economics

Is Tim Cook the right CEO for the company at this time?

A: I hold the belief that he’s been CEO for much longer than it seems. Jobs was not a CEO in any traditional sense. He was head of product and culture and all-around micromanager. He left the operational side of the company to Cook who actually built it into a colossus. Think along the lines of the pairing of Howard Hughes and Frank William Gay. What people look for in Cook is the qualities that Jobs had but those qualities and duties are now dispersed among a large team. The question isn’t whether Cook can be the “Chief Magical Officer” but rather whether the functional team that’s around Cook can do the things Jobs used to do.

[…]

Q: You’ve written extensively on the post-PC period, when will we come to the post-phone period – if ever?

A: I think less than 10 years. Maybe even five. A wristband today can have more processing power than the original iPhone. An iPhone has more power than a desktop did 4 years ago. The speed of change is incredible.

{ Interview with Horace Dediu | Continue reading }

economics, technology | September 17th, 2013 8:11 pm

In most parts of the world, the banking system is closely regulated and monitored by central banks and other government agencies. That’s just as it should be, you might think.

But banks have a way round this kind of regulation. For the last decade or so, it has become common practice for banks to do business in ways that don’t show up on conventional balance sheets. Before the 2008 financial crisis, for example, many investment banks financed mortgages in this way. To all intents and purposes, these transactions are invisible to regulators.

This so-called shadow banking system is huge and important. Indeed, many economists blame activities that took place in the shadow banking system for the 2008 crash.

Davide Fiaschi, an economist at the University of Pisa in Italy, and a couple of pals reveal […] that the shadow banking system is vastly bigger than anyone had imagined before. And although its size dropped dramatically after the financial crisis in 2008, it has since grown dramatically and is today significantly bigger than it was even then.

{ The Physics arXiv Blog | Continue reading }

art { Martin Honert, Group of Teachers, 2012 }

economics, science | September 17th, 2013 7:27 pm

In the two years since Atos Origin, the IT consultancy, declared its intention to become a “zero email” company, other companies introducing restrictions include Volkswagen, which has stopped its servers forwarding email to employees’ BlackBerrys outside working hours, and Ferrari, which clamped down on email, arguing that it is often inefficient.

It is not just email. Constant text messaging, Tweeting, checking of social networks can now be seen as a disorder. Last year, “internet addiction” was added to the DSM, the international psychiatric diagnostic manual. Concerned executives from Microsoft, Google, Xerox and Intel got together with academics and consultants some years ago to form the Information Overload Research Group to try to find solutions to the electronic deluge. Basex, the research group, estimated that information overload caused economic losses of $900bn in 2009 alone.

{ FT | Continue reading }

economics, technology | August 29th, 2013 10:12 am

Singapore is inequality on steroids, as you might expect from a high human capital, high information tech, growing financial center.

Seventeen percent of the population are millionaires, and that is not counting real estate wealth, which is substantial.

The H&M in the shopping district is closing, because the rent was doubled and it is being replaced by luxury retailers.

{ Marginal Revolution | Continue reading | Part 2 }

photo { Thomas Prior }

asia, economics, photogs | August 26th, 2013 2:54 pm

{ Taxpayer money, building overpasses for bears? Is that really necessary? Would they even use the things? Researchers have been methodically studying the crossings since 1996 to answer this. And it turns out that, yes, animals deterred by fencing that now runs the full 70-kilometer length of the highway in the park actually cross the road an awful lot like a rational pedestrian would. It takes them a while, though, to adapt to the crossings after a new one is constructed: about four to five years for elk and deer, five to seven years for the large carnivores. | The Atlantic Cities | full story }

animals, economics | August 24th, 2013 2:19 pm

And so the housing “recovery” comes to a screeching halt, which is not surprising as there never was a recovery to begin with. Moments ago cheerleaders of the second housing bubble were shocked to learn that in July a tiny 35K new houses were sold (with just 3K sold in the Northeast, and just 19K in the otherwise strong South), of which 13K houses were not even started. This translated into a puny 394K seasonally adjusted annualized sales, missing expectations of 487K by nearly a massive 100K, and in addition the June print was revised much lower from 497K to 455K (which back in July beat expectations of 484K and was trumpeted as the highest print since 2008 - so much for that). Yet one thing that did not change is that the median home sale price decline continued, and in July dropped to $257.2K down from $258.5.

