economics

Slowly, but surely, robots (and virtual ’bots that exist only as software) are taking over our jobs; according to one back-of-the-envelope projection, in ninety years “70 percent of today’s occupations will likewise be replaced by automation.” […]

If history repeats itself, robots will replace our current jobs, but, says Kelly, we’ll have new jobs, that we can scarcely imagine:

In the coming years robot-driven cars and trucks will become ubiquitous; this automation will spawn the new human occupation of trip optimizer, a person who tweaks the traffic system for optimal energy and time usage. Routine robosurgery will necessitate the new skills of keeping machines sterile. When automatic self-tracking of all your activities becomes the normal thing to do, a new breed of professional analysts will arise to help you make sense of the data.

Well, maybe. Or maybe the professional analysts will be robots (or least computer programs), and ditto for the trip optimizers and sterilizers.

{ The New Yorker | Continue reading }

economics, future, ideas, robots & ai | January 1st, 2013 11:24 am

economics, marketing, new york | December 28th, 2012 10:04 am

As the percentage of wives outearning their husbands grows, the traditional social norm of the male breadwinner is challenged. The upward income comparison of the husband may cause psychological distress that affects both partners’ mental and physical health in ways that impact decisions on marriage, divorce, and careers. This paper studies this impact through sexual and mental health problems. Using wage and prescription medication data from Denmark, we implement a regression discontinuity design to show that men outearned by their wives are more likely to use erectile dysfunction (ED) medication than their male breadwinner counterparts, even when this inequality is small. Breadwinner wives suffer increased insomnia/anxiety medication usage, with similar effects for men. We find no effects for unmarried couples or for men who earned less than their fiancée prior to marriage. Our results suggest that social norms play important roles in dictating how individuals respond to upward social comparisons.

{ Personality and Social Psychology Bulletin/SSRN | Continue reading }

economics, genders, health | December 27th, 2012 3:24 pm

Closed systems, or three-party systems, such as Discover and American Express typically issue cards to consumers and acquire merchants to accept the card. They set fees to both sides, which largely consist of an annual fee, an interest rate (for credit cards) and a rewards program for consumers, and a fee for merchants (termed the merchant discount in the industry). A closed card platform can choose any structure of prices that it so desires between cardholders and merchants. In particular, if low cardholder fees and high merchant fees are what generate the most card transactions or profit, then the closed card system is free to set this structure of prices.

In contrast, many of the largest systems separate the clearing-house services from the task of obtaining consumers and merchants. This is true for Visa and MasterCard, as well as for debit networks such as NYCE and Pulse. Thus, the direct customers of these systems are banks. The systems are open in the sense that any bank or equivalent financial institution can join. In these systems, banks join and then seek to issue cards to consumers and acquire merchants to accept cards. When a consumer makes a purchase from a merchant, the payment is authorized and routed from the issuing bank through the payment system (i.e., Visa or NYCE) to the merchant’s account with the acquiring bank; subject to liability rules governing fraud, payments are generally guaranteed to the merchant, and the issuer is responsible for collecting funds from the consumer. Since many banks are typically associated with each system, there can be substantial competition among banks to offer access to the system. The competition takes place over the terms mentioned above, fees and rewards, and other features such as consumer protection and customer service. Open systems are often referred to as four-party systems, referring to the merchant, the consumer and the two banks, although the network owner is really a fifth party.

Typically, the owner of the open system collects a fee, often called the switch fee for the service. These are fairly small and, to date, have been largely uncontroversial. In addition to the switch fee, open systems set an interchange fee. The interchange fee is an amount that the merchant’s bank pays to the consumer’s bank as part of a typical purchase transaction.

