U.S.

Unless you’re speaking with a real estate agent or a prostitute, chances are they’re not going to be excited that you’re American. It’s not some badge of honor we get to parade around. […]

Outside of getting shit-housed drunk and screaming “I LOVE YOU, MAN!”, open displays of affection in American culture are tepid and rare. Latin and some European cultures describe us as “cold” and “passionless” and for good reason. In our social lives we don’t say what we mean and we don’t mean what we say. […]

As Americans, we have this naïve assumption that people all over the world are struggling and way behind us. They’re not. Sweden and South Korea have more advanced high speed internet networks. Japan has the most advanced trains and transportation systems. Norwegians make more money. The biggest and most advanced plane in the world is flown out of Singapore. The tallest buildings in the world are now in Dubai and Shanghai. Meanwhile, the US has the highest incarceration rate in the world. […]

Unless you have cancer or something equally dire, the health care system in the US sucks. The World Health Organization ranked the US 37th in the world for health care, despite the fact that we spend the most per capita by a large margin.

The hospitals are nicer in Asia (with European-educated doctors and nurses) and cost a tenth as much. Something as routine as a vaccination costs multiple hundreds of dollars in the US and less than $10 in Colombia. And before you make fun of Colombian hospitals, Colombia is 28th in the world on that WHO list, nine spots higher than us.

A routine STD test that can run you over $200 in the US is free in many countries to anyone, citizen or not. My health insurance the past year? $65 a month. Why? Because I live outside of the US. An American guy I met living in Buenos Aires got knee surgery on his ACL that would have cost $10,000 in the US… for free.

But this isn’t really getting into the real problems of our health. Our food is killing us.

{ Mark Manson | Continue reading | Thanks Tim }

U.S. | February 24th, 2013 4:24 pm

There is no particular reason why – contrary to some forecasts – this deal [Heinz–Buffet] signals a turn in the economy that should spark a wave of mergers and acquisitions. That said, Mr Buffett has reminded us that, when money is cheap, takeovers follow. In that sense, leveraged deals could be seen as central bankers’ gift to acquirers. […]

Berkshire never bit on Heinz until now, when a deal arrived with terms that guarantee it a 6 per cent return.

In a world of near-zero interest rates, that 6 per cent looks pretty attractive. Mr Buffett, evidently, does not expect rates to rise sharply any time soon. A decade ago, he demanded a first-day return of 13 per cent before he would bother to consider a deal. Now the Oracle takes 6 per cent for his money. We should pay attention. There could hardly be a stronger signal that the investing tide has changed.

{ FT | Continue reading }

art { Mel Ramos }

U.S., economics | February 19th, 2013 8:29 am

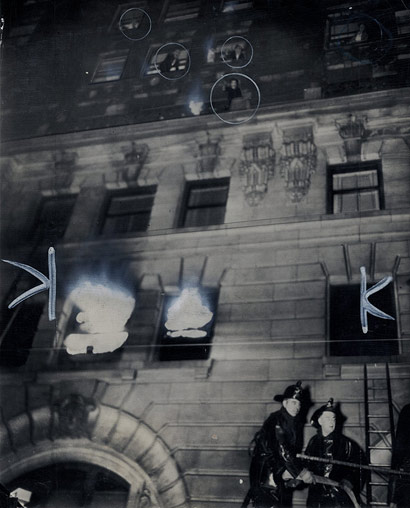

art, new york | February 18th, 2013 8:18 am

The most expensive apartment in the twin towered Art Deco masterpiece looking out over Central Park, the San Remo, rented for $900 a month. The tenant was a stockbroker named Meno Henschel who, according to what he told the Census Bureau, lived in his apartment together with his wife, a cook and two maids. Henschel had one of only two apartments that rented for more than $600. Another, with room for a family of five, plus the requisite cook, butler and maid, rented for $540.

The year was 1940, and that $540 is what would now generally be referred to as about $8,850 in today’s dollars. Except it’s almost impossible to find an apartment like that to rent today. Like most of the great prewar luxury Manhattan buildings, the San Remo has long since been converted into a co-op, owned by the residents.

Very rarely an apartment there will come up for a short-term rental. There is one listed now. The asking price is $29,750 a month.

