A quick review: Some 17 of the 27 nations that constitute the European Union have abandoned their own currencies in favor of the euro. This means they have given up control of their exchange rates and their interest rates, the latter set by the European Central Bank on a one-size-fits-all basis. In fact, it is the state of the German economy, the area’s largest, that dictates interest rate policy for the entire 17-country group. When Germany was suffering under the weight of the costs of reunification, its sluggish economy needed, and got, a low-interest rate policy from the European Central Bank. That eventually proved too stimulative for, say, Ireland, which was in the midst of an inflating property bubble.

The creation of the eurozone also led lenders to assume that the credit of every member was just about as good as the credit of Germany and France. So Greece, Portugal, Spain, and Italy could sell sovereign debt at very low interest rates and use the borrowed money to finance an expansion of their welfare states — Greeks, for instance, could retire at 50 if they were in a hazardous occupation such as hairdressing (all those chemicals). More important, countries like Portugal, with a poorly educated workforce, and Spain, with politically run regional banks making imprudent loans to local property developers, became noncompetitive with their eurozone colleagues and international rivals. No problem: Fiscal policy was not controlled from the center, and investors hadn’t yet realized that lending to the so-called PIGS (Portugal, Ireland, Greece, and Spain) was a hazardous occupation. So the latter could tap the credit markets to fill the gap between tax receipts and spending, and benefit from German-level interest rates.

Then the rating agencies rose from their torpor and downgraded the sovereign debt of Greece, helping to drive interest rates on its government bonds to unsustainable levels. Enter Brussels with a bailout for Greece. And when Ireland’s deficit soared to 32 percent after the government decided to guarantee the debts of its insolvent banks, enter Brussels with a bailout for Ireland. Now Portugal, burdened with an economy that has not grown for a decade, also is rattling its begging bowl, and another bailout is being negotiated with a conclusion along the lines of earlier bailouts imminent, never mind that the previous two have done more harm than an honest confession of insolvency would. If at first you don’t succeed, repeat the mistake.

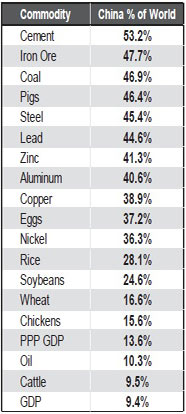

The main bailer, of course, is Germany, its economy growing smartly on the back of an export boom — it does not make what China makes, but makes what China buys. Chancellor Angela Merkel has two reasons to play Lady Bountiful. The first is her belief, shared by the German elite, that if a euro country declares bankruptcy, the currency will lose credibility and the entire European project will come unhinged.

Second, there is the small matter of the German banking system. The German banks, especially the state-run Landesbanken, are so woefully undercapitalized that some are planning to opt out of the new stress tests because they know they will fail. These banks are sitting on 220 billion euros of sovereign and bank debt of Greece, Portugal, and Spain, and if those IOUs become worthless, the German financial system might come tumbling down or at minimum require a taxpayer bailout. To make matters worse, France sits on another 150 billion euros of this dicey paper.

Add the news from tiny, previously europhile Finland. In last month’s election, the anti-euro, anti-bailout True Finn party’s share of votes jumped from 4 percent to 19 percent, and its parliamentary seats from 5 to 39 in a 200-seat parliament, enough to insist on inclusion in a coalition government. (…) Finland’s “no” vote is all that is needed to leave Portugal drowning in debt. (…)

Greece, Ireland, and Portugal are now frozen out of credit markets. The yield on Greek two-year bonds is 24 percent and on both Irish and Portuguese bonds of similar maturity around 12 percent. No country can afford to borrow at those rates. (…)

The more important question is whether Spain, its economy twice as large as those of Greece, Portugal, and Ireland combined, will be next when the bond vigilantes again saddle up. So far, the contagion has not spread. But Spain has an unemployment rate of over 20 percent (40 percent for young workers) and rising, its regional banks have so many IOUs from property developers gone bust that some failed the rather lax first round of stress tests, and Moody’s says the nation’s banks will have to raise as much as 120 billion euros in fresh capital (the government puts the figure at 15 billion euros, despite the fact that Spain’s banks and companies have 70 billion euros invested in Portuguese assets, 7 percent of Spain’s GDP).

{ The Weekly Standard | Continue reading }