{ Zero Hedge | Continue reading }

U.S., housing | August 23rd, 2013 2:58 pm

High frequency trading. I won’t go into the details, but basically it has become an arms race of being a millionth of a second faster than the other guy. The exchanges (Nasdaq and NYSE) started offering co-location within their facilities and traders started fighting for the best physical real estate within the co-location center (ie. literally trying to be a few feet closer to the exchanges’ computers). Some of the high frequency traders complained about how ‘unfair’ it was to be a few feet farther away. The exchanges conceded and added ‘latency’, basically a few feet of cable, so everyone within the co-location center is equidistant. It baffles me financial progress is moving in this direction.

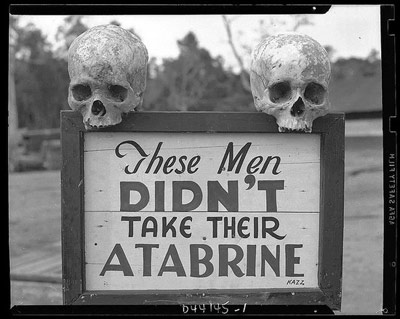

Prediction by ‘experts’/pundits. Why do people still believe in pundits and ‘experts’ on TV? If ‘experts’ could predict the future with any accuracy, they would be doing something else. They are not always wrong, they are simply not right consistently enough to provide meaningful value. I’m always surprised how confident and certain people sound on CNBC (I rarely feel sure of anything). Keynes got it right when he said, “If you must forecast, forecast often.”

{ Quora | Continue reading }

economics, traders | August 21st, 2013 2:22 pm

The economics of “happiness” shares a feature with behavioral economics that raises questions about its usefulness in public policy analysis. What happiness economists call “habituation” refers to the fact that people’s reported well-being reverts to a base level, even after major life events such as a disabling injury or winning the lottery. What behavioral economists call “projection bias” refers to the fact that people systematically mistake current circumstances for permanence, buying too much food if shopping while hungry for example. Habituation means happiness does not react to long-term changes, and projection bias means happiness over-reacts to temporary changes. I demonstrate this outcome by combining responses to happiness questions with information about air quality and weather on the day and in the place where those questions were asked. The current day’s air quality affects happiness while the local annual average does not. Interpreted literally, either the value of air quality is not measurable using the happiness approach or air quality has no value. Interpreted more generously, projection bias saves happiness economics from habituation, enabling its use in public policy.

{ National Bureau of Economic Research }

economics, ideas, psychology | August 21st, 2013 3:26 am

The biggest problem in the business world is not too little but too much—too many distractions and interruptions, too many things done for the sake of form, and altogether too much busy-ness. The Dutch seem to believe that an excess of meetings is the biggest devourer of time: they talk of vergaderziekte, “meeting sickness”. However, a study last year by the McKinsey Global Institute suggests that it is e-mails: it found that highly skilled office workers spend more than a quarter of each working day writing and responding to them. […]

Creative people’s most important resource is their time—particularly big chunks of uninterrupted time—and their biggest enemies are those who try to nibble away at it with e-mails or meetings. Indeed, creative people may be at their most productive when, to the manager’s untutored eye, they appear to be doing nothing.

