buffoons

‘Life is nothing but a competition to be the criminal rather than the victim.’ –Bertrand Russell

Yo is the hottest new app that will leave you scratching your head. The entire premise of the app is to send other users a single word: Yo. […] Without ever having officially launched, co-founder and CEO Or Arbel managed to secure $1.2 million in funding.

{ Tech Crunch | Continue reading }

That $1m funding should cover costs for a year to find out whether Yo really can succeed, Mr Arbel says. […] “It’s not just an app that says Yo,” says Mr Arbel. “It’s a whole new means of communication.”

‘All writing is pigshit. People who leave the obscure and try to define whatever it is that goes on in their heads, are pigs.’ —Antonin Artaud

Ultracrepidarian (n):”Somebody who gives opinions on subjects they know nothing about.”

Groke (v): “To gaze at somebody while they’re eating in the hope that they’ll give you some of their food.” My dog constantly grokes at me longingly while I eat dinner.

‘Self-parody precedes selfhood.’ —Rob Horning

Twitter co-creator whose real name is actually Biz Stone has a new project called “Jelly.” No one knows what it is, other than an epicenter of vagaries and tech intrigue. […] In a blog post on its mystery Tumblr, Jelly announced its latest financials backers:

Jack Dorsey, Co-founder and CEO of Square

Bono, Musician and Activist

Al Gore, Politician, Philanthropist, Nobel Laureate

Greg Yaitanes, Emmy Winning Director

Roya Mahboob, Afghan Entrepreneur and Businesswoman[…]

By Jelly’s own admissions, the “product” is still in “early prototyping,” so these celeb investors aren’t even completely sure what they’re investing in. Whatever it is, it will have something to do with “mobile devices [taking] an increasingly central role in our lives,” since “humanity has grown more connected than ever,” and “herein lies massive opportunity.”

{ ValleyVag | Continue reading }

“Jelly” has been a closely guarded secret. […] Now, it has revealed itself. It’s a way to ask your friends questions.

Watch the video and be not amazed. Watch as, for the first time ever, a dude takes a picture of a tree in the woods and sends it to someone else because he doesn’t know what he’s looking at—Yahoo! Answers for the bourgeoisie.

Have you ever posted on Facebook, asking if anyone knows a good barber? Or tweeted to your followers asking if “House of Cards” is any good? That’s Jelly—a search engine that uses your friends—only more convoluted than ever before. […]

Jelly says “it’s not hard to imagine that the true promise of a connected society is people helping each other.” This truly is a revolution in engorged, cloying, dumbstruck rhetoric, a true disruption of horse shit. With Jelly, “you can crop, reframe, zoom, and draw on your images to get more specific”—you can also do that with countless other apps. But that doesn’t matter—this is a vanity project, remember. It’s an opportunity for Biz Stone to Vimeopine on the nature of human knowledge, interconnectedness, and exotic flora. It’s an app for the sake of apps—a software Fabergé egg.

‘Nothing endures but change.’ –Heraclitus

Over the past few years various researchers have made systematic attempts to replicate some of the more widely cited priming experiments. Many of these replications have failed. In April, for instance, a paper in PLoS ONE, a journal, reported that nine separate experiments had not managed to reproduce the results of a famous study from 1998 purporting to show that thinking about a professor before taking an intelligence test leads to a higher score than imagining a football hooligan.

The idea that the same experiments always get the same results, no matter who performs them, is one of the cornerstones of science’s claim to objective truth. If a systematic campaign of replication does not lead to the same results, then either the original research is flawed (as the replicators claim) or the replications are (as many of the original researchers on priming contend). Either way, something is awry.

On Truth and Lie in an Extra-Moral Sense

How much do you like courgettes? According to one Facebook page devoted to them, hundreds of people find them delightful enough to click the “like” button – even with dozens of other pages about courgettes to choose from.

There’s just one problem: the liking was fake, done by a team of low-paid workers in Dhaka, Bangladesh, whose boss demanded just $15 per thousand “likes” at his “click farm”. […]

That particular Facebook page on courgettes was set up by the programme makers to demonstrate how click farms can give web properties spurious popularity. […]

Sir Billi, a British cartoon film voiced by Sir Sean Connery, has more than 65,000 Facebook likes – more than some Hollywood films.

