Stopping for 90 seconds in time of crisis is exactly equivalent to not picking up the phone,” Mr. Greifeld said.

A few minutes later, Duncan L. Niederauer, chief executive of NYSE Euronext, responded in an interview on CNBC, blaming Nasdaq’s computers for continuing trading while the market was in free fall.

{ NY Times | Continue reading | update: As several stocks declined sharply under heavy selling pressure, the New York Stock Exchange, one of the largest pools, stopped or slowed trading in particular stocks. | Washington Post | full story }

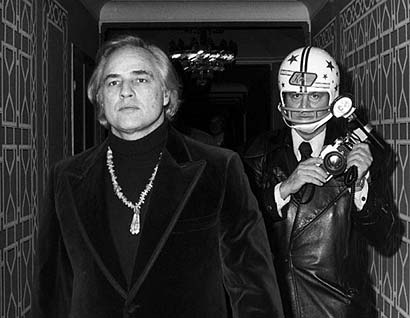

photo { Ron Gallela | SMASH HIS CAMERA, Opening with the artist at Clic Gallery, 424 Broome Street, NYC, June 10th | Read more }

‘Stop arguing Liz Lemon, we have more important things to worry about, like where are those french fries I didn’t ask for.’ –Tracy Jordan

{ Iamamiwhoami is the latest in intriguing mystery viral video phenomenon. … nine video music releases … Speculation has focused on artists such as Jonna Lee of Sweden, Trent Reznor , Little Boots , The Knife , *especially Karin Dreijer Andersson , Goldfrapp, Lykke Li , Gwen Stefani , Madonna , Lady Gaga , & Immi. | Fierth | full story + videos }

‘That virgin, vital, beautiful day: today.’ –Mallarmé

I woke up one day and everything in the apartment had been stolen and replaced with an exact replica. I said to my roommate, ‘Can you believe this? Everything in the apartment has been stolen and replaced with an exact replica.’ He said, ‘Do I know you?’

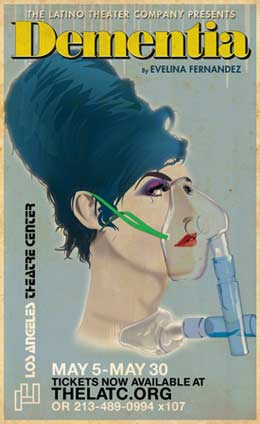

photo { Johan Willner }

Grip my hips and move me, everybody get down on me

Women in Paris may soon be allowed to wear trousers – which they have been technically banned from doing for 210 years.

Any woman in the capital that wishes to ‘dress like a man’ must obtain permission from the police, according to a law from 1800.

The law was relaxed slightly in 1892, when trousers were permitted ‘as long as the woman is holding the reins of a horse’.

photo { Emilia Nilsson }

‘Nothing lasts. You can’t count on anything but yourself.’ –Dashiell Hammett

Giant ice sheets in Antarctica behave like mirrors, reflecting the sun’s energy and moderating the world’s temperatures. The waxing and waning of these ice sheets contribute to changes in sea level and affect ocean circulation, which regulates our climate by transporting heat around the planet.

Despite their present-day cold temperatures, the poles were not always covered with ice. New climate records recovered from Antarctica during the recent Integrated Ocean Drilling Program (IODP) “Wilkes Land Glacial History” Expedition show that approximately 53 million years ago, Antarctica was a warm, sub-tropical environment. During this same period, known as the “greenhouse” or “hothouse” world, atmospheric CO2 levels exceeded those of today by ten times.

Then suddenly, Antarctica’s lush environment transitioned into its modern icy realm. In only 400,000 years — a mere blink of an eye in geologic time — concentrations of atmospheric carbon dioxide decreased. Global temperatures dropped. Ice sheets developed. Antarctica became ice-bound.

How did this change happen so abruptly and how stable can we expect ice sheets to be in the future?

To answer these questions, an international team of scientists participating in the Wilkes Land Glacial History Expedition spent two months aboard the scientific research vessel JOIDES Resolution in early 2010, drilling geological samples from the seafloor near the coast of Antarctica. Despite negotiating icebergs, near gale-force winds, snow, and fog, they managed to recover approximately 2,000 meters (over one mile) of sediment core.

photo { Alessandro Zuek Simonetti }

Benford’s Law of Controversy: Passion is inversely proportional to the amount of real information available.

Two years ago, a police officer in a Brooklyn precinct became gravely concerned about how the public was being served. To document his concerns, he began carrying around a digital sound recorder, secretly recording his colleagues and superiors.

He recorded precinct roll calls. He recorded his precinct commander and other supervisors. He recorded street encounters. He recorded small talk and stationhouse banter. In all, he surreptitiously collected hundreds of hours of cops talking about their jobs.

Made without the knowledge or approval of the NYPD, the tapes—made between June 1, 2008, and October 31, 2009, in the 81st Precinct in Bedford-Stuyvesant and obtained exclusively by the Voice—provide an unprecedented portrait of what it’s like to work as a cop in this city.

illustration { Stuart Patterson }

I don’t like to negotiate with people that I can’t beat up

Imagine a market for highly sought-after items in which the makers and sellers work hard to ensure that the items go only to certain buyers, even if other buyers might be willing to pay more. The favored buyers are then expected not to resell the items for many years, even if the values skyrocket. Ideally, in fact, the buyers are expected to give these items away eventually, for the public good. And if the buyers don’t abide by these expectations, they risk being cut off, cast out with the other unwashed wealthy who can afford to buy but have no access.

At least according to Craig Robins, a prominent Miami art collector and real estate developer who filed a federal lawsuit on March 29 in Manhattan, this is a portrait of the workings of the primary market for contemporary art, which, despite the recession, remains immense and highly competitive.

