economics

Consider the dominant story that economic forecasters have been telling you for years now: The U.S. economy just can’t catch a break. It has been poised time and again to rocket back to a growth rate that would recapture all the ground lost in the Great Recession, while delivering big job gains. But every time, some outside event scuttles things. The euro crisis flares up. A Japanese tsunami scrambles global supply chains. Lawmakers play chicken with the federal debt limit.

Most recently, “fiscal cliff” tax hikes and sequestration budget cuts are playing the culprit. And the bad-luck economy, like a fireball pitching prospect dogged by freak arm injuries, never reaches its full potential.

Now consider the possibility that the can’t-catch-a-break story gets it backward. […]

What if this slow and fragile expansion is as good as we’re likely to get for a while?

{ Washington Post | Continue reading }

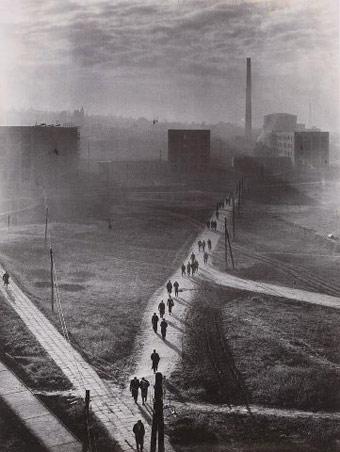

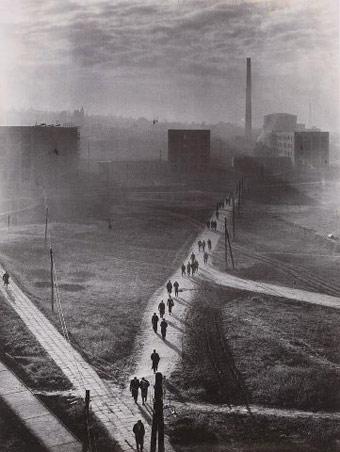

photo { Ernö Vadas, Gyár/Factory, Budapest, Hungary, 1955 }

U.S., economics | March 4th, 2013 8:58 am

Worldwide, over US$100 billion is invested every year in supporting biomedical research, which results in an estimated 1 million research publications per year. […]

An efficient system of research should address health problems of importance to populations and the interventions and outcomes considered important by patients and clinicians. However, public funding of research is correlated only modestly with disease burden, if at all. Within specific health problems there is little research on the extent to which questions addressed by researchers match questions of relevance to patients and clinicians. […]

Although some waste in the production and reporting of research evidence is inevitable and bearable, we were surprised by the levels of waste suggested in the evidence we have pieced together. Since research must pass through all four stages shown in the figure, the waste is cumulative. If the losses estimated in the figure apply more generally, then the roughly 50% loss at stages 2, 3, and 4 would lead to a greater than 85% loss, which implies that the dividends from tens of billions of dollars of investment in research are lost every year because of correctable problems.

{ Iain Chalmers, Paul Glasziou | PDF | via OvercomingBias }

economics, health, science | February 28th, 2013 7:00 am

“There’s a huge amount of vodka that’s sold for drinking at home,” Lieskovsky says. “But no one knew where it was really going”—apart from down someone’s throat eventually, and on a bad night perhaps back up again. Was it treated as a sacred fluid, not to be polluted or adulterated except by an expert mixologist? Some Absolut advertising and iconography suggested exactly this, assuming understandably that buyers of a “premium” vodka would want laboratory precision for their cocktails. Another possibility was that the drinkers might not care much about the purity of the product, and that bringing it to a party merely lubricated social interaction. “We wanted to know what they are seeking,” Lieskovsky says. “Do they want the ‘perfect’ cocktail party? Is it all about how they present themselves to their friends, for status? Is it collaboration, friendship, fun?”

Over the course of the company’s research, the rituals gradually emerged. “One after another, you see the same thing,” Lieskovsky told me. “Someone comes with a bottle. She gives it to the host, then the host puts it in the freezer and listens to the story of where the bottle came from, and why it’s important.” And then, when the bottle is served, it goes right out onto the table with all the other booze, the premium spirits and the bottom-shelf hooch mixed together, in a vision of alcoholic egalitarianism that would make a pro bartender or a cocktail snob cringe.