{ The Economics of Payment Cards/SSRN | Continue reading }

economics | December 18th, 2012 2:23 pm

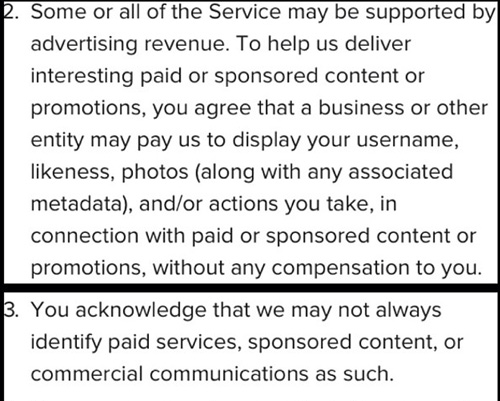

economics, haha, social networks | December 17th, 2012 2:15 pm

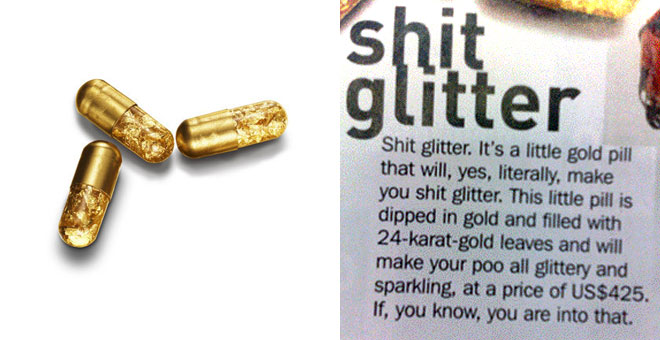

art, economics, haha | December 13th, 2012 4:34 am

In fact, crosswords are made by people (called constructors) whose status is roughly equivalent to freelance writers—that is to say, low. Puzzles are sent on spec to editors, who buy them or turn them down, and who fine-tune the ones they accept without, as a nearly universal rule, consulting the constructor. Submissions may sit in an editor’s inbox for months or even years before the author hears back. (A few months ago, constructor Tim Croce received an acceptance from The New York Times—for a puzzle he submitted in 2001.) […]

Most outlets offer less than $100 for a daily crossword and less than $300 for a Sunday-sized. […] The New York Times, which runs the most prestigious American crossword series, pays $200 for a daily or $1,000 for a Sunday.

{ The Awl | Continue reading }

The construction of a crossword consists of two operations that are quite different and in the end perfectly independent of each other: the first is the filling of the diagram; the second is the search for definitions.

{ Georges Perec/The Believer | Continue reading }

economics, leisure | December 10th, 2012 11:24 am

China is the world’s top producer of honey: it turns out about a quarter of the world’s supply.

Chinese honey is cheap and the US had been a major importer. But in 2001, in the wake of a US government investigation that found domestic honey producers being harmed by significant price disparities between Chinese and American honey, the US levied an anti-dumping duty of roughly $1.20 per pound (454 gm) on Chinese honey. This tariff, its imposition implying that this honey was being sold below its real cost of production, was intended to level the playing field for American beekeepers who could not compete with imported honey selling in America at half their cost.

For companies like ALW that were importing tonnes of Chinese honey into the US every year, this was a big business setback. To evade the duty, some of them started getting shipments via third countries, with the honey’s point-of-origin relabelled accordingly. After all, no tariff was due on honey from India, Malaysia, Mongolia or Russia.

The operation soon came to be called ‘honey laundering’. ALW was one among several firms doing it, but it has been in the spotlight ever since the arrests. According to a 44-count indictment of the firm, over 2004-06, it laundered over 2 million pounds—900 tonnes—of Chinese honey through India, evading nearly $80 million in duties.

{ Open | Continue reading }

asia, economics | December 7th, 2012 9:47 am

Check Point has revealed how a sophisticated malware attack was used to steal an estimated €36 million from over 30,000 customers of over 30 banks in Italy, Spain, Germany and Holland over summer this year.

The theft used malware to target the PCs and mobile devices of banking customers. The attack also took advantage of SMS messages used by banks as part of customers’ secure login and authentication process.

The attack worked by infecting victims’ PCs and mobiles with a modified version of the Zeus trojan. When victims attempted online bank transactions, the process was intercepted by the trojan.

Under the guise of upgrading the online banking software, victims were duped into giving additional information including their mobile phone number, infecting the mobile device. The mobile Trojan worked on both Blackberry and Android devices, giving attackers a wider reach.

{ Net Security | Continue reading }

Onity, the company whose locks protect 4 million or more hotel rooms around the world, has agreed to reimburse at least some fraction of its hotel customers for the cost of fixing a security flaw exposed in July.

