When things happen, they happen with a purpose

{ Floating Points, Love Me Like This, 2009 }

{ Dream Frequency, Live The Dream, 1990}

{ Chad Jackson, Hip Hop Megamix, 1987, Part 1 | Part II }

{ Washed Out, Belong, 2009 }

{ Floating Points, Love Me Like This, 2009 }

{ Dream Frequency, Live The Dream, 1990}

{ Chad Jackson, Hip Hop Megamix, 1987, Part 1 | Part II }

{ Washed Out, Belong, 2009 }

{ Police have made a public appeal for help to solve the mystery of how a grandfather was apparently shot by a stray bullet as he tended his front garden. Detectives, who admit that it is one of the strangest cases they have encountered, are working on one theory that the gunman could have fired into the air, possibly streets away, and remains unaware of the consequences of his actions. | Times | Continue reading }

{ U.S. risks China’s ire with decision to fund software maker tied to Falun Gong, a Buddhist-like sect long considered Enemy No. 1 by the Chinese government. | Washington Post | full story }

Gaze direction affects judgements of facial attractiveness

Much is known about the attractiveness of physical attributes, such as symmetry and averageness. Here we examine the effect of a social cue, eye-gaze direction, on facial attractiveness. Given that direct gaze signals social engagement, we predicted that faces showing direct gaze would be preferred to faces showing averted gaze.

Thirty-two males completed two tasks designed to assess preferences for female faces displaying a neutral expression. Participants were more likely to select the face with direct gaze, when choosing the more attractive face from direct- and averted-gaze versions of the same face.

This direct-gaze preference was stronger for high-attractive than low-attractive face sets, but was present for both. Attractiveness ratings were also higher for faces with direct than averted gaze. Interestingly, stimulus inversion weakened the preference for inverted faces, which suggests the preference does not simply reflect a bilateral symmetry bias.

{ Visual Cognition/InformaWorld }

Gaze bias: Selective encoding and liking effects

People look longer at things that they choose than things they do not choose. How much of this tendency—the gaze bias effect—is due to a liking effect compared to the information encoding aspect of the decision-making process? (…)

Colour content (whether a photograph was colour or black-and-white), not decision type, influenced the gaze bias effect in the older/newer decisions because colour is a relevant feature for such decisions. These interactions appear early in the eye movement record, indicating that gaze bias is influenced during information encoding.

photo { Morad Bouchakour }

This is evident in the element of chance and randomness inserted into design by painters like Arp and Pollock, but, beyond that, it is evident in the larger urge, shared by poets and writers, to make a career of violations, risks, wagers. Gauguin is the original of the type, of whom Picasso is the most famous realization, of the artist as gambler–the solitary risk-taker, indifferent to anyone’s welfare but his own and therefore capable of acts of independence and originality unknown to timid, orderly, nice people, acts that thrill and inspire new acts a century later. It is the goal of that kind of modern artist to run the red light and hit the old ladies–the old ladies of custom and convention. Where art since the Renaissance had attempted to limit luck in a system of inherited purpose and patterns, modern art demands that you press the pedal as hard as you can, and pray.

{ Excerpted by Daniel from The New Yorker }

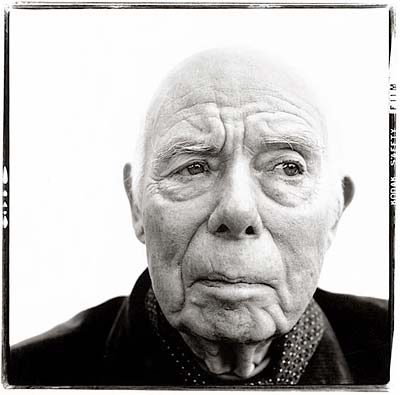

photo { Jean Renoir by Richard Avedon, 1972 }

It ought to be easy ought to be simple enough

Man meets a woman and they fall in love

But the house is haunted and the ride gets rough

And you’ve got to learn to live with what you can’t rise above if you want to ride on down in through this tunnel of love{ Bruce Springsteen, Tunnel of Love, 1987 | Thanks Jay }

video still { Pipilotti Rist }

bonus:

A world without “the pill” is unimaginable to many young women who now use it to treat acne, skip periods, improve mood and, of course, prevent pregnancy. They might be surprised to learn that U.S. officials announcing approval of the world’s first oral contraceptive were uncomfortable.