{ Bloomberg | Continue reading }

housing, new york | February 15th, 2013 3:22 pm

I shot him, two times in the forehead. Bap! Bap!

[…]

The Navy SEAL who killed Osama bin Laden will discover soon enough that when he leaves after sixteen years in the Navy, his body filled with scar tissue, arthritis, tendonitis, eye damage, and blown disks, here is what he gets from his employer and a grateful nation: Nothing. No pension, no health care, and no protection for himself or his family.

[…]

Then I just wanted to go get out of the house. We all had a DNA test kit, but I knew another team would be in there to do all that. So I went down to the second floor where the offices were, the media center. We started breaking apart the computer hard drives, cracking the towers. We were looking for thumb drives and disks, throwing them into our net bags.

In each computer room, there was a bed. Under the beds were these huge duffel bags, and I’m pulling them out, looking for whatever. At first I thought they were filled with vacuum-sealed rib-eye steaks. I thought, They’re in this for the long haul. They’ve got all this food. Then, wait a minute. This is raw opium. These drugs are everywhere. It was pretty funny to see that.

{ Center for Investigative Reporting | Continue reading }

photo { Harry Benson, Grieving Man with Flag, Washington, D.C., 1971 }

U.S., guns | February 12th, 2013 6:13 am

How far has society gone in dreaming up new dangers to protect our children from? […]

(A.) An upstate New York school district outlawed soap in its pre-school bathrooms for fear that children might suddenly start drinking it. Now kids must come out and ask an adult to squirt some soap in their hands.

(B.) Unaccompanied children under age 12 were banned from the Boulder, CO, library, lest they encounter “hazards such as stairs, elevators, doors, furniture…and other library patrons.”

(C.) The Consumer Product Safety Commission announced a recall of certain fleece hoodies sold at Target because of lead paint on the zipper, which presumably could raise blood lead levels if the zippers are eaten.

(D.) Children under age 18 were prohibited from gathering on the streets of Tucson, AZ, for fear they might “talk, play or laugh” in groups, which could lead to bullying.

(E.) A New Canaan, CT, mom was charged with “risk of injury to a minor,” for letting her 13-year-old babysit the three younger children at home for an hour while the mom went to church.

(F.) A Tennessee mother was thrown in jail for letting her kids, aged 8 and 5, go the park without her, a block and half away from home.

[…]

The message to parents? The government is better at raising your kids than you are. The message to kids? You are weak little babies.

{ CATO Unbound | Continue reading }

photo { Mary Ellen Mark }

U.S., kids, law | February 5th, 2013 6:56 am

“I would say we have a housing bubble…again.” […]

“It’s happening in the most speculative sub-prime markets, where massive amounts of ‘fast money’ is rolling in to buy, to rent, on a speculative basis for a quick trade,” he contends. “And as soon as they conclude prices have moved enough, they’ll be gone as fast as they came.” […]

Stockman argues the problem in housing is the two forces needed for a recovery, first-time buyers and trade-up buyers, are missing. With the combination of 7.9% unemployment and staggering student loan debt, he doesn’t see a young generation of new home buyers coming into the market. And with baby boomers heading for retirement with less than adequate savings, he thinks they’ll be trading down with their homes, not up. […]

“As soon as the Fed has to normalize interest rates, housing prices will stop appreciating and they’ll probably head down,” he explains. “The fast money will sell as quickly as they can and the bubble will pop almost as rapidly as it’s appeared. I don’t know how many times we’re going to do this, and the only people who benefit are the top one percent - the hedge funds, the LBO funds, the fast money people who come in for a trade, make a quick buck, and move along to the next bubble.”

{ Yahoo | Continue reading }

U.S., housing | February 5th, 2013 6:09 am

Governor Andrew Cuomo wants to use $400 million in federal funding to buy beachfront homes as he seeks to reshape the New York coastline so the state is better prepared for storms like Hurricane Sandy.

The cash would come from the $51 billion Congress approved last month to help the region recover from the Oct. 29 storm.

The governor would use the money to pay owners the pre-storm value of their homes. More than 300,000 houses in New York were damaged by Sandy.

Once sold, the houses would be razed and the land would remain vacant.