What mattered most, to the partygoers and their hosts, were the narratives that accompanied the drinks. […]

The corporate anthropology that ReD and a few others are pioneering is the most intense form of market research yet devised, a set of techniques that make surveys and dinnertime robo-calls (“This will take only 10 minutes of your time”) seem superficial by comparison. ReD is one of just a handful of consultancies that treat everyday life—and everyday consumerism—as a subject worthy of the scrutiny normally reserved for academic social science.

{ The Atlantic | Continue reading | Thanks Tim }

economics, marketing, science | February 26th, 2013 12:53 pm

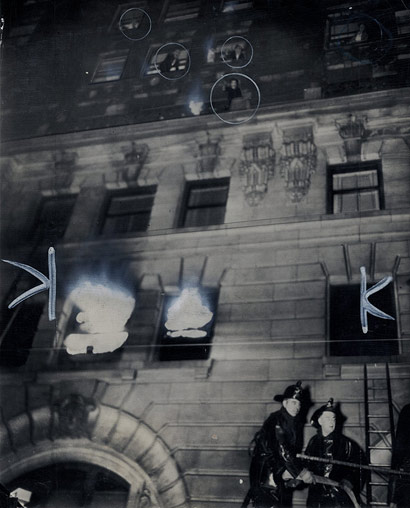

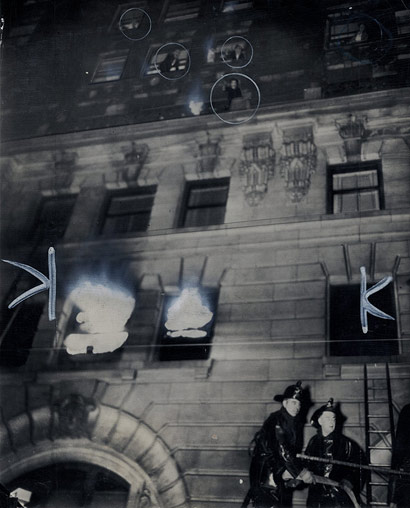

Fifteen years ago, two fraud cases sent shock waves through the world of photography, helping to trigger a revolution in photo conservation science.

Long dismissed by the art establishment as a second-tier medium, “photography used to fight for space in galleries,” says James M. Reilly, director of the Image Permanence Institute in Rochester, N.Y. But by the 1990s the prestige—and price tags—of photographs began to approach those of paintings and sculpture. During that decade, collectors increasingly paid out hundreds of thousands and then the first million dollars for vintage and contemporary photographs. Yet, as in all coming-of-age stories, life’s dark side made an appearance, this time by means of back-to-back fraud cases.

In 1998, researchers in Germany discovered that a collection of prints by the avant-garde American photographer Man Ray had not been made by the artist himself. A year later, a team in the U.S. began to scrutinize a collection of 20 prints by Lewis Hine, an early-20th-century American documentary photographer. They discovered that the iconic collection of photos of Empire State Building construction sites and child laborers, purported to have been printed by Hine himself, were made decades after his death. Both cases led to million-dollar settlements that helped stimulate the photo conservation research, transforming a niche field into a mature science.

{ Chemical & Engineering News | Continue reading }

economics, photogs, scams and heists | February 26th, 2013 4:56 am

Last August, a book titled “Leapfrogging” hit The Wall Street Journal’s list of best-selling business titles upon its debut. The following week, sales of the book, written by first-time author Soren Kaplan, plunged 99% and it fell off the list.

Something similar happened when the hardcover edition of “Networking is Dead,” was published in mid-December. A week after selling enough copies to make it onto the Journal’s business best-seller list, more hardcover copies of the book were returned than sold, says book-sales tracker Nielsen BookScan.

It isn’t uncommon for a business book to land on best-seller lists only to quickly drop off. But even a brief appearance adds permanent luster to an author’s reputation, greasing the skids for speaking and consulting engagements.

