economics

The fastest growing industry in the US right now, even during this time of slow economic growth, is probably the patent troll protection racket industry. Lawsuits surrounding software patents have more than tripled since 1999.

It’s a great business model.

Step one: buy a software patent. There are millions of them, and they’re all quite vague and impossible to understand.

Step two: FedEx a carefully crafted letter to a few thousand small software companies, iPhone app developers, and Internet startups. This is where it gets a tiny bit tricky, because the recipients of the letter need to think that it’s a threat to sue if they don’t pay up, but in court, the letter has to look like an invitation to license some exciting new technology. In other words it has to be just on this side of extortion.

Step three: wait patiently while a few thousand small software companies call their lawyers, and learn that it’s probably better just to pay off the troll, because even beginning to fight the thing using the legal system is going to cost a million dollars.

{ Joel Spolsky | Continue reading }

economics, scams and heists, technology | April 3rd, 2013 3:09 pm

Imagine you have a choice to make.

In one scenario, you’d get $8 and somebody else — a stranger – would get $8 too. In the other, you’d get $10; the stranger would get $12.

Economists typically assume you’d go for the $10/$12 option because of the belief that people try to maximize their own gains. Choosing the other scenario would just be irrational.

But new research conducted in collaboration with a professor at the University of Toronto’s Rotman School of Management shows that if a person is feeling threatened, or concerned with their status, they are more likely to choose the option that gives them less. And although this choice might seem irrational from an economic perspective, this choice satisfies an important psychological need.

People who do this, “have a reason for their behaviour, and that reason is to protect themselves from low status,” described as a low position or rank in relation to others, says Prof. Geoffrey Leonardelli.

{ University of Toronto | Continue reading }

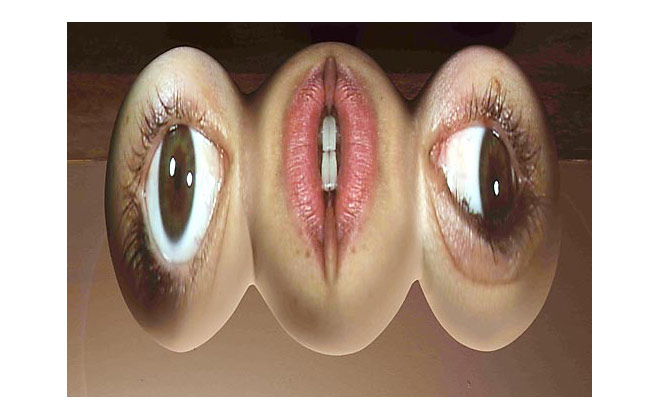

image { Tony Oursler }

economics, psychology | April 3rd, 2013 11:00 am

One of the frequent laments of the “great stagnation” era is that younger people today won’t do better than their parents. […] Over the past 150 years, or about 6 generations, the average income in one generation has been about 60 percent higher than the average income in the prior generation. […] Improvements in well-being were very closely tied to wealth.

Today, however, we are in a position to derive much of our happiness from pursuits internal to our minds. We do this by blogging, watching House of Cards on Netflix, listening to a symphony from iTunes, tweeting with friends and acquaintances, seeing their pictures on Facebook or Path, and learning and collaborating on Wikipedia. As a result, once one secures a certain income to cover basic needs, greater happiness and well-being today can be had for virtually nothing. What is the point, then, of doing materially better than one’s parents?

In his 1930 essay, “Economic Possibilities for Our Grandchildren,” John Maynard Keynes imagined a future 100 years later in which per capita income had increased fourfold or more. With 17 years to go, his prediction was right. But Keynes also thought that this increase in per capita production would result in people working fewer hours—only 15 hours a week to maintain a reasonable standard of living in 2030. The real challenge, he worried, would be filling up our leisure time.

