housing

Zillow and other tech firms are in an ‘arms race’ to buy up American homes. […]

increasingly competitive high-tech house-flipping market, otherwise known as the fast-growing “iBuyer” industry. […]

“It’s less about making money off that inventory, at least initially, and more about who can get the most inventory the fastest.” […]

After going public last year, Opendoor has now expanded into more than 40 markets and purchased 8,500 homes in the second quarter, more than any other quarter by almost 50%. The company, which is reportedly searching out a new $2 billion revolving credit facility, also announced this week that it is now willing to purchase the majority of homes in every one of its current markets.

Zillow announced similarly ambitious plans during its recent earnings call. While it bought only 3,800 homes in the second quarter, Zillow is gearing up to scale massively through the rest of 2021, saying that it expects its Homes division to bring in around $1.4-1.5 billion in revenue next quarter, roughly double what the division made this quarter. […]

“this business model can generate immense profits even if the profit per home isn’t eye-popping to the casual investor or analyst. […] Buying and selling 5,000 homes a month? It gets interesting.”

The spokesperson added that the company has an additional “dream” that people will one day sell one home on Zillow and then buy another on the website too.

{ Vice | Continue reading }

housing | August 14th, 2021 6:31 am

Canada, one of the most real estate-obsessed nations on earth — and one of the least affected by the 2008 crash — is up 42+% in the past year alone.

Even in Ethiopia, where my wife grew up, a three-bedroom detached house in the capital can cost you $1+ million USD.

Until recently, most people’s house price paradigm looked something like this:

A house’s market price is the maximum amount that a buyer can expect to afford over the next 25–40 years. But because wages are flatlined and purchasing parity is the same as in 1978, the only rational explanation for this current price explosion is a giant debt bubble.

But what if the paradigm — the baseline assumption of what dictates house prices — is changing?

What if the newly-redefined value of shelter is the maximum amount of annual rent that can be extracted per unit of housing? […]

As reader Valerie Kittell put it: “Airbnb-type models altered the market irreversibly by proving on a large scale that short term rentals were more lucrative than stable long-term residents.”

We’re in the middle of a paradigm shift to corporate serfdom.

Stop enriching corrupt banks — pay off your mortgages and never look back. Parents and grandparents with means: Help your kids get a start in housing before it’s out of their reach forever.

{ Jared A. Brock | Continue reading }

housing, theory | June 18th, 2021 8:16 am

There are more real estate agents than actual houses for sale in the United States.

Any given day, you’re likely to see about half a million homes for sale, and there are 1.5 million members of the National Association of Realtors.

