economics

How much would someone have to pay you to give up the Internet for the rest of your life? Would a million dollars be enough? Twenty million? How about a billion dollars? “When I ask my students this question, they say you couldn’t pay me enough.”

(…)

Reframe this offer so that it has more time to generate social support, and no way would most people reject it.

At 5% interest, a million dollars pays ~$4,000 a month. So let’s imagine offering people $4,000 to give up TV or internet for one month, and then renewing the offer every month afterward – they could go on or off the plan at will.

{ OvercomingBias | Continue reading }

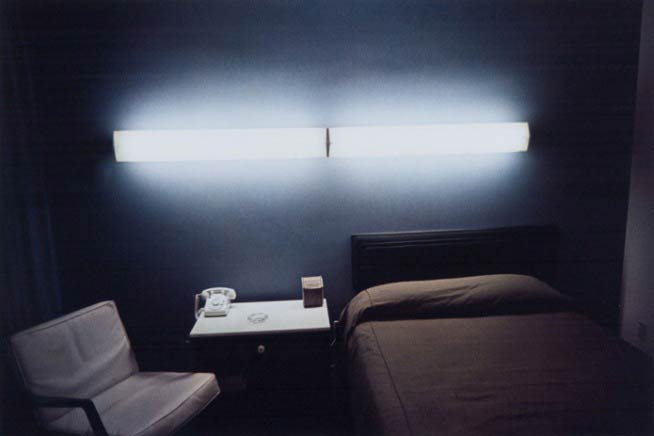

photo { William Eggleston }

economics, technology | July 11th, 2011 5:25 pm

Peter Brabeck-Letmathe chairs Nestlé, the world’s 44th-largest company, which last year earned US$10.5 billion in profits on US$121.1 billion in revenues. He is the consummate international businessman, bargaining hard, overseeing 280,000 employees, outflanking competitors and at ease with heads of state. Yet Brabeck remains incapable of negotiating one simple and irreplaceable ingredient without which his company ceases to exist: water.

He hardly seems a gloomy Malthusian, yet Brabeck foresees “limits to growth” because our global fresh water supply is both finite and being rapidly, stupidly, depleted. The world can sustainably use 4,200 cubic kilometres of water, he notes, but it consumes 4,500 even as aquifers plummet and rivers run dry.

{ China Dialogue | Continue reading }

economics, uh oh, water | July 11th, 2011 4:50 pm

Amazon.com made waves in March when it announced Cloud Player, a new “cloud music” service that allows users to upload their music collections for personal use. It did so without a license agreement, and the major music labels were not amused. Sony Music said it was keeping its “legal options open” as it pressured Amazon to pay up.

In the following weeks, two more companies announced music services of their own. Google, which has long had a frosty relationship with the labels, followed Amazon’s lead; Google Music Beta was announced without the Big Four on board. But Apple has been negotiating licenses so it can operate iCloud with the labels’ blessing.

The different strategies pursued by these firms presents a puzzle. Either Apple wasted millions of dollars on licenses it doesn’t need, or Amazon and Google are vulnerable to massive copyright lawsuits. All three are sophisticated firms that employ a small army of lawyers, so it’s a bit surprising that they reached such divergent assessments of what the law requires.

So how did it happen? And who’s right?

{ Ars Technica | Continue reading }

Why does music elevate your mood, move you to tears or make you dance? It’s a mystery to most of us, but not so much to evolutionary neurobiologist Mark Changizi.

My research suggests that when we listen to music without any visual component, our auditory system—or at least the lower-level auditory areas—”thinks” it is the sounds of a human moving in our midst, doing some sort of behavior, perhaps an emotionally expressive behavior.

The auditory system “thinks” this because music has been “designed” by cultural evolution to sound like people moving about. That is, over time, humans figured out how to better and better make sounds that mimicked (and often exaggerated) the fundamental kinds of sounds humans make when we move.