{ Forbes | Continue reading }

Some cyberattacks over the past decade have briefly affected state strategic plans, but none has resulted in death or lasting damage. For example, the 2007 cyberattacks on Estonia by Russia shut down networks and government websites and disrupted commerce for a few days, but things swiftly went back to normal. The majority of cyberattacks worldwide have been minor: easily corrected annoyances such as website defacements or basic data theft — basically the least a state can do when challenged diplomatically.

Our research shows that although warnings about cyberwarfare have become more severe, the actual magnitude and pace of attacks do not match popular perception.

{ Foreign Affairs | Continue reading }

economics, spy & security, technology | December 7th, 2012 9:32 am

From an office on Sunset Boulevard, a dapper 69-year-old has emerged as a go-to guy for musicians and songwriters looking for quick cash.

His name is Parviz Omidvar, and over the past two decades, he has been lending to artists and securing those debts with royalty payments his clients earn from their work. Michael Jackson was a customer, as is the son of late Motown legend Marvin Gaye. Omidvar’s website carries an old testimonial from Rock and Roll Hall of Fame member Bobby Womack: “Thank you so much for always being there for me.”

Today, Womack is suing Omidvar for fraud. He alleges the financier tricked him into selling for $40,000 full control of a royalty stream that annually pays many times that amount on Womack-penned hits, including blaxploitation classic “Across 110th Street” and “It’s All Over Now,” the first U.S. No. 1 record for the Rolling Stones. Womack’s lawyer says the 68-year-old musician was misled into signing the deal in April last year, when he was incapacitated by painkillers following prostate cancer surgery.

Omidvar calls Womack’s claim “a simple case of buyer’s remorse.” Womack understood he was selling his royalties, and his allegations are “a complete lie,” Omidvar says.

Omidvar’s quick cash can come at a steep price. Reuters found scores of loans with interest rates ranging from 1.5 to 2.5 percent every 10 to 15 days - annualized rates potentially ranging from 43 percent to 81 percent.

{ Reuters | Continue reading }

economics, l.a. pros and cons, music | December 7th, 2012 9:22 am

People who recall being absolved of their sins, are more likely to donate money to the church, according to research published today in the journal Religion, Brain and Behavior.

{ EurekAlert | Continue reading }

photo { Michael Wolf }

economics, psychology | December 6th, 2012 10:05 am

In 1979, Brenda and Richard Jorgenson built a split level home in the midst of a large ranch outside the tiny town of White Earth, North Dakota. […] For most of their lives the landscape of the region has been dominated by agriculture – wheat, alfalfa, oats, canola, flax, and corn. The Jorgensons always figured they would leave the property to their three children to pursue the same good life they have enjoyed.

Then the oil wells arrived. They began appearing in 2006, and within just a few years dominated the area landscape. Today at least 25 oil wells stand within two miles of the Jorgensons’ home, each with a pump, several storage tanks, and a tall flare burning the methane that comes out of the ground along with the petroleum.

Like most people in North Dakota, the Jorgensons only own the surface rights to their property, not the subsurface mineral rights. So there was nothing they could do when, in May 2010, a Dallas-based oil company, Petro-Hunt, installed a well pad on the Jorgensons’ farm, next to a beloved grove of Russian olive trees. […] Some 80 trees were dead by the summer of 2011.