Mr. Kaplan says the best-seller status of “Leapfrogging” has “become part of my position as a speaker and consultant.”

But the short moment of glory doesn’t always occur by luck alone. In the cases mentioned above, the authors hired a marketing firm that purchased books ahead of publication date, creating a spike in sales that landed titles on the lists. The marketing firm, San Diego-based ResultSource, charges thousands of dollars for its services in addition to the cost of the books, according to authors interviewed.

{ WSJ | Continue reading | via Forbes }

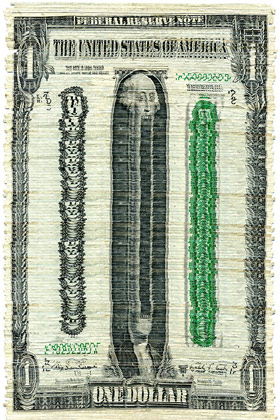

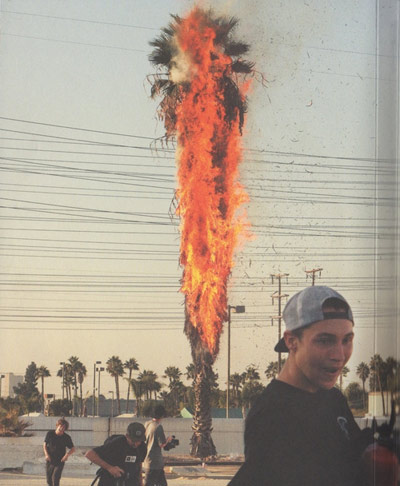

installation { Tom Sachs }

books, economics, scams and heists | February 25th, 2013 7:07 am

More than three-quarters of the food consumed in the United States today is processed, packaged, shipped, stored, and sold under artificial refrigeration. […] Despite the efforts of industry bodies, government agencies, and industrial archaeologists, this vast, distributed artificial winter that has reshaped our entire food system remains, for the most part, unmapped. What’s more, the varied forms of these cold spaces remain a mystery to most. This guide provides an introduction to a handful of the strange spatial typologies found within the “cold chain,” that linked network of atmospheric regulation on which our entire way of life depends. […]

A given piece of meat typically spends twenty-one days there, where it shrinks in size by 15 percent while increasing in value by 20 percent. In addition to its preferred temperature, prime steak’s environmental requirements include 80 percent humidity levels. […]

To engineer a consistent supply of a highly perishable product, Big Juice (Tropicana, Florida’s Natural, and their ilk) pasteurize, de-oil, and then strip the oxygen from their OJ before chilling it to 32°F and pumping it into million-gallon, refrigerated, epoxy resin-lined, carbon steel, aseptic storage tanks.

There, it often sits for as long as a year, from processing season to processing season, before being rejuvenated with the addition of specially formulated flavor packs (to ensure each brand maintains its own trademark taste), and shipped to a distribution center in Jersey City on the refrigerated box cars of the CSX “juice express,” a favorite of East Coast train spotters.

{ Cabinet | Continue reading }

photo { Nicolas Dhervillers }

economics, food, drinks, restaurants | February 22nd, 2013 1:27 pm

South Koreans enjoy Internet access today at speeds that run well over 100 times faster what most Americans can get — at half the monthly cost Americans typically pay. What do we have that South Koreans don’t? We have high-tech corporate execs routinely pulling in mega millions for delivering second-rate technology. The latest sign of the immense fortunes our high-tech titans are raking in: News reports last week revealed the late November sale of a Silicon Valley home for $117.5 million, the second-highest price ever paid for a U.S. residence. […]

The world’s wealthy once again gathered in the Alps last week to discuss how to ’solve’ the world’s problems. Their wealth, suggests a top global anti-poverty outfit, has become the problem.

Apologists for inequality have a standard retort to anyone who calls for a more equal distribution of the world’s treasure. If you took all the wealth of the wealthy and divvied it up equally among the poor, the retort goes, no one would gain nearly enough to accomplish much of anything.

