Our first game is called Well Begun is Half-Done

…to recognize that we now live in a different, more constrained world in which prices of raw materials will rise and shortages will be common.

Accelerated demand from developing countries, especially China, has caused an unprecedented shift in the price structure of resources: after 100 years or more of price declines, they are now rising, and in the last 8 years have undone, remarkably, the effects of the last 100-year decline. (…)

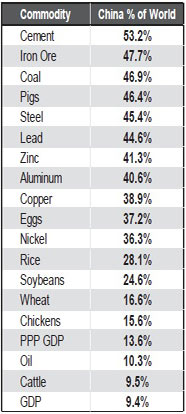

The primary cause of this change is not just the accelerated size and growth of China, but also its astonishingly high percentage of capital spending, which is over 50% of GDP, a level never before reached by any economy in history, and by a wide margin. Yes, it was aided and abetted by India and most other emerging countries, but still it is remarkable how large a percentage of some commodities China was taking by 2009. Exhibit 3 shows that among important non-agricultural commodities, China takes a relatively small fraction of the world’s oil, using a little over 10%, which is about in line with its share of GDP (adjusted for purchasing parity). The next lowest is nickel at 36%. The other eight, including cement, coal, and iron ore, rise to around an astonishing 50%! In agricultural commodities, the numbers are more varied and generally lower: 17% of the world’s wheat, 25% of the soybeans, 28% of the rice, and 46% of the pigs.