“Our own ideas of morality had nothing to do with the case,” said John Harvey of the Food and Drug Administration in 1960.

The pill was safe, in other words. Don’t blame us if you think it’s wicked.Sunday, Mother’s Day, is the 50th anniversary of that provocative announcement that introduced to the world what is now widely acknowledged as one of the most important inventions of the last century.

Marginalia are notes, scribbles, and comments made by readers in the margin of a book, as well as marginal decoration, drolleries, and drawings in medieval illuminated manuscripts, although many of these were planned parts of the book. True marginalia is not to be confused with reader’s signs, marks (e.g. stars, crosses, fists) or doodles in books. The formal way of adding descriptive notes to a document is called annotation. The scholia on classical manuscripts are the earliest known form of marginalia.

{ Wikipedia | Continue reading | Auto-Urine Therapy | Enlarge | Read more: Urine therapy }

The second most invaluable insight from contemporary American conservatism has been the recognition of the limits of the politics of grievance. That contemporary American liberalism has made the grievance of racial minorities, women, homosexuals, and the disabled a central part of our political landscape stems from a simple fact: these people are and have been aggrieved. (…) To borrow a metaphor from John Updike, grievance becomes a mask that eats the face; it is not untrue to say that, at times, those within these groups come to believe in the essential truth “we are put down,” and history becomes prophecy. (…)

I am an ultra-leftist; the odds of my preferred economic platform coming to fruition within my lifetime are punishingly low. I have to struggle against what conservatives have to struggle against: that whatever the project of America is, it is a liberal project. Some, for reasons of psychic comfort and partisan squabbling, feel the need to attach “classical” before liberal when asserting this country’s basic character. Perhaps they are right to; it makes no difference. This country’s direction is and will be the direction of John Stuart Mill and Thomas Jefferson, and what that will mean for our vision of societal responsibility for individual problems will ultimately defy them and me both.

The political battle, of course, will always be about the next election, the next piece of legislation, the material consequences of politics. As for what will happen in that realm… who can say. But my intuition, and recent history, compels me to warn my conservative friends, who despite everything I love with my human heart: this is not the moment you think it is; this victory is not the turning point you think it is; the next congress will not give you what you hope it will; and even if you get every last thing from our electoral system you could possibly ask for, politics will never make you happy.

{ A dog that has been seen at nearly every demonstration in Athens over the last two years has turned up again during the recent protests against new austerity measures. He always seems to side with the protesters, whatever the dispute. | AFP/The Guardian | more l Thanks Willie }

During the last two decades, the American economy has suffered from a series of legal, fiscal and monetary policies that have favored speculation over production. The result has been the financialization of the economy, which has been characterized in economic terms by an unhealthy growth in debt at all levels of the economy and in cultural terms by the monetization of all values. Entities such as Fannie Mae and Freddie Mac were perfect examples of how the free market had been corrupted before the 2008 financial crisis. The crisis itself demonstrated, however, that the logic of the system required all large institutions to suffer from a similar flaw. Yet these flaws were not inevitable, even at the height of the crisis; they were deliberate political choices. While stakeholders of some institutions, such as Lehman Brothers, were wiped out, those of other firms were not and some were even made whole. The most egregious example of this was the handling of American International Group (AIG), the insurance giant that morphed itself into a giant hedge fund while enriching the officials responsible for some of the most ill-informed judgments in financial history. There was no reason for the government to handle the AIG failure in a manner that made whole foreign counterparties and Goldman Sachs; alternatives including offering a blanket credit guarantee to the insurance company that would have calmed markets and obviated the necessity of the company paying out one hundred cents on the dollar for its reckless insurance bets on synthetic mortgage obligations. While the result – avoidance of the extinction-level-event that an AIG failure would have been for the financial system – was the correct one, the means by which it was achieved furthered the agenda of socializing losses and privatizing gains and bred deep distrust in the government and the system.