Oxfam International, one of the world’s premiere anti-poverty charitable organizations, would beg to differ. The world’s top 100 billionaires now hold so much wealth, says a new Oxfam report, that just the increase in their net worth last year would be “enough to make extreme poverty history four times over.”

{ Too Much | Continue reading }

economics | February 21st, 2013 10:19 am

Don’t think of arid expanses like the Sahara as desolate wastelands. Think of them as near-infinite sources of clean power. In six daylight hours, Earth’s deserts soak up more energy than humanity uses in a year. Now an unlikely consortium of politicians, scientists, and economists from around the Mediterranean has a plan to harness it. “Desertec” would involve hundreds of square miles of wind and solar plants in the world’s deserts, hooked into electrical grids to funnel reliable, renewable, and affordable power to more sun-challenged regions. Planners are hoping to get solar power flowing from North Africa to Europe first. An estimated 1,300 square miles of North African desert could handle 20 percent of Europe’s energy needs by 2050.

{ Wired | Continue reading }

economics, technology | February 20th, 2013 12:56 pm

Buffett’s Berkshire Hathaway and 3G said last Thursday they would buy Heinz for $23 billion in cash. Almost immediately, options market players noted there had been extremely unusual activity the day before the deal was announced.

On Friday, the U.S. Securities and Exchange Commission filed a suit against unknown traders who it said used a Goldman Sachs account in Switzerland to trade on purported inside knowledge of the transaction.

On Tuesday, the FBI said it was joining in as well.

{ Reuters | Continue reading }

law, traders | February 20th, 2013 10:59 am

There is no particular reason why – contrary to some forecasts – this deal [Heinz–Buffet] signals a turn in the economy that should spark a wave of mergers and acquisitions. That said, Mr Buffett has reminded us that, when money is cheap, takeovers follow. In that sense, leveraged deals could be seen as central bankers’ gift to acquirers. […]

Berkshire never bit on Heinz until now, when a deal arrived with terms that guarantee it a 6 per cent return.

In a world of near-zero interest rates, that 6 per cent looks pretty attractive. Mr Buffett, evidently, does not expect rates to rise sharply any time soon. A decade ago, he demanded a first-day return of 13 per cent before he would bother to consider a deal. Now the Oracle takes 6 per cent for his money. We should pay attention. There could hardly be a stronger signal that the investing tide has changed.

{ FT | Continue reading }

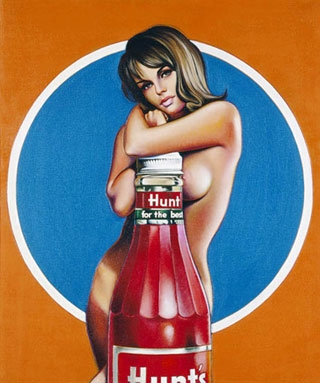

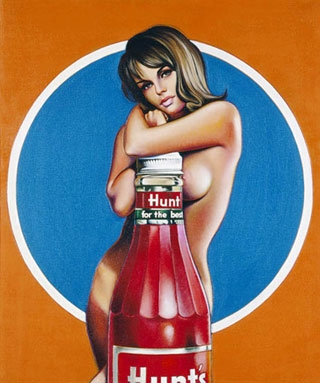

art { Mel Ramos }

U.S., economics | February 19th, 2013 8:29 am

Alien abduction insurance is an insurance policy issued against alien abduction.

The insurance policy is redeemed if the insured person is abducted by aliens.

The very first company to offer UFO abduction insurance was the St. Lawrence Agency in Altamonte Springs, Florida. The company says that it has paid out at least two claims.

The company pays the claimant $1 per year until their death or for 1 million years, whichever comes first. Over 20,000 people have purchased the insurance.

{ Wikipedia | Continue reading }

economics, space, weirdos | February 16th, 2013 2:05 pm

The most expensive apartment in the twin towered Art Deco masterpiece looking out over Central Park, the San Remo, rented for $900 a month. The tenant was a stockbroker named Meno Henschel who, according to what he told the Census Bureau, lived in his apartment together with his wife, a cook and two maids. Henschel had one of only two apartments that rented for more than $600. Another, with room for a family of five, plus the requisite cook, butler and maid, rented for $540.