At its heart, the $8 million suit is a fairly ordinary contract dispute about confidentiality agreements and sales promises. But the details of the disagreement have provided a rare view into a normally very private world of high-end art selling in which membership rules, responsibilities, rewards and reprisals can be so complex and changeable that even art world veterans say they sometimes struggle to decode them.

{ NYTimes | Continue reading }

Days after the sabotage, one of his best-known older pieces, a suspended, taxidermised horse titled The Ballad of Trotsky, was auctioned in New York for $2.1m (£1.15m). Cattelan claims he won’t get a penny of that money - he sold the horse in 1996 for $5,000. Still, what is it like knowing your work is worth so much? “It’s like going to sleep 14 years old and waking up 30,” he says. “Things that maybe seemed a joke before are now taken more seriously.”

related { The Strange caase of Maurizio Cattelan | The Economics }

photo { unsourced | via Willie }

‘We learn from experience that men never learn anything from experience.’ –George Bernard Shaw

A collection of paintings that have caused art aficionados to turn a deep shade of purple and have provoked upset and anger throughout the art world are to go on show.

The forged works include a fake Botticelli, which was bought for a higher price than a genuine work by the artist sold at the same time. A gallery director almost had to resign because of another one, a fake Holbein.

In an unprecedented spirit of public transparency (and perverse pride), the National Gallery in central London is dusting down its holdings of forged paintings, accidentally bought as genuine works, supposedly by Botticelli, Holbein and Durer, among others, and showing them off to the public.

Some experts within the gallery actually prefer the fakes to the real thing, they revealed yesterday. Rachel Billinge, a research associate in the gallery’s conservation department, said she sometimes looked upon the forgeries with more admiration than the works by their genuine counterparts. “Sometimes you can appreciate their techniques, and the effort they put in, more than the original that was churned out by a bored apprentice at a workshop,” she said.

The last known fake bought by the gallery was in the late 1950s, when it acquired a painting believed to be a genuine Rembrandt, An Old Man in an Armchair. Signed and dated falsely, many curators have marvelled at its extraordinary technique and artistic achievement.

I’ve eaten like shit all my life but I run a lot every day

In the early years of the new century, huge force-on-force clashes and low-level irregular warfare aren’t the only threats faced by US military forces. Relatively small hostile groups either have or could acquire in the next few years access to sophisticated and lethal weaponry.

With modest training, modern communications, and strong command and control, these forces can employ such advanced weapons in concert with established guerrilla tactics and gain lethal effects once unavailable to such fighters.

Analysts are calling this type of conflict “hybrid warfare”—blending elements of different forms of combat. Participants in hybrid contests will comprise both nation-states and nonstate actors—sometimes with both on the same side, sometimes opposing one another. This distinctly new type of military challenge requires national security strategists and force planners to understand new realities and prepare America’s armed forces.

Hybrid warfare blurs the distinction between pure conventional and pure irregular warfare. At present, it is also a term with at least three applications. Hybrid can refer, first, to the battlespace environment and conditions; second, to enemy strategy choices; and third, to the type of force the US should build and maintain. Early examinations of this phenomenon have often used the term to apply to all these possibilities. In February, Marine Corps Gen. James N. Mattis, head of US Joint Forces Command and NATO Supreme Allied Commander Transformation, referred to both hybrid enemies and a hybrid force the US might build.

‘Some cause happiness wherever they go; others, whenever they go.’ –Oscar Wilde

Wildlife experts are hunting a rogue bull elephant in southern India accused of killing at least 10 female elephants during a testosterone-induced ’sex rampage’.

‘I don’t hate people. I just feel better when they are not around.’ –Bukowski

Usually when you see people who have been stung by box jellyfish with that number of the tentacle contacts on their body, it’s usually in a morgue. (…) The creature didn’t just sting the 10-year-old girl. It enveloped her: Its tentacles wrapped around her limbs and wouldn’t let go. She couldn’t see or breathe. The creature, which is capable of killing an adult in four minutes, wrapped its tentacles tighter and knocked her unconscious. (…) After several weeks in the hospital Shardlow is still feeling the effects - but the fact she is feeling anything at all - let alone doing as well as she is baffles Seymour. For now, besides scarring and memory loss, she is doing well.

related { Nomura jellyfish }

‘I always try to believe the best of everybody–it saves so much trouble.’ –Rudyard Kipling

The Oswego man charged with fatally shooting his wife and their three school-age children told police he was having marital problems caused by his affair in Mexico seven months earlier and his wife’s lack of interest in adopting his Druid beliefs.

{ Chicago Breaking News | Continue reading }

A controversial alternative health guru is suing after a taste of his own medicine nearly killed him.

Gary Null - described on quackwatch.org as “one of the nation’s leading promoters of dubious treatment for serious disease” - claims the manufacturer of Gary Null’s Ultimate Power Meal overloaded the supplements with Vitamin D.

The buff “Joy of Juicing” author, whose products include Red Stuff Powder and Gary Null’s Heavenly Hair Cleaner, claims he suffered kidney damage and was left bloodied and in intense pain from two daily servings of the supplement.

{ NY Daily News | Continue reading }

A Newport Beach man attempting to steal a pornographic magazine shoved a liquor store owner so fiercely that the man flew through the air and landed on the back of his head.

The owner died the day after the vicious attack on July 28, 2007 from a fractured skull and massive bleeding in the brain.

related { Man killed in bizarre high speed crash. }

‘History is a nightmare from which I am trying to awake.’ —James Joyce

{ Six Easy Steps to Avert the Collapse of Civilization | more | Thanks Doug! }