I lay out more than 40 respects in which music sounds like people doing stuff. At the core of “moving people” is the walk. The human gait has unique characteristics, from its regularly repeating step (the beat) to the sounds of other parts of the body during the gait that are in time with the step (notes, more generally).

{ WSJ | Continue reading }

economics, google, music, neurosciences | July 8th, 2011 5:22 pm

So what is financial engineering? In a logically consistent world, financial engineering should be layered above a solid base of financial science. Financial engineering would be the study of how to create functional financial devices – convertible bonds, warrants, synthetic CDOs, etc. – that perform in desired ways, not just at expiration, but throughout their lifetime. That’s what Black-Scholes does – it tells you, under certain assumptions, how to engineer a perfect option from stock and bonds.

But what exactly is financial science?

Canonical financial engineering or quantitative finance rests upon the science of Brownian motion and other idealizations that, while they capture some of the essential features of uncertainty, are not finally very accurate descriptions of the characteristic behavior of financial objects. (…) Markets are filled with anomalies that disagree with standard theories. Stock evolution, to take just one of many examples, isn’t Brownian. We don’t really know what describes its motion. Maybe we never will. And when we try to model stochastic volatility, it’s an order of magnitude vaguer. (…)

If you’re going to work in this field, you have to understand that you’re not doing classical science at all, and that the classical scientific approach doesn’t have the unimpeachable value it has in the hard sciences.

{ Emanuel Derman/Reuters | Continue reading }

economics, ideas, science | July 8th, 2011 4:38 pm

How Flawed is the Nation’s Most Watched Economic Indicator

Last October, when the government released its monthly tally of how many people had jobs, there was a collective groan. The September report, which came out the first Friday in October, said the number of employed people in the U.S. had dropped by 95,000, worse than the 57,000 job drop the month before. After looking like we had finally hit an economic rebound, the jobs market was again slipping back again perhaps toward the dreaded double-dip recession. Or was it?

A month later the Bureau of Labor Statistics, which tracks and releases the employment numbers for the government, revised its jobs count for September. In fact, the economy, it turned out, had lost only 41,000 jobs that month. Is that right? Actually no. A month later, the BLS revised the number again. The final tally: In September, the number of people working in America fell by just 24,000. So the economy was improving? Not quite. Remember that month before figure of 57,000 jobs lost. Yeah, well, that was wrong, too, off by nearly all of the drop, or 56,000 jobs.

{ Time | Continue reading }

illustration { Joe Heaps }

economics, shit talkers | July 8th, 2011 9:00 am

While the tech world is buzzing about the launch and implications of Google’s new social network, Google+, it’s worth noting that Google isn’t just in a war with Facebook, it’s at war with multiple companies across multiple industries. In fact, Google is fighting a multi-front war with a host of tech giants for control over some of the most valuable pieces of real estate in technology. Whether it’s social, mobile, browsing, local, enterprise, or even search, Google is being attacked from all angles. (…)

Before I investigate each battle front in the war, it’s important to highlight the fact that perhaps no other tech company right now could withstand such a multifaceted attack, let alone be able to retaliate efficiently. Sure, Apple might get pushed around by Facebook, so it integrated Twitter into iOS5, and sure, Amazon and Apple have their own tussles over digital media and payments, but at the end of the day, Google is in this unique and potentially highly vulnerable position that will test the company’s mettle and ability to not only reinvent itself, but also to perhaps strengthen its core. (…) Google must battle on at least six fronts simultaneously.

{ TechCrunch | Continue reading }

economics, google | July 6th, 2011 6:26 pm

Back in 1999, a computer scientist at Cornell University began monitoring the way that the Windows NT 4.0 operating system used files. What he found was astonishing.

About 80 per cent of all files that NT creates are either over-written or deleted within 5 seconds of being born.

Today, Ragib Hasan and Randal Burns at Johns Hopkins University in Baltimore say this ought to give programmers pause for thought. Deleting data requires energy, which means that a substantial fraction of a computer system’s energy budget is currently devoted to creating and then almost immediately scrubbing data.

