There’s a gentleman that’s going round, turning the joint upside down

The 27-page shareholder letter Berkshire Hathaway chief executive Warren Buffett just released reads like a motivational speech or a pep talk trying to win over an audience that is increasingly pessimistic about America’s future: “In 2011, we will set a new record for capital spending – $8 billion – and spend all of the $2 billion increase in the United States,” he writes. “Now, as in 1776, 1861, 1932 and 1941, America’s best days lie ahead.”

(Of course, Buffett also disclosed that Berkshire failed to outperform the S&P 500 in 2010 for the second year running, the first time in the company’s history that has happened.)

In any case, the letter is also replete with anecdotes that illuminate activity across various sectors of the U.S. economy. The style is somewhat reminiscent of the Federal Reserve’s own story-like account of economic activity, called the “Beige Book” after the hue of its cover, which is released every six weeks. So, this perhaps could be dubbed the “Buffett Book.” (…)

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point. […] These businesses entered the recession strong and will exit it stronger. At Berkshire, our time horizon is forever. (…)

…the third best investment I ever made was the [$31,500] purchase of my home, though I would have made far more money had I instead rented and used the purchase money to buy stocks. (The two best investments were wedding rings.) (…)

IIn a nine-hour period [last year], we sold 1,053 pairs of Justin boots, 12,416 pounds of See’s candy, 8,000 Dairy Queen blizzards, and 8,800 Quikut knives (that’s 16 knives per minute). But you can do better. Remember: Anyone who says money can’t buy happiness simply hasn’t learned to shop.

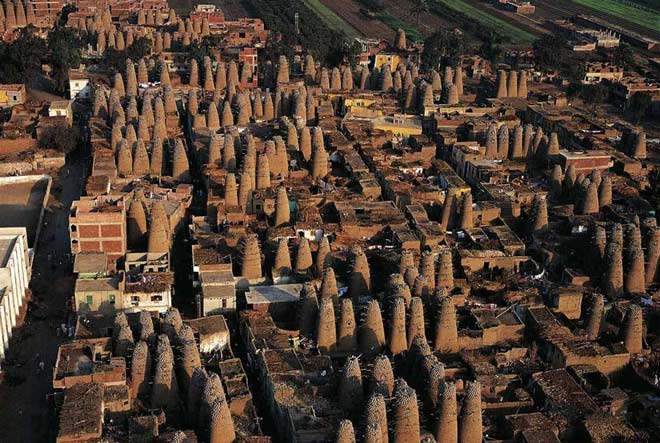

photo { Yann Arthus-Bertrand, Pigeon Houses, Mit Gahmr Delta, Egypt | Thanks Daniel }

more { Critical Analysis of Buffett’s Annual Letter | Aleph blog }