{ Jerry Brito/The Umlaut | Continue reading }

photo { Maxime Taillez }

economics, leisure | April 1st, 2013 10:44 am

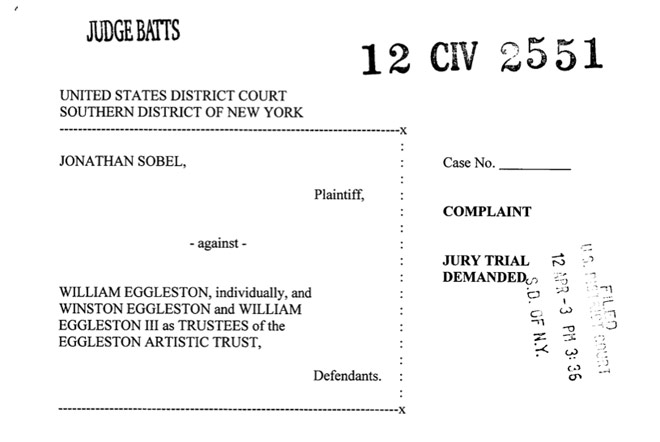

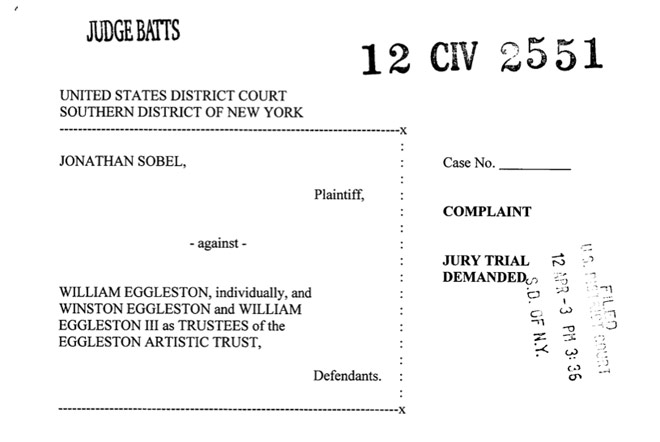

The U.S. District Court in the Southern District of New York dismissed collector Jonathan Sobel’s lawsuit against photographer William Eggleston. […]

The lawsuit was spurred by Christie’s sale last March of 36 poster-size, digital prints of images that Eggleston had shot in the Mississippi Delta more than 30 years ago. Some were created from negatives he had never printed before, while others were based on iconic works, such as “Memphis (Tricycle).” (Sobel owns a 17-inch version of that photograph, for which he reportedly paid $250,000.) The sale was a massive success — by the time it was over, the large digital works accounted for seven of the artist’s top 10 prices. (The five-foot “Tricycle” came in on top, selling for a record $578,500.)

For Sobel, who owns 190 Eggleston works, the success of the sale was part of the problem. “The commercial value of art is scarcity, and if you make more of something, it becomes less valuable,” he told ARTINFO last April.

The judge disagreed. Egggleston may have profited from the Christie’s sale, she concluded, but not at Sobel’s expense. Eggleston could be held liable only if he created new editions of the limited-edition works in Sobel’s collection using the same dye-transfer process he used for the originals — a move that would directly deflate their value. In this case, however, Eggleston was using a new digital process to produce what she deemed a new body of work.

{ ArtInfo | Continue reading }

art, economics, law, photogs | March 30th, 2013 11:30 am

China’s population is larger than those of North America, Europe, Russia and Japan combined, and has no tradition whatsoever of liberal democracy and memories are still fresh of the devastating breakup of the Soviet Union. Going further back, China’s more recent history saw chaos and wars, and on average from 1840 to 1978 a major upheaval every seven or eight years. So the Chinese fear of chaos is based on common sense and its collective memory, with very real fears that the country might well become ungovernable if it were to adopt the adversarial Western political system.

China is in many ways unique. It is an amalgam of the world’s longest continuous civilization with a huge modern state. It is a product of hundreds of states amalgamated over its long history into one. A very rough analogy would be something along the lines of the ancient Roman Empire continuing to this day as a unified modern state with a centralised government and modern economy while retaining all its diverse traditions and cultures, and with a huge population still all speaking Latin as their common language. […]

China tried American-style democracy after its 1911 Republic Revolution, and it turned out to be a devastating catastrophe. The country was immediately plunged into chaos and civil war, with hundreds of political parties vying for power and with warlords fighting one another with the support of various foreign powers. The economy was shattered and tens of millions lost their lives in the decades that followed. That lesson remains so sharp that even today ordinary Chinese are most fearful of luan, the Chinese word meaning chaos. Independent opinion surveys on values in China show that public order is generally ranked top, whereas for Americans freedom of speech is the number one value (even though, one may wonder how a politically correct society like the United States can have genuine freedom of speech).

Having myself travelled to over 100 countries, most of them developing ones, I cannot recall a single case of successful modernisation through liberal democracy, and there’s no better example illustrating this than the huge gap between India and China: both countries started at a similar level of development six decades ago, and today China’s GDP is four times greater and life expectancy 10 years longer.

{ Zhang WeiWei/Europe’s World | Continue reading }

photo { Jordan Fox by Jasper Rischen }

asia, economics | March 30th, 2013 11:28 am

While many Americans assume that the Federal Reserve is a federal agency, the Fed itself admits that the 12 Federal Reserve banks are private. […]

Indeed, the money-center banks in New York control the New York Fed, the most powerful Fed bank. Until recently, Jamie Dimon – the head of JP Morgan Chase – was a Director of the New York Fed.