Much of the crisis could have been avoided had policymakers and investors operated under realistic assumptions about how markets and economies work. Several years ago, former Federal Reserve Chairman Alan Greenspan described the failure of interest rates to react in the manner he expected as a “conundrum.” We now know that Mr. Greenspan was operating under a false set of assumptions about human nature, as well as a misguided understanding about how market participants behave. As noted in my book, had Mr. Greenspan been an acolyte of Hyman Minsky instead of Ayn Rand, he would have been less susceptible to such a fatal conceit. But beyond that, the real conundrum in modern markets is the continued reliance of investors and policymakers on two false mantras. The first is that markets are efficient; and the second is that investors are rational. Both assertions are so decidedly specious that one has to question both the sanity or the intelligence of those who cling to them.

{ Michael E. Lewitt | Continue reading }

A day after a harrowing plunge in the stock market, federal regulators were still unable on Friday to answer the one question on every investor’s mind: What caused that near panic on Wall Street? (…) The cause or causes of the market’s wild swing remained elusive, leaving what amounts to a $1 trillion question mark hanging over the world’s largest, and most celebrated, stock market. (…)

A government official who was involved in the investigation said regulators had moved away from a theory that it was a trading mistake — a so-called fat finger episode — and were examining the links between the futures and cash markets for stocks.

In particular, this official said, it appeared that as stock trading was slowed on the New York Exchange when big price moves started, orders moved automatically to other, electronic exchanges that did not have pricing restrictions.

The pressure in the less-liquid markets was amplified by the computer-driven trades, which led still other traders to pull back. Only when traders began to manually respond to the sharp drop did the market seem to turn around, said the official, who spoke on the condition of anonymity because the investigation was not complete.

On Friday evening, another government official directly involved in the investigation said that regulators had not yet been able to completely rule out any of the widely discussed possible causes of the market’s gyrations.

This official, who also spoke on the condition of anonymity, said that regulators had collected statistical and trading data from stock and futures exchanges, and had begun cross-analyzing that with trading reports from brokerage firms and large market participants. Regulators have also gathered anecdotal accounts of what happened from hedge funds and other trading firms. (…)

Over the last five years, the stock market has split into a plethora of new competing hubs and trading outlets, a legacy of deregulation earlier this decade and fast-paced technological change. On Friday, the rivalry between the two main exchanges erupted into view as each publicly pointed the finger at the other for being a main cause of the collapse on Thursday, which sent shockwaves around the globe. (…)

The absence of a unified system to halt trading in individual stocks led to bitter accusations between exchanges on Friday. Robert Greifeld, chief executive of Nasdaq OMX, appeared on CNBC to criticize the New York Stock Exchange for halting trading for up to 90 seconds in half a dozen stocks on Thursday.

“Stopping for 90 seconds in time of crisis is exactly equivalent to not picking up the phone,” Mr. Greifeld said.

A few minutes later, Duncan L. Niederauer, chief executive of NYSE Euronext, responded in an interview on CNBC, blaming Nasdaq’s computers for continuing trading while the market was in free fall.

{ NY Times | Continue reading | update: As several stocks declined sharply under heavy selling pressure, the New York Stock Exchange, one of the largest pools, stopped or slowed trading in particular stocks. | Washington Post | full story }

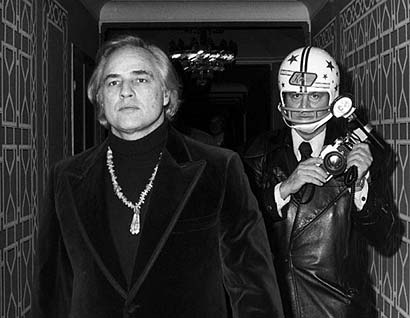

photo { Ron Gallela | SMASH HIS CAMERA, Opening with the artist at Clic Gallery, 424 Broome Street, NYC, June 10th | Read more }

Competitors playing a match against Bobby Fischer, perhaps the greatest chess player of all time, often came down with a mysterious affliction known as “Fischer-fear.” Even fellow grandmasters were vulnerable to the effect, which could manifest itself as flu-like symptoms, migraines and spiking blood pressure. As Boris Spassky, Mr. Fischer’s greatest rival, once said: “When you play Bobby, it is not a question of whether you win or lose. It is a question of whether you survive.”