And if the wasted energy weren’t bad enough, computer memory has a limited life span. Flash memory, for example, has a lifespan of 100,000 cycles. So cycling it needlessly brings the inevitable breakdown closer.

{ The Physics arXiv Blog | Continue reading }

photo { Jesse Pollock }

economics, technology | July 6th, 2011 6:22 pm

experience, housing | July 5th, 2011 3:32 pm

Nortel Networks, the bankrupt Canadian telecom company, came that much closer to disappearing completely yesterday with the cash sale of its portfolio of 6000 patents for $4.5 billion to a consortium of companies including Apple, EMC, Ericsson, Microsoft, Research In Motion (RIM), and Sony. The bidding, which began with a $900 million offer from Google, went far higher than most observers expected and only ended, I’m guessing, when Google realized that Apple and its partners had deeper pockets and would have paid anything to win. This transaction is a huge blow to Google’s Android platform, which was precisely the consortium’s goal.

{ Robert X. Cringely | Continue reading }

economics, technology | July 1st, 2011 4:06 pm

There are numerous comparisons between Google’s new Google+ social offering and Facebook, but most of them miss the mark. Google knows the social train has left the station and there is a very slim chance of catching up with Facebook’s 750 million active users. However, Twitter’s position as a broadcast platform for 21 million active publishers is a much more achievable goal for Google to reach. (…)

While Facebook is not sweating about Google+, the threat to Twitter is significant. Google has the opportunity to displace Twitter if it gets publishers and celebrities to encourage Google+ follows on their websites as well as pushing posts to the legions of Google users while they are in Search, Gmail and YouTube. Google was turned down when it tried to buy Twitter for $10 billion, and now it is going to try to replicate it.

{ Social Beat | Continue reading }

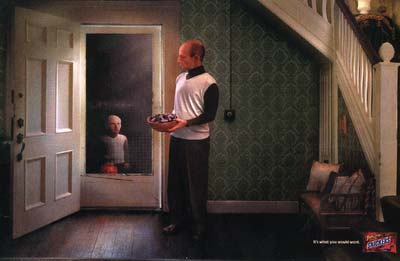

photo { Jay Van Dam }

related { Invite your entire Facebook graph into Google Plus | Searching through other people’s photographs as soon as they’ve taken them is now possible thanks to a new search service. }

economics, google, social networks | July 1st, 2011 3:09 pm

We don’t quite understand small probabilities.

You often see in the papers things saying events we just saw should happen every ten thousand years, hundred thousand years, ten billion years. Some faculty here in this university had an event and said that a 10-sigma event should happen every, I don’t know how many billion years.

So the fundamental problem of small probabilities is that rare events don’t show in samples, because they are rare. So when someone makes a statement that this in the financial markets should happen every ten thousand years, visibly they are not making a statement based on empirical evidence, or computation of the odds, but based on what? On some model, some theory.

So, the lower the probability, the more theory you need to be able to compute it. Typically it’s something called extrapolation, based on regular events and you extend something to what you call the tails. (…)

The smaller the probability, the less you observe it in a sample, therefore your error rate in computing it is going to be very high. Actually, your relative error rate can be infinite, because you’re computing a very, very small probability, so your error rate is monstrous and probably very, very small. (…)

There are two kinds of decisions you make in life, decisions that depend on small probabilities, and decisions that do not depend on small probabilities. For example, if I’m doing an experiment that is true-false, I don’t really care about that pi-lambda effect, in other words, if it’s very false or false, it doesn’t make a difference. (…) But if I’m studying epidemics, then the random variable how many people are affected becomes open-ended with consequences so therefore it depends on fat tails. So I have two kinds of decisions. One simple, true-false, and one more complicated, like the ones we have in economics, financial decision-making, a lot of things, I call them M1, M1+.