{ Washingtons Blog/Ritholtz | Continue reading }

U.S., economics | March 29th, 2013 9:00 am

You are insolvent when you can’t pay your debts. Households and firms have struggled with insolvency for centuries. Insolvency is usually a balance sheet concept based around the valuation of assets. When the value of your assets is less than the value of your liabilities, you are insolvent. Usually you work out a repayment schedule with your creditors via a restructuring process.

For countries the notion of national insolvency is a newer, and potentially very misleading, idea. Countries aren’t corporations. Technically almost every country would be insolvent if if was asked to pay all of its debt using its available assets. All governments in practice secure their national debts on their abilities to levy taxes. You can’t really repossess a country, in fairness. When a sovereign borrows too much, it either pushes the debt into the future by rolling over its debt, or failing that, defaults on some or all of the debt. The history of sovereign debt is in fact the history of sovereign default. Defaults tend to happen, in bursts, about every 30 years or so. But before the current crisis, very little attention was paid to this idea of national insolvency. There are very few mentions of national insolvency during the East Asian crisis of the late 1990s, for example.

{ HBR | Continue reading }

economics | March 26th, 2013 6:22 am

Would Time Travellers Affect Security Prices?

Financial markets in a world with time travel would look very different from ours. But would time travellers come to our time, making our markets look like theirs? This paper discusses this issue and related matters such as the problem of prediction in financial economics, the nature of security prices, the social and mental nature of financial reality, and the relation of Financial Economics to Physics. It presents a solution to the problem of bilking behaviour of time travellers, and gives a definite answer to the title question.

{ Richard Hudson | Continue reading }

art { Alexander Calder, Gibraltar, 1936 }

economics, ideas, time | March 25th, 2013 8:30 am

For years, publishers could count on bored shoppers waiting in the checkout line to pick up a magazine, get engrossed in an article, and toss it into their cart alongside the milk and eggs. Then came “mobile blinders.”

These days, consumers are more likely to send a quick text and check their Facebook feed than to read a magazine or develop a momentary craving for the gum or candy on display. […]

Hearst, which sells 15 percent of its U.S. magazines at retailers, is adding cardboard displays in places other than the checkout line. […]

The gum category […] declined 5.5. percent last year.

{ Businessweek | Continue reading }

photo { Luigi Ghirri }

economics | March 24th, 2013 3:05 pm

“We really wanted to be a power couple when we got together in our early twenties,” says Julie softly. “We were both going to work and raise our kids together, taking on equal responsibility. But my commitment to my job meant Rob had to take on a lot of female-gendered roles, like cooking and cleaning, and we rarely had sex because we were both tired. It just wasn’t fun. We were sleep deprived, overweight, and had a healthy bank account.”

Rob laughs, as if the answer was simple and under their noses the entire time.

“We thought one day: Wow! We’re not taking advantage of our economically superior position as educated cisgendered heterosexual white people! We need to start capitalizing on this shit. Julie can stay at home working on her blog and tweeting about the kids, I can spend more time earning money and feeding my sense of self-importance. I mean – fuck everyone else who doesn’t have our opportunities in life. If you’re a single black mother on welfare, that’s your problem. We have mediocre sex at least once a week now and Julie’s blog had fifty unique page views last month.”

{ The World Breaks Everyone | Continue reading | Thanks Max }

economics, haha, relationships | March 21st, 2013 2:08 pm

The decline of two-parent households may be a significant reason for the divergent fortunes of male workers, whose earnings generally declined in recent decades, and female workers, whose earnings generally increased, a prominent labor economist argues in a new survey of existing research. […]

Only 63 percent of children lived in a household with two parents in 2010, down from 82 percent in 1970. The single parents raising the rest of those children are predominantly female. And there is growing evidence that sons raised by single mothers “appear to fare particularly poorly,” Professor Autor wrote in an analysis for Third Way, a center-left policy research organization. […]

Men who are less successful are less attractive as partners, so women are choosing to raise children by themselves, producing sons who are less successful and attractive as partners. […]

“I think the greatest, most astonishing fact that I am aware of in social science right now is that women have been able to hear the labor market screaming out ‘You need more education’ and have been able to respond to that, and men have not,” said Michael Greenstone, an M.I.T. economics professor. […]

Professor Autor said in an interview that he was intrigued by evidence suggesting the consequences were larger for boys than girls, including one study finding that single mothers spent an hour less per week with their sons than their daughters. Another study of households where the father had less education, or was absent entirely, found the female children were 10 to 14 percent more likely to complete college. A third study of single-parent homes found boys were less likely than girls to enroll in college. […]

Instead of making marriage more attractive, he said, it might be better for society to help make men more attractive.