{ NPR | Continue reading }

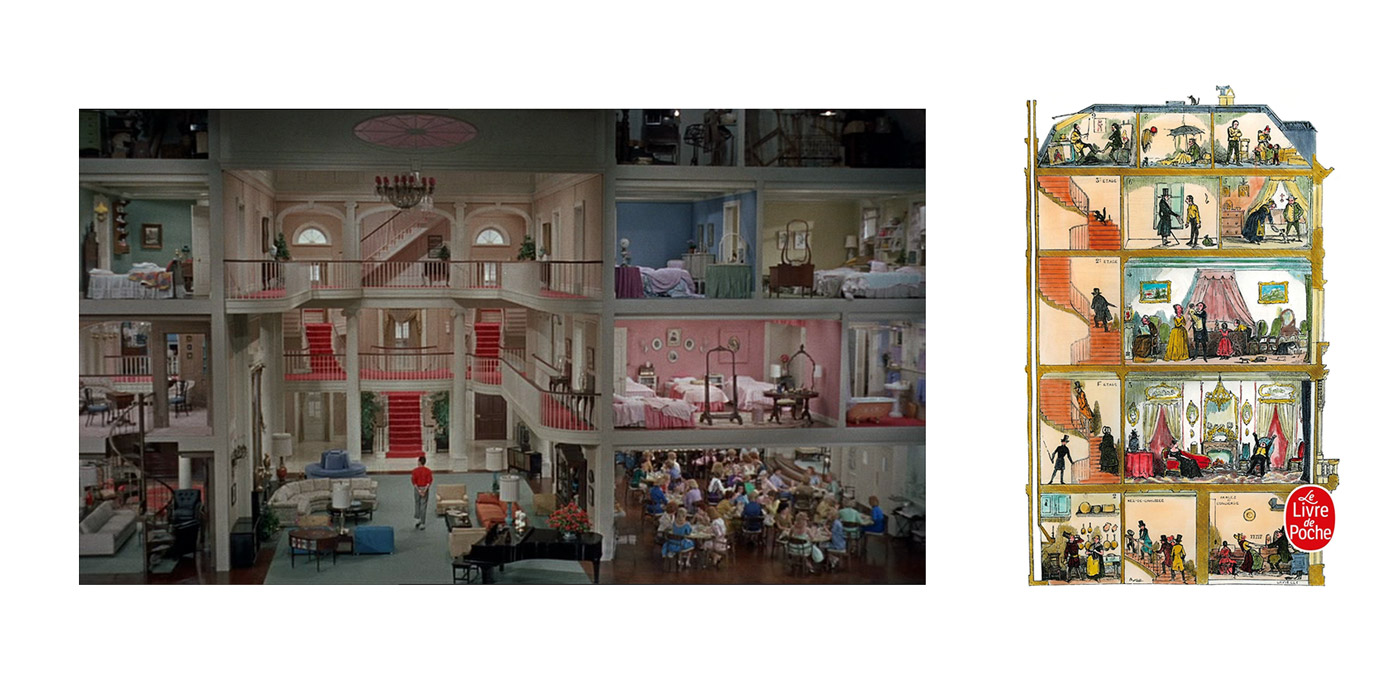

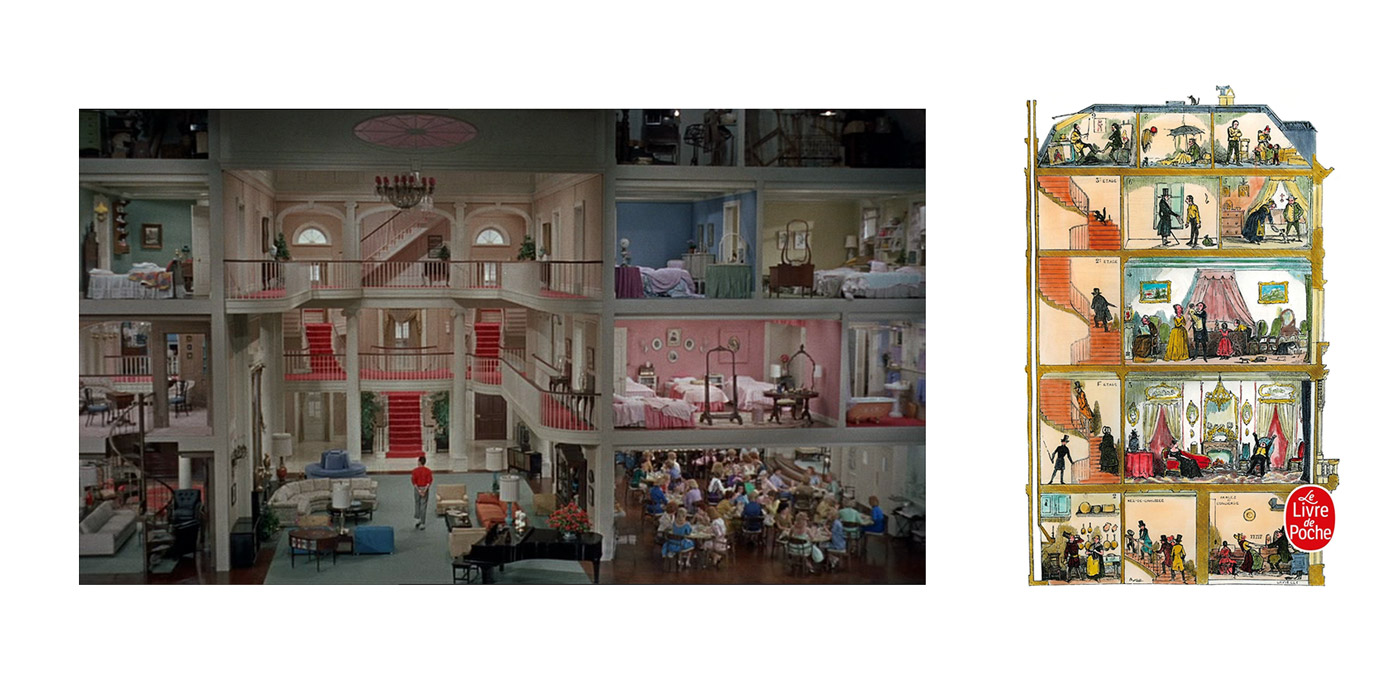

images { Jerry Lewis, The Ladies Man, 1961 | Georges Perec, La vie mode d’emploi, 1978 }

