We are advised the waxy is at the present in the Sweeps hospital and that he may never come out!

Nine months after the Ukrainian revolution, Manafort’s family life also went into crisis. The nature of his home life can be observed in detail because Andrea’s text messages were obtained last year by a “hacktivist collective”—most likely Ukrainians furious with Manafort’s meddling in their country—which posted the purloined material on the dark web. The texts extend over four years (2012–16) and 6 million words. Manafort has previously confirmed that his daughter’s phone was hacked and acknowledged the authenticity of some texts. […]

When he called home in tears or threatened suicide in the spring of 2015, he was pleading for his marriage. The previous November, as the cache of texts shows, his daughters had caught him in an affair with a woman more than 30 years his junior. It was an expensive relationship. According to the text messages, Manafort had rented his mistress a $9,000-a-month apartment in Manhattan and a house in the Hamptons, not far from his own. He had handed her an American Express card, which she’d used to good effect. “I only go to luxury restaurants,” she once declared on a friend’s fledgling podcast, speaking expansively about her photo posts on social media: caviar, lobster, haute cuisine.

The affair had been an unexpected revelation. Manafort had nursed his wife after a horseback-riding accident had nearly killed her in 1997. “I always marveled at how patient and devoted he was with her during that time,” an old friend of Manafort’s told me. But after the exposure of his infidelity, his wife had begun to confess simmering marital issues to her daughters. Manafort had committed to couples therapy but, the texts reveal, that hadn’t prevented him from continuing his affair. Because he clumsily obscured his infidelity—and because his mistress posted about their travels on Instagram—his family caught him again, six months later. He entered the clinic in Arizona soon after, according to Andrea’s texts. […]

By the early months of 2016, Manafort was back in greater Washington, his main residence and the place where he’d begun his career as a political consultant and lobbyist. But his attempts at rehabilitation—of his family life, his career, his sense of self-worth—continued. He began to make a different set of calls. As he watched the U.S. presidential campaign take an unlikely turn, he saw an opportunity, and he badly wanted in. He wrote Donald Trump a crisp memo listing all the reasons he would be an ideal campaign consigliere—and then implored mutual friends to tout his skills to the ascendant candidate. […]

In 2006, Rick Gates, who’d begun as a wheel man at the old firm, arrived in Kiev. (Gates did not respond to multiple requests for comment on this article.) Manafort placed him at the helm of a new private-equity firm he’d created called Pericles. He intended to raise $200 million to bankroll investments in Ukraine and Russia. […]

Manafort had always intended to rely on financing from Oleg Deripaska to fund Pericles. In 2007, Manafort persuaded him to commit $100 million to the project, a sum that would have hardly made a dent in the oligarch’s fortune. On the eve of the 2008 global financial crisis, he was worth $28 billion.

Deripaska handed his money to Paul Manafort because he trusted him. […] Manafort used Deripaska’s money to buy a telecommunications firm in Odessa called Chorne More (“Black Seas,” in English) at a cost of $18.9 million. He also charged a staggering $7.35 million in management fees for overseeing the venture.

But months after the Chorne More purchase, the 2008 financial crisis hit, gutting Deripaska’s net worth. It plummeted so far that he needed a $4.5 billion bailout from the Russian state bank to survive. The loan included an interest payment in the form of abject humiliation: Putin traveled to one of Deripaska’s factories and berated him on television.

As Deripaska’s world came crashing down, his representatives asked Manafort to liquidate Pericles and give him back his fair share. Manafort had little choice but to agree. But that promise never translated to action. An audit of Chorne More that Rick Gates said was under way likewise never materialized. Then, in 2011, Manafort stopped responding to Deripaska’s investment team altogether. […]

The FBI investigation into Yanukovych’s finances came to cover Manafort’s own dealings. Soon after the feds took an interest, interviewing Manafort in July 2014, the repatriations ceased. Meanwhile, Manafort struggled to collect the money owed him by Yanukovych’s cronies. To finance his expensive life, he began taking out loans against his real estate—some $15 million over two years, his indictment says. This is not an uncommon tactic among money launderers—a bank loan allows the launderer to extract clean cash from property purchased with dirty money. But according to the indictment, some of Manafort’s loans were made on the basis of false information supplied to the bank in order to inflate the sums available to him, suggesting the severity of his cash-flow problems. All of these loans would need to be paid back, of course. And one way or another, he would need to settle Deripaska’s bill. […]

The Reagan administration had remade the contours of the Cold War, stepping up the fight against communism worldwide by funding and training guerrilla armies and right-wing military forces, such as the Nicaraguan contras and the Afghan mujahideen. This strategy of military outsourcing—the Reagan Doctrine—aimed to overload the Soviet Union with confrontations that it couldn’t sustain.