{ Bloomberg | Continue reading }

U.S., climate, economics, incidents | February 4th, 2013 3:49 pm

In America, 43 states have at least one Grand Canyon. Seventy three nations boast a Grand Canyon or two. There are Grand Canyons in the bottoms of oceans, too. Nevertheless, only a small number of the world’s Grand Canyons are recognized by agencies of geographic nomenclature, such as the U.S. Board of Geographic Names and the National Imagery and Mapping Agency. This still did not stop a few geographically challenged writers and bureaucrats from misplacing Arizona’s canyon altogether, calling it the “Grand Canyon of New Mexico,” “Nevada’s Grand Canyon,” and “Colorado’s Grand Canyon.” The Colorado transplant was sensationally replicated by the U.S. Postal Service in 1999 when they produced a full run of postage stamps portraying “Grand Canyon, Colorado.” All 100 million stamps were then destroyed. […]

In fact, the size of Arizona’s Grand Canyon was only an educated guess when the Smithsonian Institution first mentioned the place in 1857. It was called “Big Canyon” then. […]

Canyonicity is all about depth; the deeper the better. But surprisingly, a canyon’s “depth” has been redefined. It was and still is measured from top to bottom. However, canyons that have no rims per se (deep declivities in mountain ranges, for example) are measured relative to the tops of nearby mountain peaks. Even the National Geographic Society embraces this method of determining depth, and to this end the Society has identified and promoted the idea that there are “deeper” and “grander” canyons than Arizona’s famous chasm. This is geological nonsense.

{ Is the Grand Canyon a Fake? | PDF | via Improbable }

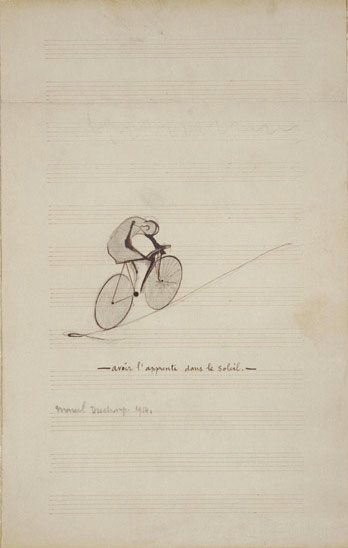

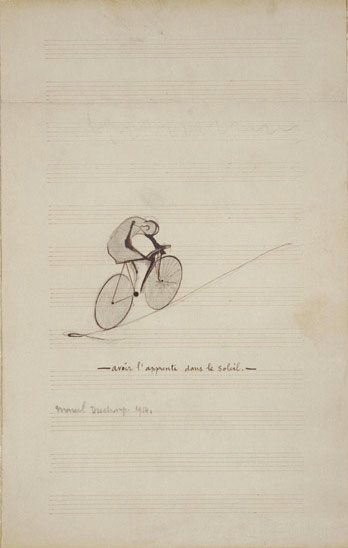

art { Marcel Duchamp, To Have the Apprentice in the Sun (Cyclist), 1914 }

U.S. | February 4th, 2013 5:24 am

The Government of Antigua is planning to launch a website selling movies, music and software, without paying U.S. copyright holders.

{ TorrentFreak | Continue reading }

During a meeting in Geneva today the World Trade organization (WTO) authorized Antigua’s request to suspend U.S. copyrights. The decision confirmed the preliminary authorization the Caribbean island received in 2007, and means that the local authorities can move forward with their plan to start a download portal which offers movies, music and software without compensating the American companies that make them.