{ Nassim Nicholas Taleb/Edge | Continue reading }

economics, ideas, mathematics | June 28th, 2011 1:39 pm

Albert Einstein is reported to have said that insanity consists of doing the same thing over and over again and expecting different results. By those standards, the deal with Greece that is about to be agreed looks insane. The only justification is that it is needed to play for time. This is a bad strategy. Something more radical is required.

The question about the prospects for Greece is not whether the country will default. That is, in my view, as near to a certainty as any such thing can be. The question is whether a default would be enough to return the economy to reasonable health. I strongly doubt it. The country seems too uncompetitive for that. A default is a necessary, but not a sufficient, condition for a return to economic health.

{ Financial Times | Continue reading }

painting { Andrew Wyeth, Wind From the Sea, 1947 }

economics | June 23rd, 2011 8:15 pm

The ad industry is quickly evolving into a new industry - one that won’t offer only the limited menu of services that’s attributed to it today. I’m not sure if this new industry should even be called advertising anymore, as the term itself can be an albatross to innovation. But whatever the name is, it’ll be even more exciting and productive than in its current incarnation.

When I invented the 4th Amendment Wear brand for my consultancy, I didn’t realize at the time that it would teach me such an important lesson about where we’re headed. (…)

It’s one thing to create an ad. It’s a whole other beast to invent new technology, create products using that technology, tap into social media, and orchestrate a marketing campaign to reach millions. (…)

While much of 4th Amendment Wear’s success can be attributed to the brand being in the right place at the right time, the truth is, all brands need to be.

{ Tim Geoghegan | Continue reading | 4th Amendment Wear picked up the Gold lion for Promo & Activation at Cannes. }

Heineken Star Player… (…) Whether this piece of work gets recognized at Cannes this week or not is not relevant or even important. What’s important is that it wasn’t the regular copywriter + art director duo who came up with the Idea. It was a combination of a Storyteller and a Software Developer who conceived it.

{ Rei Inamoto | Continue reading }

economics, ideas, marketing | June 23rd, 2011 12:18 pm

Look at eggs. Today, a couple of workers can manage an egg-laying operation of almost a million chickens laying 240,000,000 eggs a year. How can two people pick up those eggs or feed those chickens or keep them healthy with medication? They can’t. The hen house does the work—it’s really smart. The two workers keep an eye on a highly mechanized, computerized process that would have been unimaginable 50 years ago.

But should we call this progress? In a sense it sounds like a deal with the devil. Replace workers with machines in the name of lower costs. Profits rise. Repeat. It’s a wonder unemployment is only 9.1%. Shouldn’t the economy put people ahead of profits?

Well, it does. The savings from higher productivity don’t just go to the owners of the textile factory or the mega hen house who now have lower costs of doing business. Lower costs don’t always mean higher profits. Or not for long. Those lower costs lead to lower prices as businesses compete with each other to appeal to consumers.

The result is a higher standard of living for consumers. (…)

Somehow, new jobs get created to replace the old ones. Despite losing millions of jobs to technology and to trade, even in a recession we have more total jobs than we did when the steel and auto and telephone and food industries had a lot more workers and a lot fewer machines.

{ WSJ | Continue reading }

economics, ideas | June 23rd, 2011 12:12 pm

The Rule of 72 deserves to be better known among technical people. It’s a widely-known financial rule of thumb used for understanding and calculating interest rates. But others, including computer scientist and start-up founders, are often concerned with growth rates. Knowing and applying the rule of 72 can help in developing numerical literacy numeracy around growth.

For example, consider Moore’s Law, which describes how “the number of transistors that can be placed inexpensively on an integrated circuit doubles approximately every two years.” If something doubles every two years, at what rate does it increase per month, on average? If you know the rule of 72, you’ll instantly know that the monthly growth rate is about 3%. You get the answer by dividing 72 by 24 (the number of months).

{ Terry Jones | Continue reading }

economics, mathematics | June 22nd, 2011 4:55 pm

Turntable.fm is a little miracle that does something simple and essential: It lets you play your favorite songs for your friends and strangers on the Web, in real time, for free.