halves-pairs, housing | May 4th, 2021 12:23 pm

Gendville met Brooks-Church in an Area Yoga class, according to a person who has known the couple for more than a decade. He was “this sexy Spanish guy,” a flâneur type. He had grown up mostly on the resort island of Ibiza, the son of outlaw parents, hippies hunted by the Feds for two antiwar bombings in the ’80s until his mother turned herself in and his father reportedly got caught in Arkansas trying to pick up $6 million in cocaine. Brooks-Church became an adherent of Human Design, a pseudoscience combining astrology and chakras, which was created on Ibiza in 1992 by an advertising executive named Alan Krakower, who claimed to have received messages on the meaning of life from an entity called “the Voice.” […]

Brooks-Church, 49, was a “green builder” with a construction company called Eco Brooklyn who had spoken about sustainability at the Brooklyn Public Library; he was a vocal advocate for designating the Gowanus Canal a Superfund site, making it eligible for environmental protections. He did CrossFit. Gendville, 45, was the owner of a restaurant called Planted Community Cafe and a local chain of yoga studios, spas, and children’s stores called Area — a “mini-mogul,” according to the New York Times. The pair were currently renting out a brownstone they owned on Airbnb not five miles away, with a tree house and turtle pond, for nearly $800 a night. What could drive two yogic, environmentally conscious, vegan brownstoners to kick out their unemployed tenants during a global pandemic? […]

Though they own two businesses and six properties in one of the country’s most expensive real-estate markets, the landlords were apparently homeless.

{ NY mag | Continue reading }

housing, new york | September 1st, 2020 4:54 pm

$350,000 […] connected to the home is a 2500 sq ft legitimate jail with 9 cells, booking room and 1/2 bath.

{ flexmls | Continue reading }

household, housing | August 17th, 2020 7:49 am

[A]verage quality-adjusted single-family house prices, corrected for overall inflation, have risen a paltry 1.1% at a compound annual rate since 1972. […] Since 1972, 30-year fixed-rate mortgage rates in real terms have averaged 4.1%, meaning it has cost the homeowner 3% per year to own a house before taxes, maintenance, utilities and insurance. That’s a real negative return.

{ Bloomberg | Continue reading }

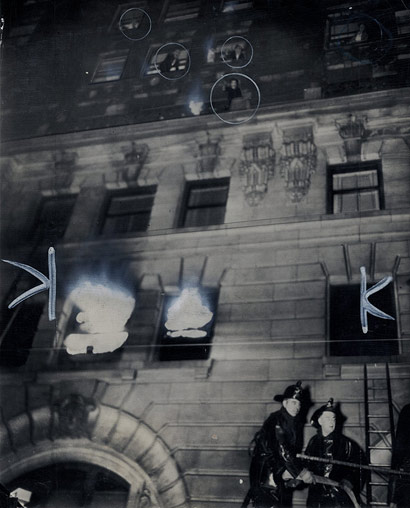

photo { Frank Lloyd Wright at the Guggenheim Museum during construction, photographed by Sam Falk, 1957 | NY Times }

