‘Never go to bed mad. Stay up and fight.’ –Phyllis Diller

First, while the Mexican government has lost control over matters having to do with drugs and with the borderlands of the United States, Mexico City’s control over other regions — and over areas other than drug enforcement — has not collapsed (though its lack of control over drugs could well extend to other areas eventually). Second, while drugs reshape Mexican institutions dramatically, they also, paradoxically, stabilize Mexico. We need to examine these crosscurrents to understand the status of Mexico.

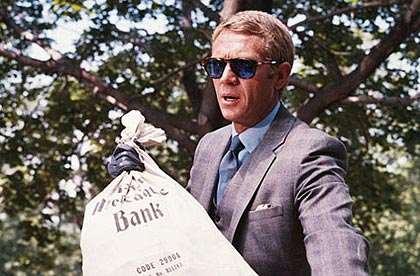

Let’s begin by understanding the core problem. The United States consumes vast amounts of narcotics, which, while illegal there, make their way in abundance. Narcotics derive from low-cost agricultural products that become consumable with minimal processing. With its long, shared border with the United States, Mexico has become a major grower, processor and exporter of narcotics. Because the drugs are illegal and thus outside normal market processes, their price is determined by their illegality rather than by the cost of production. This means extraordinary profits can be made by moving narcotics from the Mexican side of the border to markets on the other side.

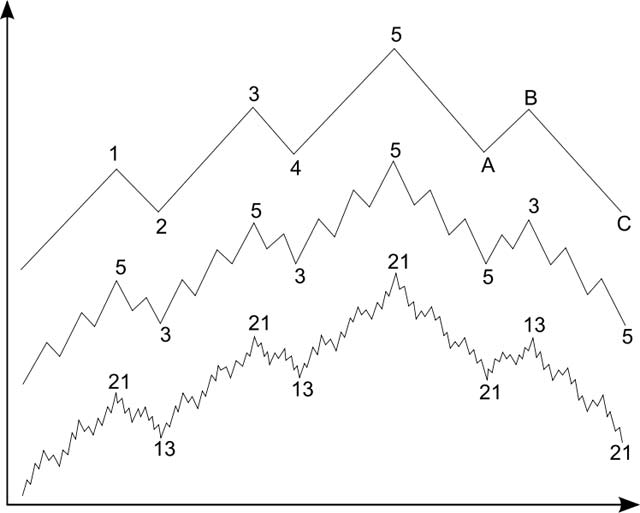

Whoever controls the supply chain from the fields to the processing facilities and, above all, across the border, will make enormous amounts of money. Various Mexican organizations — labeled cartels, although they do not truly function as such, since real cartels involve at least a degree of cooperation among producers, not open warfare — vie for this business. These are competing businesses, each with its own competing supply chain.

Typically, competition among businesses involves lowering prices and increasing quality. This would produce small, incremental shifts in profits on the whole while dramatically reducing prices. An increased market share would compensate for lower prices. Similarly, lawsuits are the normal solution to unfair competition. But neither is the case with regard to illegal goods.

The surest way to increase smuggling profits is not through market mechanisms but by taking over competitors’ supply chains. Given the profit margins involved, persons wanting to control drug supply chains would be irrational to buy, since the lower-cost solution would be to take control of these supply chains by force. Thus, each smuggling organization has an attached paramilitary organization designed to protect its own supply chain and to seize its competitors’ supply chains.

The result is ongoing warfare between competing organizations. Given the amount of money being made in delivering their product to American cities, these paramilitary organizations are well-armed, well-led and well-motivated. Membership in such paramilitary groups offers impoverished young men extraordinary opportunities for making money, far greater than would be available to them in legitimate activities.

The raging war in Mexico derives logically from the existence of markets for narcotics in the United States; the low cost of the materials and processes required to produce these products; and the extraordinarily favorable economics of moving narcotics across the border. This warfare is concentrated on the Mexican side of the border. But from the Mexican point of view, this warfare does not fundamentally threaten Mexico’s interests.