{ TorrentFreak | Continue reading }

U.S., law, within the world | January 29th, 2013 7:55 am

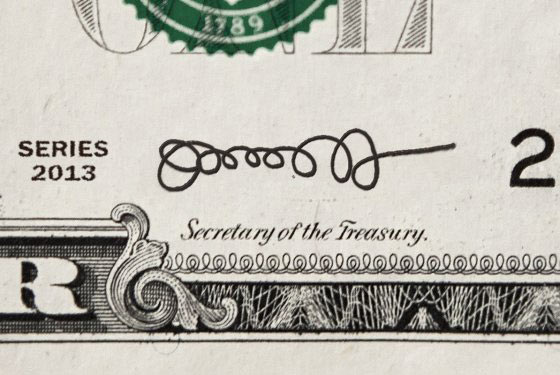

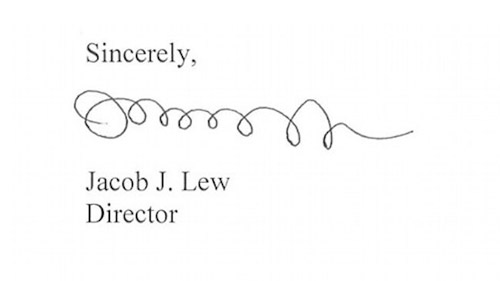

U.S., economics, visual design | January 29th, 2013 7:55 am

U.S., guns | January 20th, 2013 7:18 am

From the 1940s through the 1980s, recovery was accompanied by significant job growth—on the order of between 10 and 20 percent after four years. In our last three recessions, by contrast, we actually continued to lose jobs through the first months of “recovery,” and then added jobs at a glacial pace.

In 2003-4 and again over the last three years, this combination is often passed off as a curiosity: a “jobless recovery” in which the economy gets better but the labor market doesn’t. But that’s not really what’s happening. Job growth is slow because the recovery is slow. From the 1940s through the 1980, recoveries were relatively short and robust—usually adding about 10 percent to GDP in the first two years after the trough of the business cycle. In the 1991-3 recovery, GDP grew only 6 percent. In 2001-3, GDP grew only 5.9 percent. In the first two years of our current recovery (through July 2011), GDP grew only 4.4 percent. That’s not a jobless recovery. It’s no recovery at all.

{ Dissent | Continue reading }

photo { Allen Frame }

U.S., economics | January 18th, 2013 4:30 pm

Infiniti Poker, like several other new online gambling sites, plans to accept Bitcoin when it launches later this month. […]

Developed in 2009 by a mysterious programmer known as Satoshi Nakamoto, Bitcoins behave much like any currency. Their value—currently about $13 per Bitcoin—is determined by demand. Transactions are handled through a decentralized peer-to-peer network similar to BitTorrent, the protocol for sharing films and music over the Internet. An assortment of merchants around the globe accept Bitcoin; it’s also the currency used on online black markets such as Silk Road, which processes an estimated $1.2 million a month in sales of illegal drugs, according to Nicolas Christin, the associate director of Carnegie Mellon’s Information Networking Institute.

Individuals can buy and sell Bitcoins using global currencies through such online exchanges as Mt. Gox. There’s even a service facilitated by BitInstant, a payment-processing company, that allows you to purchase the virtual currency for cash at 700,000 U.S. locations, including participating Wal-Mart, Duane Reade, and 7-Eleven stores. Once users have Bitcoins, they store them on their computers or mobile devices in files known as Bitcoin wallets or in cloud-based “e-wallets.”

Hajduk says Infiniti Poker will accept credit cards, wire transfers, and other payment options, but players in the U.S. will be able to play only using Bitcoins. He originally included the currency not to get around U.S. law but to reduce the time it takes to cash players out. Bank transactions can take up to 12 weeks; players who use Bitcoin can get a payout in a matter of hours, he says.

{ Businessweek | Continue reading }

U.S., card games, economics, law, technology | January 11th, 2013 12:12 pm

U.S., economics, visual design | January 10th, 2013 2:22 pm

U.S., haha | January 10th, 2013 3:40 am

It’s an exciting time to be in the energy industry in America. The impact of unconventional oil and gas development on the U.S. economy is considerable, with potentially hundreds of billions of dollars in investments, millions of new jobs, and a renaissance of American ingenuity and innovation.

In thinking about what is to come, looking back five years helps set the stage. January 2008: The energy sector was facing the great recession, high current and future expected natural gas prices, and job losses to China. There was a generally poor outlook for the energy industry and the economy.

Few could have predicted the changes that were to come. Unforeseen happenings include the North Dakota oil rush, liquefied natural gas facilities being used as export facilities (instead of as import facilities as originally planned), railroads hauling crude oil, and jobs coming back from China. And, this is just the beginning. The commencement of the crude oil and natural gas revolution can be boiled down to one simple equation:

Abundant resources + cost effective extraction = high production levels of unconventional oil and gas.

