Damn your yellow stick. Where are we going?

There are basically two possible outcomes from here. First, Ben Bernanke and his gang artificially suppress interest rates for a very long period of time creating the “Japan Syndrome” in the US, which leads to rolling recessions and a general economic malaise. Or, secondly, interest rates rise back towards more normalized levels as the economy begins a real and lasting recovery. I am really hoping for the later. In either case there is a negative and sustained impact to housing going forward. The excesses that were created over the last 20 years will have to be absorbed into the system, allowing prices to return to a more normalized and sustainable level.

{ Advisor Perspectives | Continue reading }

History suggests that 2012 will see neither a big housing rebound nor a second crash. After the last housing collapse, which first bottomed out in April 1991, prices stayed almost perfectly flat for about six years.

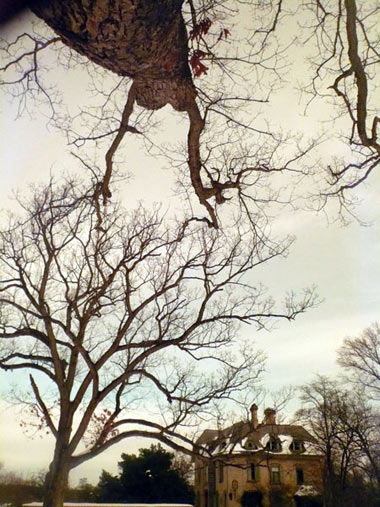

photo { Luisa Opalesky }