{ NY Times | Continue reading }

economics, kids, relationships | March 20th, 2013 10:25 am

U.S., economics | March 20th, 2013 6:17 am

So, it’s mid-March 2013 and, the S&P 500 is at 1550, right where I said it would be nine months ago. […] I see the S&P continuing to frustrate the majority (that is what markets do). It may hit 1560-1580 prior to actually having a legitimate correction of 5-10%. There is so much liquidity awaiting deployment upon a pullback that the pullback will be quick. Later in the year, it’s very likely we’ll see 1600-plus on the S&P (September-November). In my view, the market will be a good sell at that point, so will many credit products. There is no way the Fed can shift its policy stance concurrent with having to immunize a $4 trillion balance sheet going into the end of a fiscal year. 2014 is likely to be challenging.

Enjoy this while it lasts. […]

The People’s Republic’s big issues will start in fiscal years 2013-2014. China Merchants Bank, for example, is already seeing a bigger rise in bad-loan provisioning and lower good-loan growth than Western equity analysts think. The CEOs of two large Brazilian companies, Vale and Petrobras, are starting to plan for China to “hit a wall” in 2015-2018. Essentially, China will look OK through April 2013 then big problems will hit the country.

Europe will not implode.

{ Secret top source/Minyanville | Continue reading }

U.S., asia, economics, traders | March 18th, 2013 5:30 am

It seems to me that MFA programs have become a tool of indoctrination that has had an unprecedented homogenizing effect on artistic practices worldwide, an effect that is now being replicated with curatorial and critical writing programs. […]

The market of art is not merely a bunch of dealers and cigar-smoking connoisseurs trading exquisite objects for money behind closed doors. Rather, it is a vast and complex international industry of overlapping institutions which jointly produce artworks’ economic value and support a wide range of activities and occupations including training, research, development, production, display, documentation, criticism, marketing, promotion, financing, historicizing, publishing, and so forth. The standardization of art greatly simplifies all of these transactions. For a few years now I have experienced a certain sense of déjà vu while walking through art fairs or biennials, a feeling that many other people have also commented on: that we have already seen all these works that are supposedly brand new. We are experiencing the impact of contemporary art as a globally traded commodity that is produced, displayed, and circulated by an industry of specially trained professionals. […] This is not a new observation: I think Marcel Duchamp already fully understood this danger a hundred year ago. […]

Today it would be rather futile to try to reconstitute bohemia—the free-flowing, organic creative space—because it never really existed within the constellation of institutions of art, the art market, and the art academy. If Warhol’s Factory was an entry into art that enabled a group of people of very different backgrounds to enter a certain kind of productive modality (both within and in spite of the surrounding economy), it was a space of free play that no longer exists. Instead, what we have now are MFA programs: a standardization not even of bohemia, but only its promise. […]

As artists, curators, and writers, we are increasingly forced to market ourselves by developing a consistent product, a concise presentation, a statement that can be communicated in thirty seconds or less—and oftentimes this alone passes for professionalism.

{ Anton Vidokle/e-flux | Continue reading }

photo { Adam Broomberg & Oliver Chanarin }

art, economics, ideas, photogs | March 17th, 2013 2:04 pm

Competition is supposed to lead to lower prices and improvements in quality. But, as a study on the automobile smog-testing industry shows, competition can lead to corruption and even public health problems.

{ United Academics | Continue reading }

photo { Mike Brodie }

economics, photogs, psychology | March 14th, 2013 11:34 am

World’s total wealth (including all bank savings, stocks, homes, company treasuries, government funds, pension funds, mines and other natural resources) amounts to $200 trillion or about $25,000 per person.

{ Quora | Continue reading }

economics, within the world | March 13th, 2013 8:30 am

For the last six months, Cody Wilson and his non-profit group Defense Distributed have worked towards a controversial goal: To make as many firearm components as possible into 3D-printable, downloadable files. Now they’re seeking to make those files searchable, too–and to make a profit while they’re at it.

In a talk at the South By Southwest conference in Austin, Texas Monday afternoon, Wilson plans to announce a new, for-profit spinoff of his gun-printing project that will serve as both a repository and search engine for CAD files aimed at allowing anyone to 3D-print gun parts in their own garage.

{ Forbes | Continue reading }

related links posted between april 2012 and today in every day, the same, again:

The world’s first 3D-printed gun.

Airbus designer hopes to see planes roll out of hangar-sized 3D printers by 2050.

MIT students reveal PopFab, a 3D printer that fits inside a briefcase.