I’d say it’s astonishing no one has done it before, but it’s not: The music business has a long tradition of resisting good ideas. So how did the Turntable.fm guys finally get the industry on board?

They haven’t. The start-up doesn’t have deals in place with any labels or publishers.

{ All Things D | Continue reading }

economics, music | June 22nd, 2011 4:05 pm

{ Death penalty costs California $184 million a year, study says. That’s more than $4 billion on capital punishment in California since it was reinstated in 1978, or about $308 million for each of the 13 executions carried out since then. | LA Times }

U.S., economics, l.a. pros and cons | June 22nd, 2011 3:12 pm

Despite the first ‘Cars’ movie’s somewhat unimpressive reviews and ticket sales, Pixar is rolling out a sequel. Why? Because the animated film sparked a long-lived licensing bonanza.

In the five years since its 2006 release, “Cars” has generated global retail sales approaching $10 billion, according to Disney. That ranks the Pixar film alongside such cinematic merchandising standouts as “Star Wars,” “Spider-Man” and “Harry Potter.”

No fewer than 300 toys — and countless other items, including bedding, backpacks and SpaghettiOs — are rolling out in stores, in anticipation of the “Cars 2″ opening.

“We anticipate the consumer products program to be the largest in industry history, eclipsing the high water mark set by ‘Toy Story 3,’” Disney Consumer Products Chairman Andy Mooney said in a webcast last week before the annual toy licensing show in Las Vegas. Last year, the third installment of “Toy Story” generated $2.8 billion in merchandise sales.

{ LA Times | Continue reading }

photo { Alex Tehrani }

economics, marketing, showbiz, toys | June 21st, 2011 7:40 pm

Husband’s employment status threatens marriage, but wife’s does not, study finds.

A new study of employment and divorce suggests that while social pressure discouraging women from working outside the home has weakened, pressure on husbands to be breadwinners largely remains.

The research, led by Liana Sayer of Ohio State University and forthcoming in the American Journal of Sociology, was designed to show how employment status influences both men’s and women’s decisions to end a marriage.

{ EurekAlert | Continue reading }

economics, relationships | June 20th, 2011 9:05 pm

Betty Jo Patton spent her childhood on a 240-acre farm in Mason County, West Virginia, in the 1930s. Her family raised what it ate, from tomatoes to turkeys, pears to pigs. They picked, plucked, slaughtered, butchered, cured, canned, preserved, and rendered. They drew water from a well, cooked on a wood stove, and the bathroom was an outhouse. (…)

Evidence of the nostalgia abounds. (…) The surest sign that this nostalgia has reached a critical mass, though, is that food companies have begun to board the retro bus. (…) Mountain Dew (featuring a cartoon hillbilly from the 1960s) in which they’ve replaced “bad” high-fructose corn syrup with “good” cane sugar. (…)

It’s unlikely that most serious food reformers think America can or should dismantle our industrial food system and return to an agrarian way of life. But the idea that “Food used to be better” so pervades the rhetoric about what ails our modern food system that it is hard not to conclude that rolling back the clock would provide at least some of the answers. The trouble is, it wouldn’t. And even if it would, the prospect of a return to Green Acres just isn’t very appealing to a lot of people who know what life there is really like.

{ Lapham’s Quaterly | Continue reading }

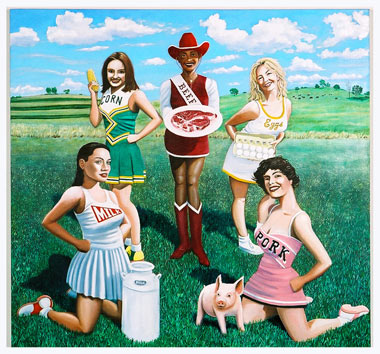

artwork { Eric Thor Sandberg }

economics, food, drinks, restaurants | June 20th, 2011 7:08 pm