housing | November 4th, 2019 6:20 pm

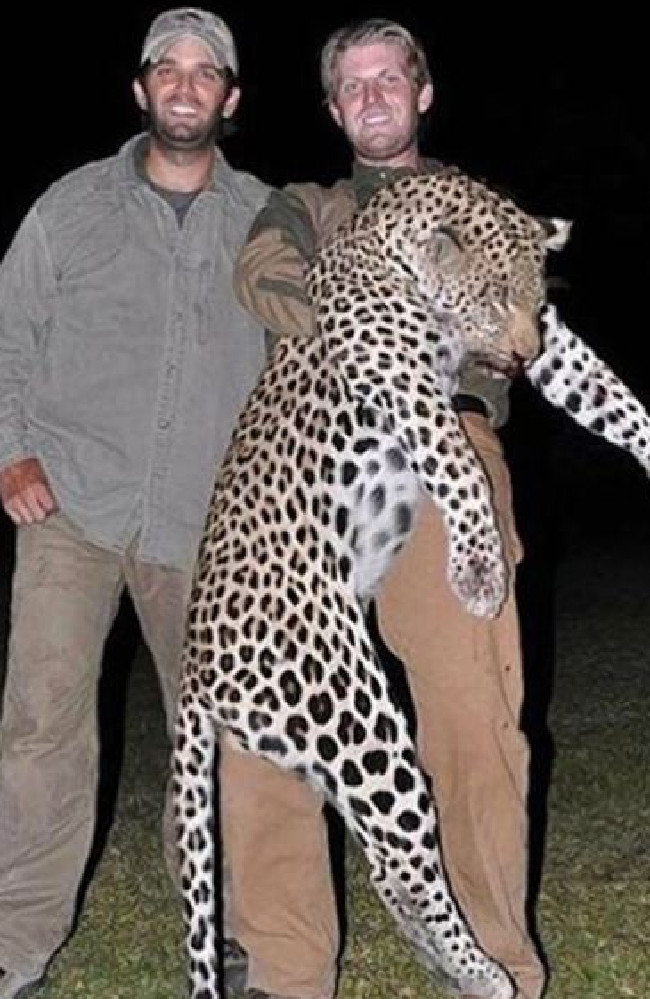

A company tied to Donald Trump Jr. and Eric Trump owns a 171-acre hunting preserve that is being used as a private shooting range. […]

During negotiations, said Joe Kleinman — who with his wife, Jocelyn, sold the property in August 2013 for $665,000 — the buyer’s agent tried to reduce the price by invoking a 1991 state court decision that requires buyers disclose to sellers if a property is known to be haunted.

Kleinman refused, saying anyone who truly believed it was haunted would either abandon the sale or pay a premium.

{ Poughkeepsie Journal | Continue reading }

quote { entire crew is HorseFaced for real }

U.S., guns, housing | March 7th, 2019 1:55 pm

[T]he patient was a woman who, although she was being examined in my office at New York Hospital, claimed we were in her home in Freeport, Maine. The standard interpretation of this syndrome is that she made a duplicate copy of a place (or person) and insisted that there are two. […]

This woman was intelligent; before the interview she was biding her time reading the New York Times. I started with the ‘So, where are you?’ question. ‘I am in Freeport, Maine. I know you don’t believe it. Dr Posner told me this morning when he came to see me that I was in Memorial Sloan-Kettering Hospital. […] Well, that is fine, but I know I am in my house on Main Street in Freeport, Maine!’ I asked, ‘Well, if you are in Freeport and in your house, how come there are elevators outside the door here?’

The grand lady peered at me and calmly responded, ‘Doctor, do you know how much it cost me to have those put in?’ […]

Because of her lesion the part of the brain that represents locality is overactive and sending out an erroneous message about her location. The interpreter is only as good as the information it receives, and in this instance it is getting a wacky piece of information.

{ NeuroDojo | Continue reading }

brain, housing | November 15th, 2014 1:19 pm

And so the housing “recovery” comes to a screeching halt, which is not surprising as there never was a recovery to begin with. Moments ago cheerleaders of the second housing bubble were shocked to learn that in July a tiny 35K new houses were sold (with just 3K sold in the Northeast, and just 19K in the otherwise strong South), of which 13K houses were not even started. This translated into a puny 394K seasonally adjusted annualized sales, missing expectations of 487K by nearly a massive 100K, and in addition the June print was revised much lower from 497K to 455K (which back in July beat expectations of 484K and was trumpeted as the highest print since 2008 - so much for that). Yet one thing that did not change is that the median home sale price decline continued, and in July dropped to $257.2K down from $258.5.

{ Zero Hedge | Continue reading }

U.S., housing | August 23rd, 2013 2:58 pm

From Bloomberg’s Jody Shenn:

Wells Fargo & Co., the largest U.S. mortgage lender, is offering 30-year fixed-rate loans at 4.5 percent, according to its website, up from 4.13 percent on June 18 and 3.88 percent on May 22, when comments by Bernanke to lawmakers and the release of the minutes of the last Fed meeting caused bonds to plummet.