Japanese company will 3D print your fetus for $1,275.

PayPal Founder Backs Synthetic Meat Printing Company.

3D print glove is a wearable mobile phone.

Ever wanted a life-like miniature of yourself or loved ones? Now’s your chance, thanks to Omote 3D, which will soon be opening a 3D printing photo booth in Harajuku, Japan.

In October, 3D-printing startup Shapeways opened its New York production facility in Long Island City, Queens, the biggest consumer-focused 3D printing factory in the world.

The Pirate Bay launches crazy Physibles category for printing 3D objects.

Which 3D printers should you buy?

In many ways, today’s 3D printing community resembles the personal computing community of the early 1990s.

China’s first 3D printing museum opens.

“3D pen” can write in the air.

An Artificial Ear Built By a 3D Printer and Living Cartilage Cells.

3D printing, economics, guns, spy & security, weirdos | March 12th, 2013 11:00 am

Research done in the Universities of Granada (Spain), Freiburg (Germany) and University College London (UK) has demonstrated that when we have a low opinion of somebody, we are more likely to reject their money, even though the offer is attractive, because the social information we have on that person influences our decision. Furthermore, people are prepared to even lose money rather than accept it from those they do not hold in high consideration.

{ UGR | Continue reading }

economics, psychology | March 8th, 2013 6:59 am

As we noted in 2008, the problem was never liquidity. The problem is that the big banks became insolvent because of stupid gambling.

In other words, the government’s whole approach to the 2008 financial crisis was entirely wrong. And the easy money policy (quantitative easing) of central banks doesn’t help, but instead hurts the economy and the little guy. […]

“The IIF said the US Dow Jones Industrial Average’s had hit an all-time high this week more because of relaxed international monetary conditions than thanks to any recovery in the real economy.”

{ Ritholtz | Continue reading }

buffoons, economics | March 8th, 2013 5:37 am

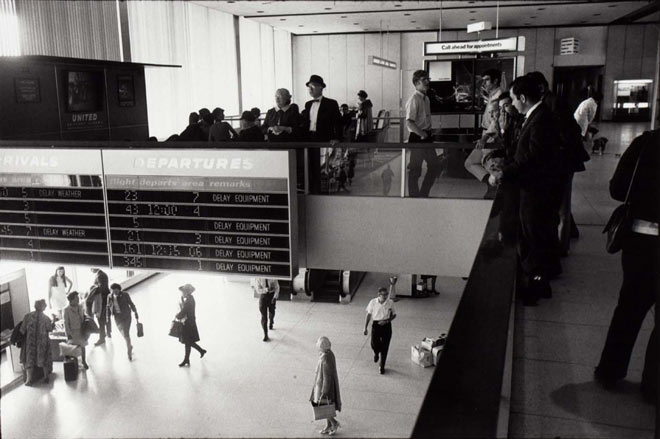

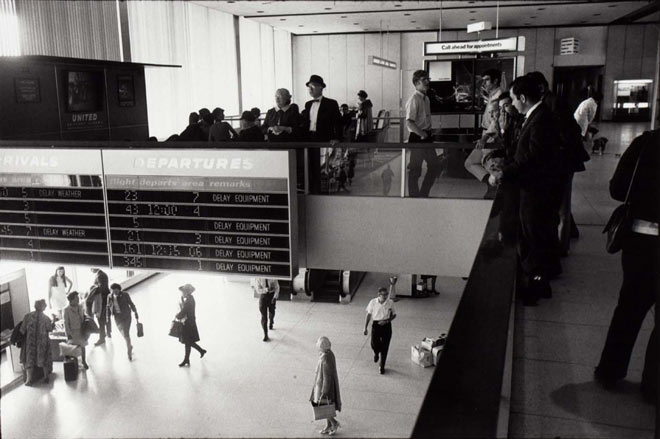

As a gateway to the city, Los Angeles International Airport could hardly be more dispiriting. A jumble of mismatched, outdated terminals, LAX gives visitors a resounding first impression of civic dysfunction.

The city, which owns the airport, has tried several times to remake LAX. The latest attempt is a master plan by Fentress Architects, which is also designing the nearly $2-billion Tom Bradley International Terminal.

But the truth is that the airport’s biggest liability is not simply architectural. Somehow Los Angeles built a major rail route, the Green Line, past LAX 20 years ago without adding a stop at the airport.

And guess what? We are about to build another light-rail route — this time the $1.7-billion Crenshaw Line — near the airport and make precisely the same mistake again.

{ LA Times | Continue reading }

photo { Garry Winogrand }

airports and planes, economics, l.a. pros and cons | March 7th, 2013 12:06 pm