{ Guardian | Continue reading }

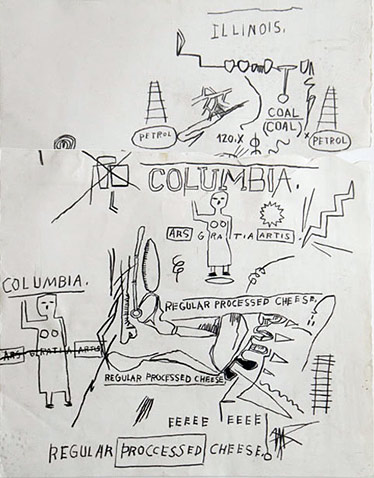

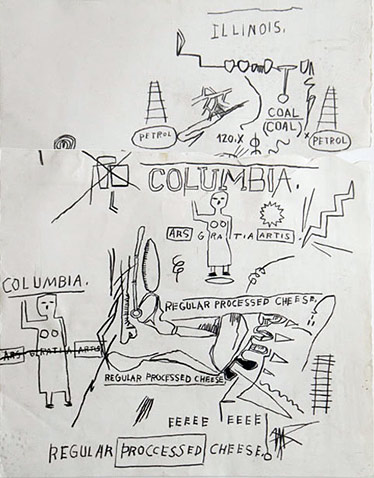

artwork { Basquiat, Untitled, 1982 }

related { Ukraine Crushed in $1.1bn Fake Gas Deal | Thanks GG }

economics, housing, oil | December 6th, 2012 9:15 am

Six years ago, Mexico was the world’s ninth largest exporter of cars. Today the country is ranked fourth—behind Germany, Japan and South Korea—with exports expected to total more than 2.14 million vehicles this year.

One in 10 cars sold last year in the U.S. was made in Mexico. Next year, every new taxi in New York’s fleet—made by Nissan Motor Co. —will carry the “Hecho en Mexico” label. Mexico is now exporting vehicles to China, and even helped Japan keep up with orders after last year’s tsunami.

Mexico’s Economy Minister Bruno Ferrari boasted that a batch of new factories planned by car makers will help Mexico surpass South Korea in a few years. […]

For decades, the free world drove cars made primarily in the U.S., Germany and Japan. But a global shift toward smaller cars has put pressure on profit margins, forcing car companies to find lower-cost manufacturing elsewhere. […]

Wages for Mexican assembly-line workers begin at $40 a day, experts said. That is far below minimum wage requirements in the U.S. or Europe and approaching the average manufacturing wage in China, which is $3 per hour.

{ WSJ | Continue reading }

economics, motorpsycho | November 21st, 2012 11:00 am

The shadow banking system is the collection of non-bank financial intermediaries that provide services similar to traditional commercial banks. It includes entities such as hedge funds, money market funds and structured investment vehicles (SIV). Investment banks may conduct much of their business in the shadow banking system (SBS), but most are not SBS institutions themselves.

{ Wikipedia | Continue reading }

The system of so-called “shadow banking,” blamed by some for aggravating the global financial crisis, grew to a new high of $67 trillion globally last year — more than the total economic output of all the countries in the study.

A report by the Financial Stability Board (FSB) on Sunday appeared to confirm fears among policymakers that shadow banking is set to thrive, beyond the reach of a regulatory net tightening around traditional banks and banking activities.

{ Reuters | Continue reading }

economics | November 20th, 2012 7:57 am

The OECD has a new report out projecting what countries’ economic output, both total and per capita, will be in 2060. Unsurprisingly, the Chinese and Indian economies will have eclipsed the U.S. one, which will remain in third place.

But the per capita numbers are more striking, and encouraging. The report projects that between 2011 and 2060, real GDP per capita will increase sevenfold in India and China. In China, that means a jump from $8,387 in 2011 to almost $60,000 in 2060, in constant 2011 dollars. By contrast, U.S. GDP per capita in 2011 was $48,328.

OECD also projects declining inequality between countries over the next fifty years. The United States will still have a much bigger GDP per capita than China in 2060 — about $136,611, if the OECD is right. But that’s a little more than double China’s level, whereas today, U.S. GDP per capita is almost six times that of China’s.

{ Washington Post | Continue reading }

photo { Mark Power , The Shipping Forecast, 1992-96 }

asia, economics, photogs, within the world | November 19th, 2012 11:09 am

It’s all about the fact that people want to achieve two things at the same time. We want to think of ourselves as honest, wonderful people, and then we want to benefit from cheating. Our ability to rationalize our own actions can actually help us be more dishonest while thinking of ourselves as honest. So the idea that everybody else does it, or the idea that nobody is really going to suffer, or the idea that the entity you are stealing from is actually a bad entity, or the idea that you don’t see it—all of those things help people be dishonest.

{ Daniel Ariely/The Politic | Continue reading }

economics, psychology, scams and heists | November 18th, 2012 4:11 pm

Food and nutrition. In concept it seems straightforward enough. Food is what we eat to obtain the nourishment and thus the energy to keep us going from day to day. Yet food has undergone radical changes over the past hundred years, especially in the industrialized West. People who lived at the turn of the 20th century wouldn’t recognize today’s grocery stores, and they certainly wouldn’t recognize much of what fills grocery store shelves as nourishment.