Recent research on what is known as the superstar effect demonstrates that such mental collapses aren’t limited to chess. While challenging competitions are supposed to bring out our best, these studies demonstrate that when people are forced to compete against a peer who seems far superior, they often don’t rise to the challenge. Instead, they give up. (…)

Because his competitors expect him to win, they end up losing; success becomes a self-fulfilling prophecy. (…)

In the early 1960s, the psychologist Sam Glucksberg demonstrated that the same effect could also inhibit creativity. He gave subjects a standard test of creativity known as the Duncker candle problem. The “high drive” group was told that the person solving the task in the shortest amount of time would receive $20. The “low drive” group, in contrast, was reassured that their speed didn’t matter. Here’s where the results get weird: The subjects with an incentive to think quickly took, on average, more than three minutes longer to find the answer. Experiments like this have led Ms. Beilock to conclude that people should be skeptical of evaluations based on a single high-stakes performance.

I disregard the proportions, the measures, the tempo of the ordinary world. I refuse to live in the ordinary world as ordinary women. To enter ordinary relationships. I want ecstasy. I am a neurotic — in the sense that I live in my world. I will not adjust myself to the world. I am adjusted to myself.

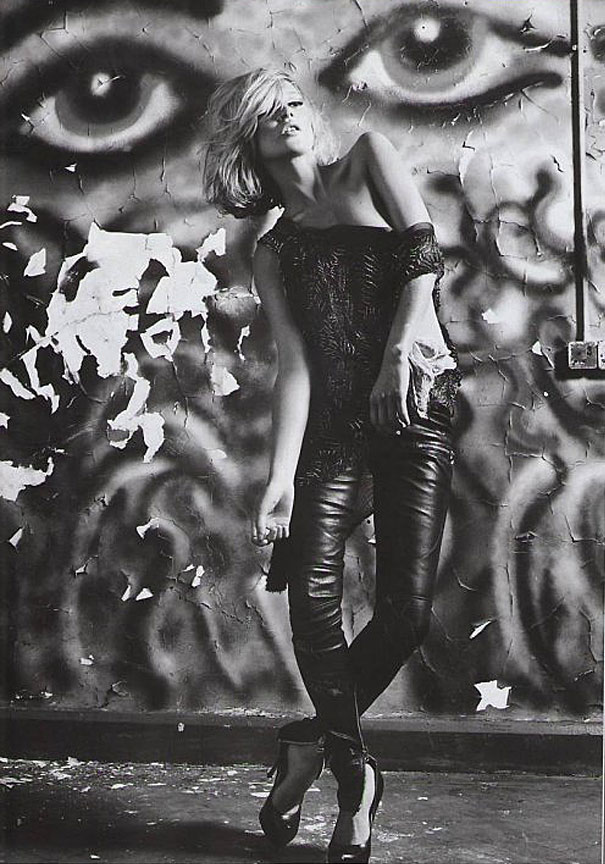

photo { Kate Moss photographed by Mario Sorrenti, Vogue Australia, March 2009 }

The cure for procrastination? Forgive yourself!

There are so many things you’d rather be doing than what you ought to be doing and what happens is that you delay doing what you ought. All the evidence shows that this procrastination is bad for you, for your productivity, your school grades, for your health. But still we keep putting things off. Until. Tomorrow. Now Michael Wohl and colleagues have proposed a rather surprising cure - self-forgiveness. That’s right, forgive yourself for you have procrastinated, move on, get over it and you’ll be more likely to get going without delay next time around.

photo { Alison Brady }

How shoes can change your life–and your skeleton

You might think that shoes can only change your life if you are a sex-and-the-city type shoe lover, spending huge amounts of money on designer footwear. And for most of us, that kind of dedication to shoes is fairly incomprehensible - after all, they’re just things to wear to keep your feet safe from broken glass and tarmac, right? Wrong….

In fact, footwear doesn’t just change your life in the way that owning that perfect pair of Jimmy Choos can affect a girl. Instead, it can influence the way you walk, the shape of your foot, and even the number and type of pathologies present in your foot bones.

A recent study by Zipfel and Berger (2007), for example, has found that some 70% of European males and 66% - that’s two in every three! - females has some pathological condition in their big toe, compared to only about 35% of individuals from an archaeological population which habitually walked barefoot.

photos { Lady Gaga visits MoMA | Lady Gaga’s shoes | Thanks Bucky! }