SF bay area craigslist > san francisco > housing > room/share wanted

$1000 Best. Roommate. Ever.

Date: 2011-08-18, 3:39PM PDT

Konichiwa bitches. Are you looking for the most kick-ass fucking roommate that ever lived? If so, look no further. You fucking found him. I’m a 25-year-old professional marketing agent with experience at bad-ass companies in New York Fucking City. That’s right! What you know about experience? I graduated from Auburn University in Alabama, and moved to NYC at the ripe, tender age of 22. After deciding that New York was a stinky shit-hole, I moved back to Alabama to cultivate more professional experience. Why? So I can make millions of dollars and not have to post shit like this on Craigslist.

Anyway, so I landed this job with a marketing firm in San Francisco, and I have no fucking clue where to live. Honestly, I’m moving there in 3 weeks, so I don’t give a shit if I have to sleep in your bathtub.

A bit about me: I’m respectful, quiet, clean and I won’t bother any of your shit. If you leave shit out, I’m just like, “Oh fuck I better not mess with this shit, because it’s not mine.” I turn off lights. I clean toilets. Fuck it. I’ll even cook for you. That’s right! My dad is a chef and taught me everything there is to know about cooking southern cajun cuisine. I’ll fry green tomatoes, cover them with marinated crab meat and smother that shit in bearnaise. EVERY. GODDAMN. NIGHT. Don’t eat meat? That’s fucking FANTASTIC! I’ll make a zucchini and yellow squash carpaccio that will knock your fucking socks off.

I also read a lot. I fucking LOVE books. Vonnegut, Palahniuk, Hawthorne. All that shit. I read Tuesday’s with Morrie the other day. It’s a sad story, but I learned something about life, love, knowledge and the pursuit of something greater than myself. Fucking smart. Do you like movies? I fucking love them. We can watch the shit out of some movies together if you like, or go get drinks, or work out, hike, play video games or play a game of one-on-one basketball, or I don’t have to talk to you at all. It’s completely UP TO YOU!

Sometimes I play guitar. Are you going to love getting baked and listening to Bob Dylan and Pink Floyd? LIVE? WHENEVER THE FUCK YOU WANT? Of course you are! I’ll take requests and learn any song you like, because I have the voice of an angel and the acoustical stylings of James Fucking Taylor. AWWWWWW SHIT YEA!

A lot of people ask me, “Hey, you’re from Alabama. Are you racist?” And, the answer to that question is, no. I’m not racist or judgmental at all. I love everyone. I’m a secular humanist. I FUCKING LOVE PEOPLE. That’s the only requirement to being a secular humanist actually. You have to like other human beings and want to help them for no other reason than they are human regardless of race, religion or sexual preference. WTF?!!!? Pretty fucking cool right?

I own almost nothing! I’m driving my car from Alabama to California in which I’ll be transporting two duffelbags of clothes, one laptop computer, one guitar, one cell-phone with charger, 8 pairs of shoes, one picture frame, probably some condoms and a shitload of beef jerky and Pringles for the trip. Though, you can expect the jerky to be gone upon my arrival. Unless you’d like me to pick up some on my way into the city. See?! I’m the most considerate person you’ve ever met. I’m offering to buy you shit already!

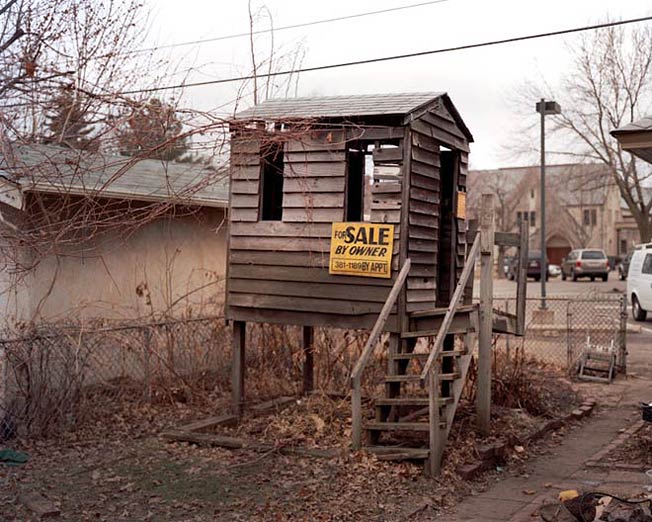

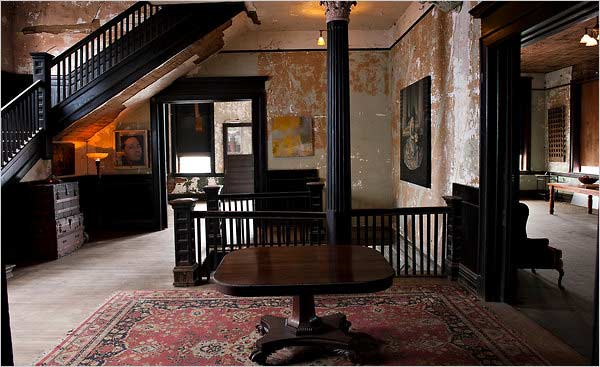

Am I interested in your pad? You can bet my nomadic ass I am! I only require 4 walls, a ceiling and a floor to shelter me from the elements. Other than that, anything else will be considered a convenient plus. I’m taking being a roommate to the next level. Email me! I’ll hook yo ass up with Facebook links, background checks, credit reports, phone numbers, resumes, references, awards, sexual history, pictures of karate trophies and a list of the top 10 women I’d like to bang before I die. If you want a next-generation roommate who consistently blows your fucking mind with awesomeness, then hit me up. I’m ready to give you money.

{ Craigslist }