It all began with a push toward greater convenience in an increasingly mechanized world. Electricity and then electronics brought with them an endless stream of new gadgets for the home, each promising to make life easier in some way. Many of these time- and labor-saving devices were destined for the kitchen. Factories, too, were retooled to streamline the manufacture of everything, including food. But a growing segment of today’s population is concerned about healthy eating and about the place of heavily processed foods in their diet. Should convenience be the ruler by which we measure food and nutrition?

Some convenience foods actually predate the 20th century, among them canned soups, fruits and vegetables; gelatin dessert mixes; ketchup and other prepared condiments; pancake mixes; ready-to-eat breakfast cereals; sweetened condensed milk. After the First World War, these and more found their way into the kitchens of eager young housewives, with manufacturers often promoting their innovative products via free recipe books.

There’s no denying that flavor, texture and nutrients suffered, but people began to rely on these conveniences, and their tastes simply changed to accommodate. […]

Throughout the 20th century, the food industry worked to provide not only convenience but also ostensibly wholesome substitutes for natural foods, including butter. In fact, margarine has been around since the late 19th century, but for many years it was white by law. Eventually, however, it came with added artificial flavor and a capsule of yellow artificial food coloring (to be kneaded in after purchase) so it would taste and look more like the real thing. […]

After several generations of variations on this theme, however, we are seeing the effects of eating foods that are so far removed from their original state. Not only are many diseases linked to poor diet—from certain cancers to diabetes to heart disease—but obesity affects an unprecedented segment of the Western population.

{ Vision | Continue reading }

economics, food, drinks, restaurants, gross | November 16th, 2012 3:55 am

This article looks in more depth at the different ways in which ideas about cashless societies were articulated and explored in pre-1900 utopian literature. Taking examples from the works of key writers such as Thomas More, Robert Owen, William Morris and Edward Bellamy, it discusses the different ways in which the problems associated with conventional notes-and-coins monetary systems were tackled as well as looking at the proposals for alternative payment systems to take their place. Ultimately, what it shows is that although the desire to dispense with cash and find a more efficient and less-exploitable payment system is certainly nothing new, the practical problems associated with actually implementing such a system remain hugely challenging.

{ MPRA/Academia | Continue reading }

economics, ideas | November 16th, 2012 3:55 am

In July, Wells Fargo paid a $175 million settlement after the feds caught its brokers systematically pushing minority customers into mortgages with higher rates and fees, even though they posed the same credit risks as whites.

One study found that Wells Fargo charged Hispanics $2,000 more in what the Justice Department called a “racial surtax.” The bank docked blacks nearly $3,000 extra for their own improper pigmentation.

Across the country, in Minneapolis, U.S. Bank also swindled its customers, though at least it let whites in on the action. Instead of logging debit card purchases in the order they were made, the bank rearranged them from highest amount to lowest, the better to artificially stick customers with overdraft fees.

U.S. Bank paid $55 million to settle a class action suit in July. It was the 13th major bank caught running this scam.

These were just the opening salvos of the assault. Bank of America was caught illegally foreclosing on the homes of active-duty soldiers. Visa and MasterCard were charged with fixing the prices they charged merchants to process credit card payments. Morgan Stanley colluded to drive up New York electricity prices. And in the most depraved case of all, Morgan Stanley was even sued for allegedly swindling Irish nuns in an investment deal.

{ Village Voice | Continue reading }

U.S., economics, scams and heists | November 13th, 2012 4:09 pm

Foxconn, the maker of Apple’s iPhone and iPad, plans to rely more on robots for manufacturing over the coming years, allowing the company to invest more in research and development and save on labor costs. […]

Local Chinese media reported that Foxconn CEO Terry Gou had said the company plans on deploying 1 million robots over the next three years to complete routine assembly tasks. Foxconn currently uses 10,000 robots. […]

The Taiwan-based company has more than 1 million employees, the majority of which are located at facilities in mainland China. Foxconn is one of the world’s largest producers of electronics. Aside from Apple, the company also manufactures products for companies like HP, Sony and Nintendo.

{ IT World | Continue reading }

asia, economics, future, robots & ai | November 13th, 2012 11:51 am