{ The Economist | Continue reading }

economics | August 18th, 2013 11:54 am

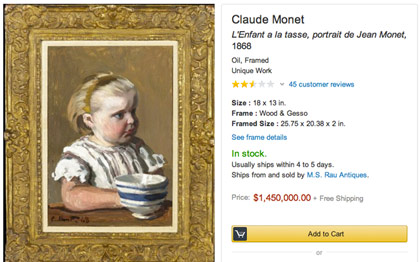

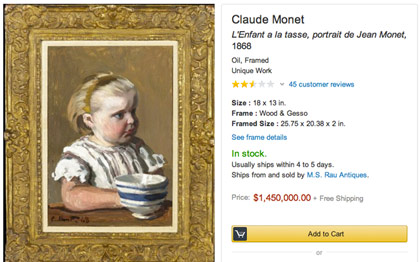

I purchased this product and sent it back immediately. The moment I took it out of the wrapping, I knew there was a problem, but I couldn’t quite put my finger on it.

Then I did put my finger on it. It felt a bit weird and when I started picking at it some of the paint flaked off. Cheap materials.

Anyhow, I may not be a member of the cognoscenti, but I have several Thomas “the Painter of Light” Kinkade paintings, so I know art. First of all, shouldn’t the lines be straight? It’s way too blurry and it hurts my eyes just to look at it. You know what also hurts my eyes? That little girls face. It looks like she has rosacea or something. And why is the girl so sad?!? Thomas Kinkade paintings are happy and joyful. This painting is just a bummer.

Save yourself a lot of disappointment and $1,448,500 and just get yourself a nice Kinkade lithograph. You’ll be glad that you did.

{ Customer Review/Amazon | Continue reading }

related { Amazon Enters Art World; Galleries Say They Aren’t Worried }

related { The utility of bad art }

art, economics, haha, technology | August 7th, 2013 11:45 am

“Tell me what kinds of toxins are in your body, and I’ll tell you how much you’re worth,” could be the new motto of doctors everywhere. In a finding that surprised even the researchers conducting the study, it turns out that both rich and poor Americans are walking toxic waste dumps for chemicals like mercury, arsenic, lead, cadmium and bisphenol A, which could be a cause of infertility. And while a buildup of environmental toxins in the body afflicts rich and poor alike, the type of toxin varies by wealth.

People who can afford sushi and other sources of aquatic lean protein appear to be paying the price with a buildup of heavy metals in their bodies, found Jessica Tyrrell and colleagues from the University of Exeter.

{ Quartz | Continue reading }

economics, food, drinks, restaurants, poison | August 5th, 2013 11:27 am

Back in 1978, the Chinese politburo enacted the “one-child policy”, whose main purpose was to “alleviate social, economic, and environmental problems” in China as a result of the soaring population. According to estimates, the policy prevented more than 250 million births between 1980 and 2000, and 400 million births from about 1979 to 2011. And while not applicable to everyone, in 2007 approximately 35.9% of China’s population was subject to a one-child restriction.

Regardless of the numbers, things are about to change: with the Chinese economy now having peaked and suddenly finding itself in rapid deceleration with excess credit growth providing virtually no boost to marginal growth, the Chinese government is forced to reexamine 35 years of social policy in order to extract growth from the one place where for nearly 4 decades it had tried to stifle: demographics.

According to the 21st Business Herald which cited sources close to the National Population and Family Planning Commission, China may relax its one-child policy at end-2013 or early-2014 (read end) by allowing families to have two children if at least one parent is from a one-child family. A plan for allowing all families to have two children after 2015 is also being reviewed.

{ ZeroHedge | Continue reading }

asia, economics, kids | August 5th, 2013 5:53 am

On average, ATD made less than a penny on every share it traded, but it was trading hundreds of millions of shares a day. Eventually the firm moved out of Hawkes’s garage and into a $36 million modernist campus on the swampy outskirts of Charleston, S.C., some 650 miles from Wall Street.

By 2006 the firm traded between 700 million and 800 million shares a day, accounting for upwards of 9 percent of all stock market volume in the U.S. And it wasn’t alone anymore. A handful of other big electronic trading firms such as Getco, Knight Capital Group, and Citadel were on the scene, having grown out of the trading floors of the mercantile and futures exchanges in Chicago and the stock exchanges in New York. High-frequency trading was becoming more pervasive.