Although it has so far only been released in South Korea, Facebook data suggests the city of Dhaka is the source of the third-largest number of likes. (The Egyptian capital, Cairo, is presently the source of the highest number.)

‘Never argue with an idiot. They will bring you down to their level and beat you with experience.’ –George Carlon

Forget patenting an invention. These days, companies patent conceptual categories for future inventions.

During the first dot-com boom, Amazon famously patented the concept of buying things online with one click. More recently, companies have patented concepts such as scanning documents to an e-mail account, clearing checks electronically and sending e-mail over a wireless network.

The problem with these kinds of abstract patents is that lots of people will independently discover the same basic concept and infringe by accident. Then the original patent holder — who may not have come up with the concept first, or even turned the concept into a usable technology — can sue. That allows for the kind of abusive litigation that has been on the rise in recent years.

A lawsuit over an Internet advertising patent offered a key appeals court an opportunity to rein in these abstract patents. Instead, the court gave such patents its endorsement on Friday, setting the stage for rampant patent litigation to continue unchecked.

A firm called Ultramercial claims to have invented the concept of showing a customer an ad instead of charging for content. The company has sought royalties from a number of Web sites, including Hulu and YouTube. Ultramercial’s patent isn’t limited to any specific software algorithm, server configuration or user interface design. If you build a Web site that follows the general business strategy claimed by the patent, Ultramercial thinks you owe them money.

She wasn’t always like this. She used to be happy. We used to be happy.

A real-estate agent keeps her own home on the market an average of ten days longer [than she would for a client] and sells it for an extra 3-plus percent, or $10,000 on a $300,000 house. When she sells her own house, an agent holds out for the best offer; when she sells yours, she encourages you to take the first decent offer that comes along.

Build a fort, pay for soup, set that on fire

As we noted in 2008, the problem was never liquidity. The problem is that the big banks became insolvent because of stupid gambling.

In other words, the government’s whole approach to the 2008 financial crisis was entirely wrong. And the easy money policy (quantitative easing) of central banks doesn’t help, but instead hurts the economy and the little guy. […]

“The IIF said the US Dow Jones Industrial Average’s had hit an all-time high this week more because of relaxed international monetary conditions than thanks to any recovery in the real economy.”

‘Mal nommer les choses, c’est ajouter au malheur du monde.’ –Albert Camus

People who identify as strong multitaskers tend to be impulsive, sensation-seeking and overconfident in their ability to juggle multiple tasks simultaneously. In fact, note the researchers in the latest issue of PLOS, the people who multitask the most are often the least capable of doing so effectively.

[…]

“The people who are most likely to multitask harbor the illusion they are better than average at it,” says Strayer, “when in fact they are no better than average and often worse.”

‘We have already gone beyond whatever we have words for.’ –Nietzsche

According to a songwriting blogger named Graham English, a typical pop song has anywhere from 100 to 300 words, with the Beatles at the low end of that scale and the verbose Bruce Springsteen at the high end. (Don McLean’s epic “American Pie,” for those who wonder, clocks in at 324 words.) […]

[Rihanna’s “Diamonds,”] 67 words. Underwhelming. But at least it’s more complex than “Where Have You Been,” […] 40 distinct words.

photo { Alexandra Ziegler }

I will sometimes apologize for farting even when I didn’t just so people think mine don’t stink

Whenever a successful writer gets busted for “cheating,” the narrative always involves the collective wondering of why they would take such a risk. We saw this with the downfall of Jayson Blair and Johann Hari, and most recently with Jonah Lehrer. For example, Erik Kain called Lehrer’s actions “strange and baffling.” Curtis Brainard at CJR straight-up asks what’s on everybody’s mind: “Following the revelations of self-plagiarism, outright fabrication, and lying to cover his tracks, we were bewildered. How could such a seemingly talented journalist, and only 31 years old, have thrown it all away?”