The year was 1940, and that $540 is what would now generally be referred to as about $8,850 in today’s dollars. Except it’s almost impossible to find an apartment like that to rent today. Like most of the great prewar luxury Manhattan buildings, the San Remo has long since been converted into a co-op, owned by the residents.

Very rarely an apartment there will come up for a short-term rental. There is one listed now. The asking price is $29,750 a month.

{ Bloomberg | Continue reading }

housing, new york | February 15th, 2013 3:22 pm

[I]t’s helpful to remember how banks traditionally make money: They take deposits from the public, which they lend out longer term to companies and individuals, capturing the spread between the two.

Managing this type of bank is straightforward and can be done on spreadsheets. The assets are assigned a possible loss, with the total kept well beneath the capital of the bank. This form of banking dominated for most of the last century, until the recent move towards deregulation.

Regulations of banks have ebbed and flowed over the years, played out as a fight between the banks’ desire to buy a larger array of assets and the government’s desire to ensure banks’ solvency.

Starting in the early 1980s the banks started to win these battles resulting in an explosion of financial products. It also resulted in mergers. My old firm, Salomon Brothers, was bought by Smith Barney, which was bought by Citibank.

Now banks no longer just borrow to lend to small businesses and home owners, they borrow to trade credit swaps with other banks and hedge funds, to buy real estate in Argentina, super senior synthetic CDOs, mezzanine tranches of bonds backed by the revenues of pop singers, and yes, investments in Mexico pesos. Everything and anything you can imagine. […]

Many risk managers will privately tell you that knowing what they own is as much a problem as knowing the risk of what is owned.

Put mathematically, the complexity now grows non-linearly. This means, as banks get larger, the ability to risk-manage the assets grows much smaller and more uncertain, ultimately endangering the viability of the business.

{ Chris Arnade/Scientific American | Continue reading }

related { In 1900, the Fifth Avenue Bank in New York City featured a special row of tellers’ windows for the ladies. }

economics, experience | February 11th, 2013 6:19 am

Coca-Cola won’t say how it makes its best-selling Simply Orange orange juice, but one thing is for sure: It’s not so simple. A new investigation by Bloomberg Businessweek shows that the Coke-owned orange juice brand that’s billed as less processed version of Tropicana is in fact a hyper-engineered and dauntingly industrial product. […]

Coke also figured out that people are willing to pay 25 percent more for juice that’s not processed, that is, not made from concentrate. Enter Simply Orange. It is indeed just oranges, but boy have those oranges been through hell and back. Coke calls the process Black Book, because it won’t tell anyone how it works. The consultant that designed the Black Book formula will, however.

Bob Cross of Revenue Analytics explained to Bloomberg Businessweek that Coke relies on a deeply complex algorithm for every step of the juice-making process. The algorithm is designed to accept any contingency that might affect manufacturing, from weather patterns to shifts in the global economy, and make adjustments to the manufacturing process accordingly. Built into the model is a breakdown of the 600-plus flavors that are in orange juice that are tweaked throughout the year to keep flavor consistent and in line with consumer tastes. Coke even sucks the oxygen out of the juice when they send it to be mixed so that they can keep it around for a year or more to balance out other batches.

{ The Atlantic Wire | Continue reading }

economics, food, drinks, restaurants, gross | February 6th, 2013 3:22 pm

In the real world, lending a book to a friend or selling your used music collection isn’t exactly groundbreaking. In the digital world, it’s patentable.

Amazon.com has been awarded what appears to be a broad patent on a “secondary market for digital objects” — a system for users to sell, trade and loan digital objects including audio files, eBooks, movies, apps, and pretty much anything else.

The patent, originally filed in 2009 and granted on Jan. 29, covers transferring digital goods among users, setting limits on transfers and usage, charging an associated fee, and other elements of a marketplace for “used” digital goods.

{ GW | Continue reading }

economics, technology | February 5th, 2013 12:41 pm

The only thing that can go thru innovation at an agency is the process for which a client is served.