The definition of HFT varies, depending on whom you ask. Essentially, it’s the use of automated strategies to churn through large volumes of orders in fractions of seconds. Some firms can trade in microseconds. (Usually, these shops are trading for themselves rather than clients.) And HFT isn’t just for stocks: Speed traders have made inroads in futures, fixed income, and foreign currencies. Options, not so much. […]

By 2010, HFT accounted for more than 60 percent of all U.S. equity volume and seemed positioned to swallow the rest. […] For the first time since its inception, high-frequency trading, the bogey machine of the markets, is in retreat. According to estimates from Rosenblatt Securities, as much as two-thirds of all stock trades in the U.S. from 2008 to 2011 were executed by high-frequency firms; today it’s about half. In 2009, high-frequency traders moved about 3.25 billion shares a day. In 2012, it was 1.6 billion a day. Speed traders aren’t just trading fewer shares, they’re making less money on each trade.

{ Bloomberg | Continue reading }

related { Today’s Comforting Stat: Hedge funds are a trillion dollars in debt }

technology, traders | August 3rd, 2013 12:49 pm

The pressures and expectations of the market weigh heavily on everyone. The erosion of long-term stability in employment means that people are expected to throw themselves into any job they find. Every minor task or training exercise must be met with absolute enthusiasm, as if motivation were something that could be turned on or off at will.

Such behaviour is impossible to sustain, and exacts its toll: depressive feelings, physical and emotional exhaustion at the expenditure of energy on projects we care little about.

Motivation loses its roots in our childhood interests and ideals, and becomes something external to us. Hence the oscillation between hyper-motivation and depletion characteristic of the contemporary worker.

{ The Guardian | Continue reading }

art { Kevin Barton }

economics, psychology | July 29th, 2013 4:06 pm

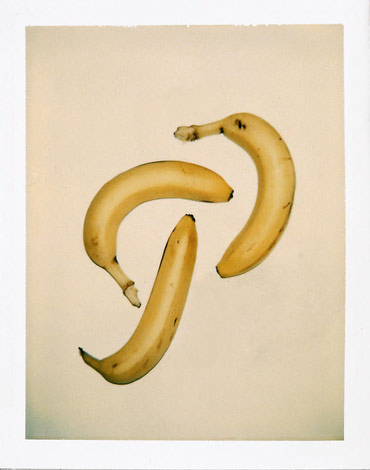

A banana may be healthier than a burger, but how it’s brought to you is not all that different. Before the fast-food industry learned to process, pack, and ship inexpensive temperature-controlled meals, banana carriers had already perfected their own shipping process. […]

The result “is bananas that arrive at the market on their final green day, and which will last exactly seven days before turning brown.”

By the time bananas land on the supermarket shelf, their ripening process has already been carefully engineered through the use of three gases: ethylene, carbon dioxide, and oxygen.

{ Nautilus | Continue reading }

polaroid { Andy Warhol }

economics, food, drinks, restaurants | July 29th, 2013 4:06 pm

What if talent and luck are increasingly hard to distinguish?

Alan Krueger, the departing chairman of Barack Obama’s Council of Economic Advisers, hit upon just that possibility in a speech in June, when he observed, “The lucky and the talented – and it is often hard to tell the difference – have been doing better and better, while the vast majority has struggled to keep up.” […]

Imperfect substitution means that you “would rather listen to one song by your favorite singer than a song and a half by someone else. Or, in another context, it means that if you need to have heart surgery, you would rather have the best surgeon in Cleveland perform it rather than the second and third best together.” In the corporate context, a board of directors would sooner pay $100 million for the best possible CEO than $10 million for the second best. […] But how does one get to be the best CEO, rather than second best? Here’s where luck comes in.