What’s interesting is that this question takes a noble view of the offender. The implication is always that the person got to the top on their merits, and then drastically changed their behavior due to situational pressures. People rarely consider that the offender might have risen to the top because they’re predisposed to bending rules or inhabiting the gray areas in an advantageous way. […]

Why assume that everything the offenders accomplished up until their downfall was based purely on virtuous actions?

Furthermore, research on the fundamental attribution error (FAE) predicts that people would not attribute the mistakes of somebody like Lehrer to situational pressures. The FAE describes the tendency to believe that a person’s behavior and mental state correspond to a degree that is logically unwarranted by the situation. […] Situational factors tend to be ignored, and that means when somebody cheats, we tend to assume that they have always been, and forever will be, a cheater.

Why then do writers tend to give Lehrer the benefit of the doubt by focusing the pressures of his situation? […] I think it’s fair to say that because of the nature of the industry most writers do have a personal interest in understanding why writers fabricate, how they should be judged, and what the consequences should be. […]

I think it’s worth mentioning Seth Mnookin’s recent post highlighting previously unknown errors made by Lehrer. Mnookin concludes by essentially saying that Lehrer is a cheater, and has always been a cheater.

The delegation, present in full force, consisted of Commendatore Bacibaci Beninobenone (the semi-paralysed doyen of the party who had to be assisted to his seat by the aid of a powerful steam crane), the Archjoker Leopold Rudolph von Schwanzenbad-Hodenthaler, Countess Marha Virdga Kisászony Putrápesthi…

Fallout continues from the MOCA board’s removal of chief curator Paul Schimmel.

“Jeffrey has always been supportive of my work, but I don’t understand the direction he’s taking the museum right now,” McCarthy said. “I see it as placating the populace. It’s not really what art’s about, but a ratings game.”

Among those in Deitch’s corner is Shepard Fairey, an art star of a younger generation, especially since he designed the “Hope” poster that became the unofficial image of Barack Obama’s 2008 presidential campaign. (The design firm Fairey founded, Studio One, is now handling much of MOCA’s design work.)

In an email, Fairey, 42, praised Deitch’s “astute understanding of the interconnected nature of high and low art culture. When I say low, I don’t mean inferior.”

{ LA Times | Continue reading }

John Baldessari, citing Paul Schimmel’s ouster, becomes the fifth trustee to bolt since February.

threesome { Jeffrey Deitch, Yoko Ono, Jeff Koons }

Fellow sharpening knife and fork, to eat all before him

Yesterday we found out that Jonah Lehrer, the Gladwellesque whiz kid who’s The New Yorker’s newest staff writer, reused his own old writings for every goddamn blog post he’s written for The New Yorker so far. […] What’s the latest? […]

Repackaging the work of others without disclosure is arguably a much more serious offense than reusing your own work without disclosure. […]

This is also why you should never pay someone in their 20s to give a speech and expect to learn something new.

{ Hamilton Nohan | Continue reading }

Wired editor Chris Anderson cemented his speaker-circuit bona fides with a 2006 book, The Long Tail, that was hailed as cogent and disruptive. His last effort, Free: The Future of a Radical Price, met with considerably worse reviews, and its premise was derided on many blogs. Worse, chunks of it turned out to have been copied and pasted without attribution from Wikipedia. None of that matters on the speaking circuit, where Mr. Anderson’s agency says he is in more demand than almost any other client worldwide.

‘Although rivaled closely by SATAN PUT THE DINO BONES THERE, QUENTIN.’ –Malcolm Harris

Worst Companies At Protecting User Privacy: Skype, Verizon, Yahoo!, At&T, Apple, Microsoft.

photos { Marlo Pascual | Sean and Seng }

‘Come on girl. Everyone’s doing it!’ –Peer pressure

Chances are pretty good you’ve recently seen the “Banksy on Advertising” quote that begins, “People are taking the piss out of you everyday.” The passage is from Banksy’s 2004 book Cut It Out, and it presents the idea that if advertisers are going to fill your world with ads, you have every right to “take, re-arrange and re-use” those images without permission. The quote has been posted widely on Facebook, Tumblr, and Twitter, which is where I found it.

Here’s the interesting part:

Most of it is swiped directly from an essay I wrote in 1999.

Nobody uses Facebook anymore. It’s too crowded.