{ Digiday | Continue reading | Thanks Tim }

photo { Neil Bedford }

economics, marketing | February 5th, 2013 6:14 am

“I would say we have a housing bubble…again.” […]

“It’s happening in the most speculative sub-prime markets, where massive amounts of ‘fast money’ is rolling in to buy, to rent, on a speculative basis for a quick trade,” he contends. “And as soon as they conclude prices have moved enough, they’ll be gone as fast as they came.” […]

Stockman argues the problem in housing is the two forces needed for a recovery, first-time buyers and trade-up buyers, are missing. With the combination of 7.9% unemployment and staggering student loan debt, he doesn’t see a young generation of new home buyers coming into the market. And with baby boomers heading for retirement with less than adequate savings, he thinks they’ll be trading down with their homes, not up. […]

“As soon as the Fed has to normalize interest rates, housing prices will stop appreciating and they’ll probably head down,” he explains. “The fast money will sell as quickly as they can and the bubble will pop almost as rapidly as it’s appeared. I don’t know how many times we’re going to do this, and the only people who benefit are the top one percent - the hedge funds, the LBO funds, the fast money people who come in for a trade, make a quick buck, and move along to the next bubble.”

{ Yahoo | Continue reading }

U.S., housing | February 5th, 2013 6:09 am

Governor Andrew Cuomo wants to use $400 million in federal funding to buy beachfront homes as he seeks to reshape the New York coastline so the state is better prepared for storms like Hurricane Sandy.

The cash would come from the $51 billion Congress approved last month to help the region recover from the Oct. 29 storm.

The governor would use the money to pay owners the pre-storm value of their homes. More than 300,000 houses in New York were damaged by Sandy.

Once sold, the houses would be razed and the land would remain vacant.

{ Bloomberg | Continue reading }

U.S., climate, economics, incidents | February 4th, 2013 3:49 pm

Federal prosecutors intend to bring civil charges against Standard & Poor’s for wrongdoing in its rating of mortgage bonds prior to the 2008 financial crisis.

Allegations against the McGraw-Hill unit will center on the model used to rate the bonds and will reportedly be made in lawsuits to be filed as soon as this week.

A move by U.S. officials would be the first federal enforcement action against a major credit rating agency over alleged illegal behavior tied to the financial crisis.

The lawsuit is reportedly regarding 30 triple-A rated CDOs from the first half of 2007, and the Department of Justice is seeking “a 10 figure plus settlement and the admission of wrongdoing,” according to sources.

“A DOJ lawsuit would be entirely without factual or legal merit,” S&P said in a statement. “It would disregard the central facts that S&P reviewed the same subprime mortgage data as the rest of the market – including U.S. government officials who in 2007 publicly stated that problems in the subprime market appeared to be contained – and that every CDO that DOJ has cited to us also independently received the same rating from another rating agency.”

Shares of McGraw-Hill are down nearly 14 percent following news of the charges.

{ CNBC | Continue reading }

economics, law, scams and heists | February 4th, 2013 3:10 pm

But there are compelling reasons for paying attention to these small countries [Finland, Sweden, Denmark, and Norway] on the edge of Europe. The first is that they have reached the future first. They are grappling with problems that other countries too will have to deal with in due course, such as what to do when you reach the limits of big government and how to organize society when almost all women work. And the Nordics are coming up with highly innovative solutions that reject the tired orthodoxies of left and right.

The second reason to pay attention is that the new Nordic model is proving strikingly successful. The Nordics dominate indices of competitiveness as well as of well-being. Their high scores in both types of league table mark a big change since the 1980s when welfare took precedence over competitiveness.

The Nordics do particularly well in two areas where competitiveness and welfare can reinforce each other most powerfully: innovation and social inclusion. […]

The Nordic countries led the world in introducing the mobile network in the 1980s and the GSM standard in the 1990s. Today they are ahead in the transition to both e-government and the cashless economy. Locals boast that they pay their taxes by SMS.

{ Economist | Continue reading }

economics, within the world | February 4th, 2013 5:29 am