{ The Economist | Continue reading }

economics | July 24th, 2013 3:46 am

Summer movies are often described as formulaic. But what few people know is that there is actually a formula—one that lays out, on a page-by-page basis, exactly what should happen when in a screenplay. It’s as if a mad scientist has discovered a secret process for making a perfect, or at least perfectly conventional, summer blockbuster.

The formula didn’t come from a mad scientist. Instead it came from a screenplay guidebook, Save the Cat! The Last Book on Screenwriting You’ll Ever Need. In the book, author Blake Snyder, a successful spec screenwriter who became an influential screenplay guru, preaches a variant on the basic three-act structure that has dominated blockbuster filmmaking since the late 1970s. […]

Instead of a broad overview of how a screen story fits together, his book broke down the three-act structure into a detailed “beat sheet”: 15 key story “beats”—pivotal events that have to happen—and then gave each of those beats a name and a screenplay page number. Given that each page of a screenplay is expected to equal a minute of film, this makes Snyder’s guide essentially a minute-to-minute movie formula.

{ Slate | Continue reading }

photo { Ralph Crane }

economics, ideas, showbiz | July 24th, 2013 3:33 am

If we — art dealers, collectors, writers and experts — all agree a particular work has value, it surely does, irrespective of its cost of production, utility and purpose.

In that sense a lot of the art market fuses the core characteristics of both Bitcoin and the gold market.

Though, of course, art, unlike Bitcoin and gold, is not scarce. Certain works of established artists, especially those who are no longer living, are scarce. Only forgeries can threaten supply in that case. But overall there are no barriers of entry. New assets can always be produced.

Consequently, regulating supply is down to the tight and clubby world of the art dealer and auctioneer network.

{ FT | Continue reading }

Art, then, is very similar to venture capital, insofar as who you know matters — and also insofar as both markets go to great lengths to hide natural valuation fluctuations. “Down rounds” are if anything even more harmful to an artist than they are to a startup: galleries will, as a rule, drop an artist before selling her art for less than she was charging at her previous show. The reason is entirely to protect the gallery’s own credibility: the gallery wants collectors to see it as a place where they can buy art which is going to rise in value, and as a result it will do everything in its power to make it look as though the work of all of its artists is only ever going up in price rather than down.

{ Salmon/Reuters | Continue reading }

art, economics | July 22nd, 2013 9:04 am

If you’re a corporate executive, this may be one of the last sentences you want to hear: “Erich Spangenberg is on the line.” Invariably, Mr. Spangenberg, the 53-year-old owner of IPNav, is calling to discuss a patent held by one of his clients, which he says your company is infringing — and what are you going to do about it?

Mr. Spangenberg is likely to open the conversation on a diplomatic note, but if you put up enough resistance, or try to shrug him off, he can also, as he put it, “go thug.”

[…]

“Once you go thug, though, you can’t unthug,” he explained, returning to his warm and normal tone. “Actually, you can unthug, but if you do that, you can’t rethug. Then you just seem crazy.”

Mr. Spangenberg’s company, based in Dallas, helps “turn idle patents into cash cows,” as it says on its Web site.

{ NY Times | Continue reading }

economics | July 15th, 2013 4:27 pm

Within a week of Random House and Penguin merging to become the world’s largest books publisher with an estimated revenue of $4 billion, the aftershocks have started. The new entity, eager to cut cost and streamline operations, has asked author Vikram Seth to return his $1.7 million advance, a part of which was paid to him for A Suitable Girl, the ‘jumpsequel’ to his best-selling novel, A Suitable Boy.

Seth, one of the world’s bestloved writers, was scheduled to submit his manuscript this June but has been unable to do so, leading to the publishers’ demarche. […]

“It’s possible that Vikram Seth has not started on the book or that it’s nowhere close to completion, which explains the move.”

{ Mumbai Mirror | Continue reading }

books, economics | July 9th, 2013 3:40 pm