Five reasons why I’m not buying Facebook

Excuse me for raining on the Facebook parade, but the $450 million investment by Goldman Sachs and $50 million from Russia’s Digital Sky Technology didn’t move me the way it seemed to move others. This despite the suggested $50 billion valuation, as big and beautiful a number as the stock market has seen in some time.

I am certainly not moved in the same way it appears to have moved Goldman’s own clients: the Wall Street firm has pledged to line up another $1.5 billion in sales to its high net worth investors, who are said to be champing at the bit to get a piece of the action, which starts with a $2 million minimum. Not that I have $2 million lying around, but I wouldn’t buy this stock if I did.

Reason #1: Someone who knows a lot more than I do is selling. While the identities of the specific sellers remain unknown, the current consensus seems to be that most will be from venture capital investors like Accel Partners, Peter Thiel, and Greylock Partners. Maybe Mark Zuckerberg will kick in $50 million or so himself, just for some fooling around money. (…) The way the social network is talked about these days, it’s the best investment opportunity in town. So why would anyone want to forsake it? And don’t give me that crap about VCs being “early stage” and wanting to cash out of a “mature” investment. These people are as money hungry as any other institutional investor, and would let it ride unless….they saw something that suggested that the era of stupendous growth was over. Facebook reached 500 million users in July. There’s been no update since, even though the company had meticulously documented every new 50 million users to that point. Might the curve have crested? And let’s not even talk about the fact that they don’t really make much money per user — a few dollars a year at most. (Its estimated $2 billion in 2010 revenues would amount to $4 per user at that base.)

Reason #2: Goldman Sachs. I’ve got nothing against Goldman Sachs. Hell, I worked there. But when Reuters’ Felix Salmon says that the Goldman investment “ratifies” a $50 billion valuation, he’s only half right. That is, someone, somewhere—perhaps the Russians at DST Global—might just believe this imaginary number. (It’s hard to see why, though: DST got in at a $10 billion valuation in May 2009. Facebook’s user base has more than doubled since then. So its valuation should…quintuple?) But concluding that Goldman Sachs believes in a $50 billion valuation is poor reasoning. (…)

Reason #5: Warren Buffett cautions those looking at outsize valuations to consider one’s purchase of company stock in a different way than price of an individual share, whatever it may be. He suggests one look at the total market valuation – in this case, a sketchy $50 billion – and to consider: Would you buy the whole company for that price, if you had the money? The market value of Goldman Sachs is just $88 billion. I’d take more than half that company over the whole of Facebook any day of the week.

related { For News Sites, Google Is the Past and Facebook Is the Future | Google’s stealth multi-billion-dollar business }

and { The Next 10 Years Will Be Great For Both Founders And VCs }

For this is how things are

Preventing preterm births just got 150 times more expensive, now that KV Pharmaceuticals has gained exclusive rights to produce a progesterone shot used to prevent premature births in high-risk mothers.

Although the shot has been available in unregulated form from specialty compounding pharmacies for years for $10 a pop, the Food and Drug Administration recently granted KV Pharmaceuticals sole rights to produce the drug, which will be marketed as Makena and cost $1,500 per dose — an estimated $30,000 in total per pregnancy. (…)

Because FDA laws prohibit compounding pharmacies from making FDA-approved products, doctors will be legally obligated to stop using the cheaper version of this drug.

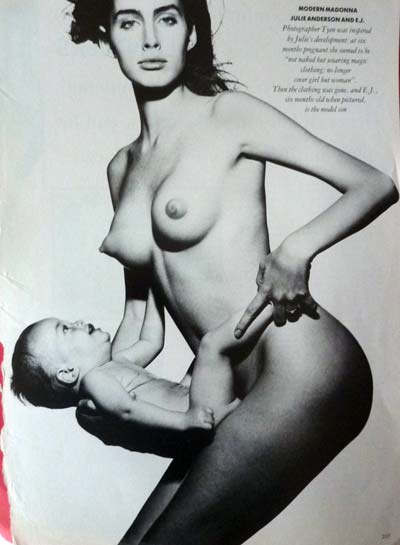

photo { Julie Anderson and E.J. photographed by Tyen }