So in one month, the average 30 year fixed rate mortgage has jumped by over 60 basis points. What does this mean for net purchasing power? […] Assuming a $2000/month budget to be spent on amortizing a mortgage (or otherwise spent for rent), it means that suddenly instead of being able to afford a $425K house, the average consumer can buy a $395K house.

This means that, all else equal, housing just sustained a 7% drop in the average equlibrium price based on what buyers can afford.

{ Zero Hedge | Continue reading }

economics, housing | June 21st, 2013 10:12 am

REITs [Real Estate Investment Trust] are sold like stocks, and they’re held by many individuals and institutional investors. You might have a REIT in your retirement fund. REITs are trusts that own and develop property and earn rental income. […] “They are forced by law — a law created in 1960 — that provides that real estate investment trusts have to meet certain tests,” says Brad Thomas, editor of the Intelligent REIT Investor. “And if they do, they are forced to pay out 90 percent of their taxable income in the form of dividends.” Those dividends are a regular stream of income, and they’re what make REITs attractive to investors.

I put down $513.94 on a REIT index fund. It’s basically a smorgasbord of many different REITs. It contains what you might expect — REITs that own apartment buildings and shopping centers. But Thomas says the range of REITs today goes far beyond that, “from billboards to prisons to cell towers, campus housing. Even solar is on the horizon potentially.”

{ NPR | Continue reading }

related { Agents use a median 250 characters for homes listed under $100,000. For homes priced over $1 million, they go nearly twice as long, with a median 487 characters. }

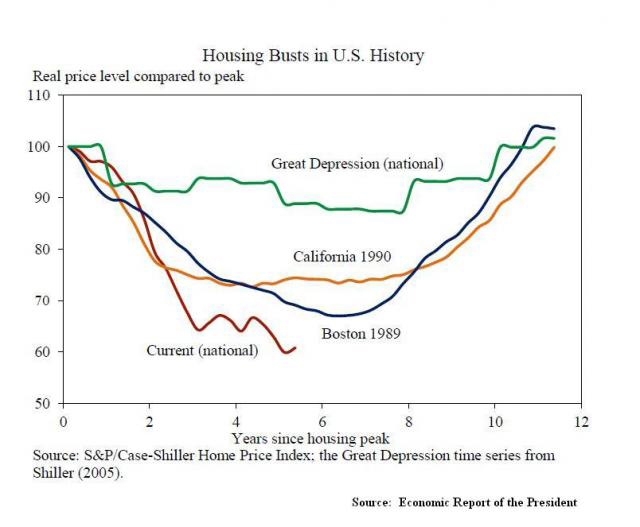

related { If There Is A “Housing Recovery” Then This Chart Can’t Be Right }

housing, traders | June 13th, 2013 1:40 pm

The airwaves are full of stories of economic recovery. One trumpeted recently has been the rapid recovery in housing, at least as measured in prices.

The problem is, a good portion of the rebound in house prices in many markets has less to do with renewed optimism, new jobs, and rising wages, and more to do with big money investors fueled by the ultra-cheap money policies of the Fed.

On my recent trip to Salt Lake City, Utah, after presenting to a bi-partisan audience in the Capitol building, a gentleman came up to me and introduced himself as a real estate agent. He explained that he’d been seeing something very strange over the past six months, where very well capitalized, out-of-state private equity funds had been buying up huge swaths of residential real estate with cash.

The effect, not surprisingly, is that regular home buyers are being outbid and eventually priced out of the market. Over time, these full cash offers at the ask get noticed and home sellers begin to raise their asking prices.

{ Chris Martenson/Zero Hedge | Continue reading }

[W]e were surprised to see an article in the very much mainstream, and pro-administration policies NYT, exposing just this facet of the new housing bubble. […]

Blackstone, which helped define a period of Wall Street hyperwealth, has bought some 26,000 homes in nine states. Colony Capital, a Los Angeles-based investment firm, is spending $250 million each month and already owns 10,000 properties. With little fanfare, these and other financial companies have become significant landlords on Main Street. Most of the firms are renting out the homes, with the possibility of unloading them at a profit when prices rise far enough.

