Nazi theft of Greek gold during the Second World War is to blame for the country’s faltering finances, Athens claimed yesterday. It came as new protests about the economy turned violent.

Greece said the real culprit for its problems were the Nazis, whose occupation lasted from 1941 to 1945.

‘They took away the Greek gold that was at the Bank of Greece, they took away the Greek money and they never gave it back,’ said Deputy prime minister Theodoros Pangalos. ‘I don’t say they have to give back the money necessarily but they have at least to say “thanks”.’

{ Daily Mail | Continue reading }

Where is all that Greek gold?

Last week I mentioned the (what seemed to me and much of the world) odd incident of Greek politicians talking about the need for Germany to pay its debts to Greece. I got this response from a Greek reader. Comments afterword.

“Dear Mr. Mauldin,

I am an avid reader and I just wanted to correct you about a comment in one of your articles, “The Pain in Spain”, specifically:

‘Somehow they forgot about the German government paying 115 million deutschmarks in 1960 — not a small sum back then.’

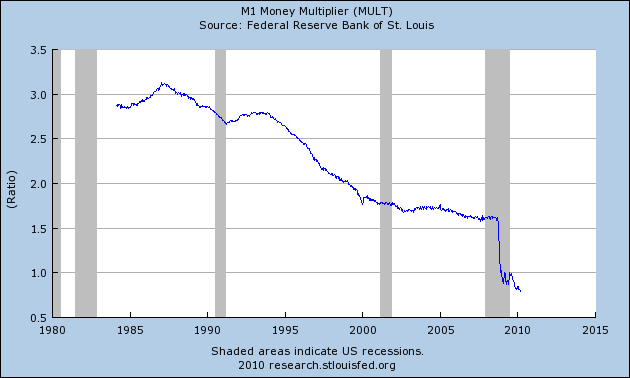

This repayment of 1960 is undeniable. but the total amount owed was $10 billion ($3.5 billion for the return of the gold stolen and the repayment of the war loans Greece was forced into giving Germany, and $7 billion in war reparations awarded to Greece in 1946). As the DM/$ parity was then four for one, this means they gave Greece $29 million out of the $10 billion owed.

Germany also proclaims that they have given Greece over the years, in one form or another, €16.5 billion. But the fact of the matter is that despite these alleged payments, the issue of the war loans and gold is still not settled.

Greece has never stopped asking for the money to be paid back … it is estimated that this sum owed now totals $70 billion [I assume the Greeks want interest – JM]. So even taking into account the €16.5 billion, more than $50 billion is still owed.

Helmut Kohl refused to even discuss the repayment, presenting as an excuse that this amount was owed by the whole of Germany and until Germany is unified the issue could not be discussed.

Guess what, Germany is unified….

Best Regards,

Anthony Kioussopoulos

P.S. Do not take my e-mail as a refusal to acknowledge the fault of successive Greek governments in creating this mess; just take it as a correction for a specific issue.”

+++++

The point here is not that Anthony is 100% right, though his statements have the ring of authenticity. The point is that the Greeks believe it. And thus my lack of surprise last week when I noted that leading Greek politicians of both the conservative and liberal parties were talking the same line. This is an issue that runs across the Greek political spectrum. And that makes the situation all the more intractable, as emotional responses are not the stuff of rational debates.

{ John Mauldin | Continue reading | PDF }