Ben Bernanke has not only refused to abandon his idee fixe of an “inflation target”, a key cause of the global central banking catastrophe of the last twenty years (because it can and did allow asset booms to run amok, and let credit levels reach dangerous extremes).

Worse still, he seems determined to print trillions of emergency stimulus without commensurate emergency justification to test his Princeton theories, which by the way are as old as the hills. Keynes ridiculed the “tyranny of the general price level” in the early 1930s, and quite rightly so. Bernanke is reviving a doctrine that was already shown to be bunk eighty years ago.

{ Telegraph | Continue reading }

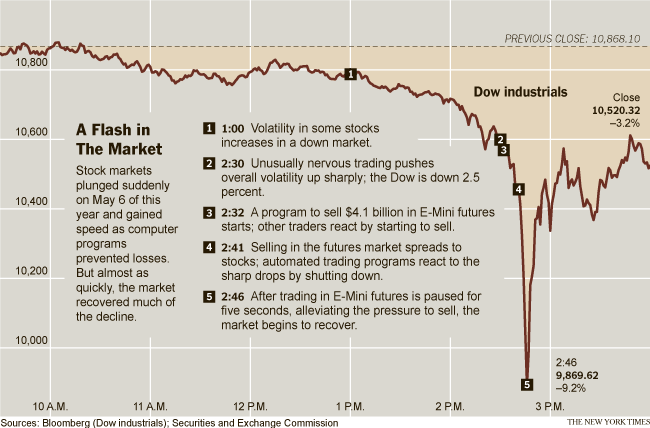

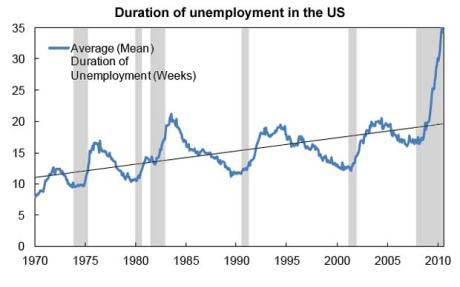

Structural unemployment is a fake problem, which mainly serves as an excuse for not pursuing real solutions.

Who are these wise heads I’m talking about? The most widely quoted figure is Narayana Kocherlakota, the president of the Federal Reserve Bank of Minneapolis, who has attracted a lot of attention by insisting that dealing with high unemployment isn’t a Fed responsibility: “Firms have jobs, but can’t find appropriate workers. The workers want to work, but can’t find appropriate jobs,” he asserts, concluding that “It is hard to see how the Fed can do much to cure this problem.”

Now, the Minneapolis Fed is known for its conservative outlook, and claims that unemployment is mainly structural do tend to come from the right of the political spectrum. But some people on the other side of the aisle say similar things. For example, former President Bill Clinton recently told an interviewer that unemployment remained high because “people don’t have the job skills for the jobs that are open.”

Well, I’d respectfully suggest that Mr. Clinton talk to researchers at the Roosevelt Institute and the Economic Policy Institute, both of which have recently released important reports completely debunking claims of a surge in structural unemployment.

After all, what should we be seeing if statements like those of Mr. Kocherlakota or Mr. Clinton were true? The answer is, there should be significant labor shortages somewhere in America — major industries that are trying to expand but are having trouble hiring, major classes of workers who find their skills in great demand, major parts of the country with low unemployment even as the rest of the nation suffers.

None of these things exist. Job openings have plunged in every major sector, while the number of workers forced into part-time employment in almost all industries has soared. Unemployment has surged in every major occupational category. Only three states, with a combined population not much larger than that of Brooklyn, have unemployment rates below 5 percent.

Oh, and where are these firms that “can’t find appropriate workers”? The National Federation of Independent Business has been surveying small businesses for many years, asking them to name their most important problem; the percentage citing problems with labor quality is now at an all-time low, reflecting the reality that these days even highly skilled workers are desperate for employment.

So all the evidence contradicts the claim that we’re mainly suffering from structural unemployment. Why, then, has this claim become so popular?

Part of the answer is that this is what always happens during periods of high unemployment — in part because pundits and analysts believe that declaring the problem deeply rooted, with no easy answers, makes them sound serious.

{ Paul Krugman/NY Times | Continue reading }