{ Tyler Durden/Zero Hedge | Continue reading }

more { The Entire US Housing Market In One Chart }

U.S., housing | June 5th, 2013 11:26 am

A real-estate agent keeps her own home on the market an average of ten days longer [than she would for a client] and sells it for an extra 3-plus percent, or $10,000 on a $300,000 house. When she sells her own house, an agent holds out for the best offer; when she sells yours, she encourages you to take the first decent offer that comes along.

{ via Overcoming Bias | Continue reading }

buffoons, housing | April 12th, 2013 1:00 pm

The most expensive apartment in the twin towered Art Deco masterpiece looking out over Central Park, the San Remo, rented for $900 a month. The tenant was a stockbroker named Meno Henschel who, according to what he told the Census Bureau, lived in his apartment together with his wife, a cook and two maids. Henschel had one of only two apartments that rented for more than $600. Another, with room for a family of five, plus the requisite cook, butler and maid, rented for $540.

The year was 1940, and that $540 is what would now generally be referred to as about $8,850 in today’s dollars. Except it’s almost impossible to find an apartment like that to rent today. Like most of the great prewar luxury Manhattan buildings, the San Remo has long since been converted into a co-op, owned by the residents.

Very rarely an apartment there will come up for a short-term rental. There is one listed now. The asking price is $29,750 a month.

{ Bloomberg | Continue reading }

housing, new york | February 15th, 2013 3:22 pm

“I would say we have a housing bubble…again.” […]

“It’s happening in the most speculative sub-prime markets, where massive amounts of ‘fast money’ is rolling in to buy, to rent, on a speculative basis for a quick trade,” he contends. “And as soon as they conclude prices have moved enough, they’ll be gone as fast as they came.” […]

Stockman argues the problem in housing is the two forces needed for a recovery, first-time buyers and trade-up buyers, are missing. With the combination of 7.9% unemployment and staggering student loan debt, he doesn’t see a young generation of new home buyers coming into the market. And with baby boomers heading for retirement with less than adequate savings, he thinks they’ll be trading down with their homes, not up. […]

“As soon as the Fed has to normalize interest rates, housing prices will stop appreciating and they’ll probably head down,” he explains. “The fast money will sell as quickly as they can and the bubble will pop almost as rapidly as it’s appeared. I don’t know how many times we’re going to do this, and the only people who benefit are the top one percent - the hedge funds, the LBO funds, the fast money people who come in for a trade, make a quick buck, and move along to the next bubble.”

{ Yahoo | Continue reading }

U.S., housing | February 5th, 2013 6:09 am

In 1979, Brenda and Richard Jorgenson built a split level home in the midst of a large ranch outside the tiny town of White Earth, North Dakota. […] For most of their lives the landscape of the region has been dominated by agriculture – wheat, alfalfa, oats, canola, flax, and corn. The Jorgensons always figured they would leave the property to their three children to pursue the same good life they have enjoyed.

Then the oil wells arrived. They began appearing in 2006, and within just a few years dominated the area landscape. Today at least 25 oil wells stand within two miles of the Jorgensons’ home, each with a pump, several storage tanks, and a tall flare burning the methane that comes out of the ground along with the petroleum.

Like most people in North Dakota, the Jorgensons only own the surface rights to their property, not the subsurface mineral rights. So there was nothing they could do when, in May 2010, a Dallas-based oil company, Petro-Hunt, installed a well pad on the Jorgensons’ farm, next to a beloved grove of Russian olive trees. […] Some 80 trees were dead by the summer of 2011.