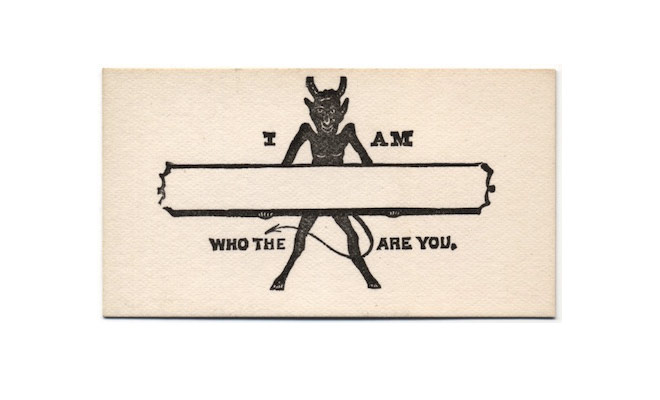

All of the money Congress began spending on anti-communist proxies represented a vast opportunity. Iron-fisted dictators and scruffy commandants around the world hoped for a share of the largesse. To get it, they needed help refining their image, so that Congress wouldn’t look too hard at their less-than-liberal tendencies. Other lobbyists sought out authoritarian clients, but none did so with the focused intensity of Black, Manafort, Stone and Kelly. The firm would arrange for image-buffing interviews on American news programs; it would enlist allies in Congress to unleash money. Back home, it would help regimes acquire the whiff of democratic legitimacy that would bolster their standing in Washington.

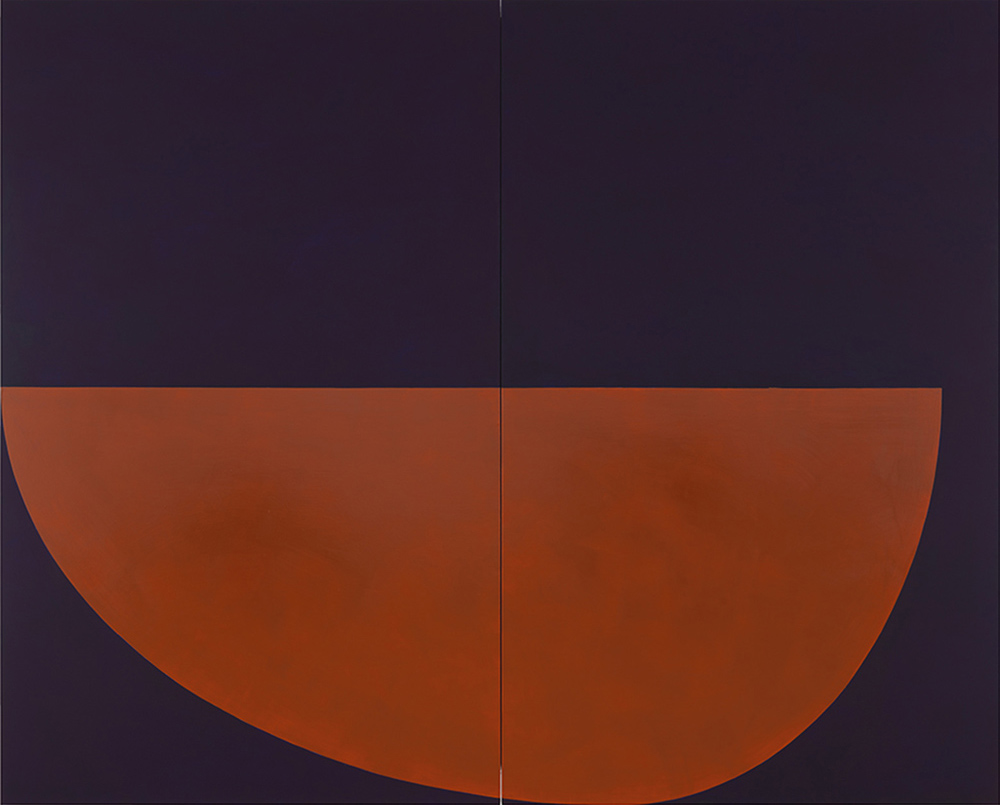

Oil on linen { Suzan Frecon, lantern, 2017 }