The net effect is a reshaping of the U.S. energy industry and our economy.

{ Forbes | Continue reading }

U.S., economics, oil | January 2nd, 2013 10:00 am

economics, marketing, new york | December 28th, 2012 10:04 am

The US surveillance regime has more data on the average American than the Stasi ever did on East Germans.

The American government is collecting and storing virtually every phone call, purchases, email, text message, internet searches, social media communications, health information, employment history, travel and student records, and virtually all other information of every American.

Some also claim that the government is also using facial recognition software and surveillance cameras to track where everyone is going. Moreover, cell towers track where your phone is at any moment, and the major cell carriers, including Verizon and AT&T, responded to at least 1.3 million law enforcement requests for cell phone locations and other data in 2011. And – given that your smartphone routinely sends your location information back to Apple or Google – it would be child’s play for the government to track your location that way.

As the top spy chief at the U.S. National Security Agency explained this week, the American government is collecting some 100 billion 1,000-character emails per day, and 20 trillion communications of all types per year.

{ Washington Blogs | Continue reading }

U.S., spy & security | December 28th, 2012 5:50 am

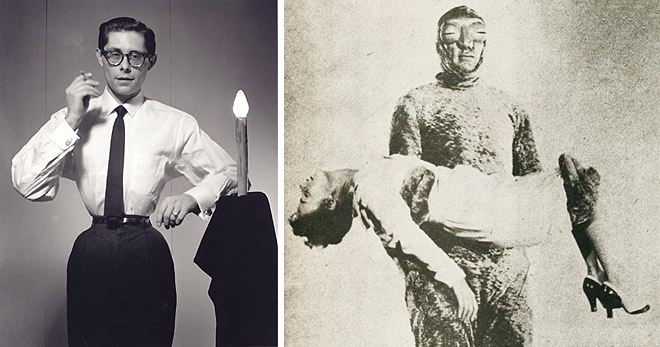

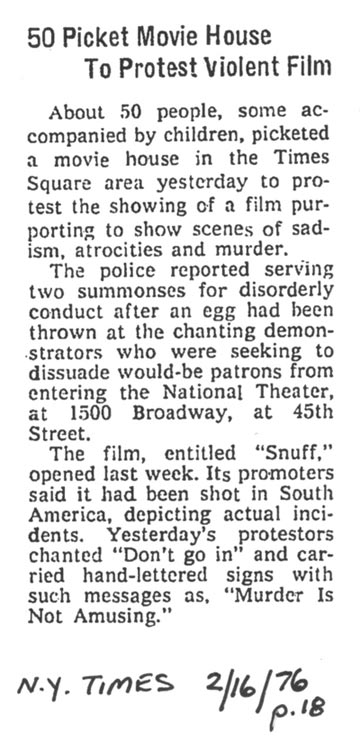

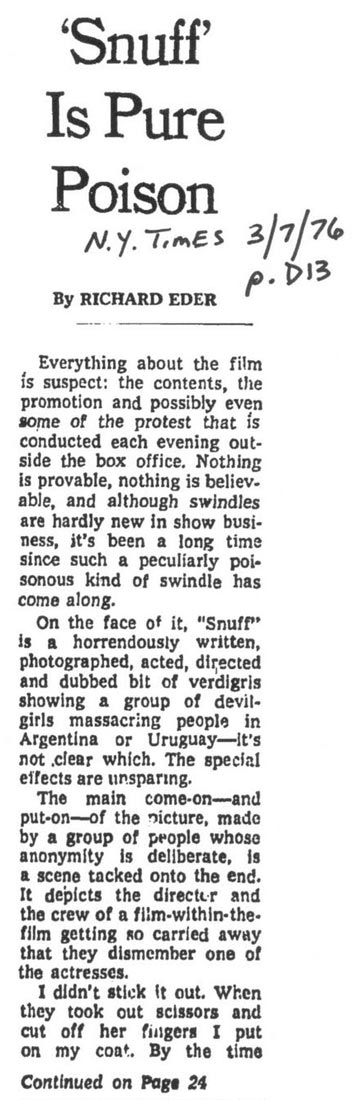

flashback, new york, showbiz | December 12th, 2012 2:22 am