{ Guardian | Continue reading }

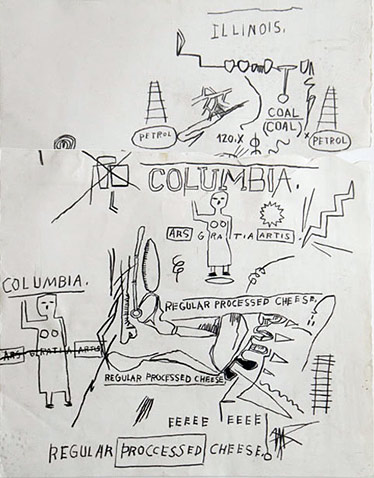

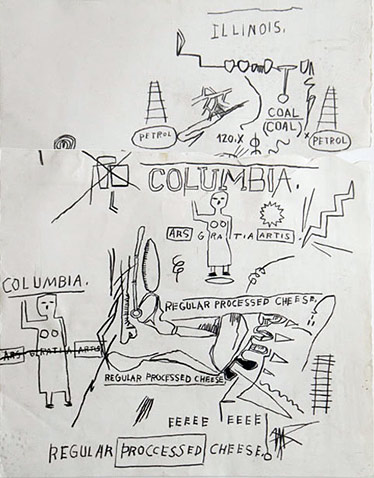

artwork { Basquiat, Untitled, 1982 }

related { Ukraine Crushed in $1.1bn Fake Gas Deal | Thanks GG }

economics, housing, oil | December 6th, 2012 9:15 am

If you’re a lawyer in New York, there’s no sweeter deal than getting assigned to an estate case in Surrogate’s Court.

The work is often routine — selling assets, paying bills, contacting heirs — but the pay can reach into the millions.

Landing such a gig requires currying favor with one of the city’s seven surrogate judges, who handle wills and estates. They have the power to appoint lawyers and approve their sometimes jaw-dropping invoices.

The jobs often go to the judges’ friends, associates or campaign contributors, court authorities admit. Looting of the estates can sometimes result.

The most recent example involves Bronx Judge Lee Holzman, who last week faced removal from the surrogate bench after he signed off on legal work that was never done.

The bills, according to the Bronx District Attorney’s Office, totaled $300,000 and went to the judge’s associate, lawyer Michael Lippman, a Democratic Party crony who ran Holzman’s campaign financing, raising $125,000, a court watchdog claims.

Lippman then got into money trouble himself, racking up $1 million in gambling debts and allegedly faking bills to cover his losses.

Prosecutors say they uncovered the cooked books and charged him with fraud.

Another alleged thief preyed on a lucrative and largely unsupervised part of the system — cases in which there is no will.

Such cases go to public administrators, who work with Surrogate’s Court judges in handling their finances.

In May, Richard Paul, the bookkeeper for the Brooklyn public administrator, was indicted for stealing $2.6 million from these estates, allegedly manipulating the check-writing process to get at the cash.

{ NY Post | Continue reading }

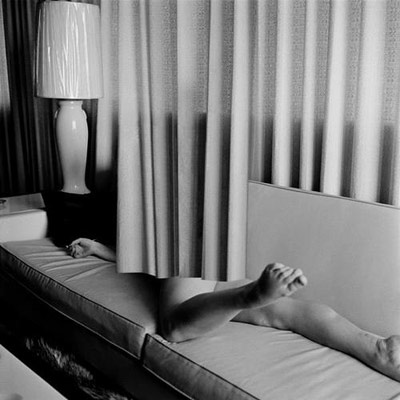

photo { Dina Goldstein }

housing, law, scams and heists | August 1st, 2012 10:30 am

Rates are at historic lows of 3.53% for 30-year mortgages. Rents are at record levels all over the country, hitting highs in 74 markets tracked by real-estate-data provider Reis Inc. And housing prices appear to have finally begun increasing, with gains posted for three months in a row according to the index put out by the Federal Housing Finance Agency. So why aren’t more Americans buying houses?

The answer to that is rather complex, but one major factor is that trade-up buyers — folks who upgrade from smaller, cheaper “starter homes” to pricier properties, and who classically are a pumping piston in the engine that drives the housing market — are finding it difficult, if not impossible, to trade up right now. This key segment of the market is especially likely to be “equity poor.”

{ Time | Continue reading }

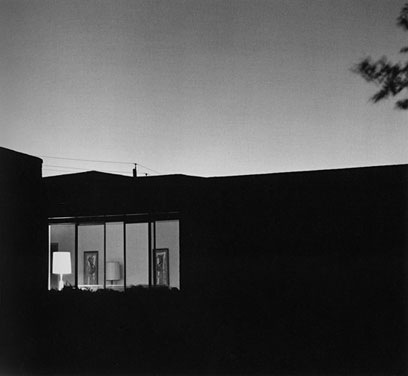

photo { Robert Adams }

U.S., housing | July 26th, 2012 12:48 pm

haha, horse, housing | March 28th, 2012 8:27 am

U.S., economics, housing | February 23rd, 2012 2:10 pm