economics

The problems of darknet markets have triggered an evolution in online black markets. […]

Instead of using websites on the darknet, merchants are now operating invite-only channels on widely available mobile messaging systems like Telegram. This allows the merchant to control the reach of their communication better and be less vulnerable to system take-downs. To further stabilize the connection between merchant and customer, repeat customers are given unique messaging contacts that are independent of shared channels and thus even less likely to be found and taken down. Channels are often operated by automated bots that allow customers to inquire about offers and initiate the purchase, often even allowing a fully bot-driven experience without human intervention on the merchant’s side. […]

The other major change is the use of “dead drops” instead of the postal system which has proven vulnerable to tracking and interception. Now, goods are hidden in publicly accessible places like parks and the location is given to the customer on purchase. The customer then goes to the location and picks up the goods. This means that delivery becomes asynchronous for the merchant, he can hide a lot of product in different locations for future, not yet known, purchases. For the client the time to delivery is significantly shorter than waiting for a letter or parcel shipped by traditional means - he has the product in his hands in a matter of hours instead of days. Furthermore this method does not require for the customer to give any personally identifiable information to the merchant, which in turn doesn’t have to safeguard it anymore. Less data means less risk for everyone.

{ Opaque | Continue reading }

photo { Weegee }

crime, economics, technology | January 24th, 2019 5:18 pm

identical twins […] bought home kits from AncestryDNA, MyHeritage, 23andMe, FamilyTreeDNA and Living DNA, and mailed samples of their DNA to each company for analysis. Despite having virtually identical DNA, the twins did not receive matching results from any of the companies. […]

An entire DNA sample is made up of about three billion parts, but companies that provide ancestry tests look at about 700,000 of those to spot genetic differences.

{ CBC | Continue reading }

economics, genes | January 20th, 2019 10:17 am

{ The Holotypic Occlupanid Research Group occupies itself by doing “research in the classification of occlupanids. These small objects are everywhere, dotting supermarket aisles and sidewalks with an impressive array of form and color.” | Improbable Research }

economics, visual design | January 15th, 2019 12:18 pm

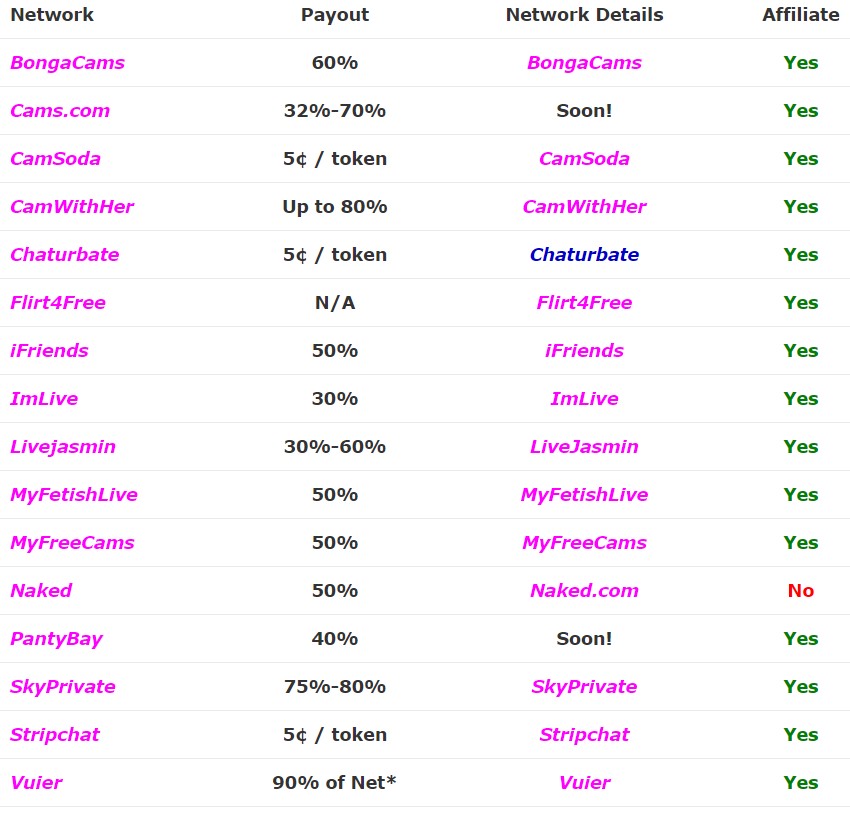

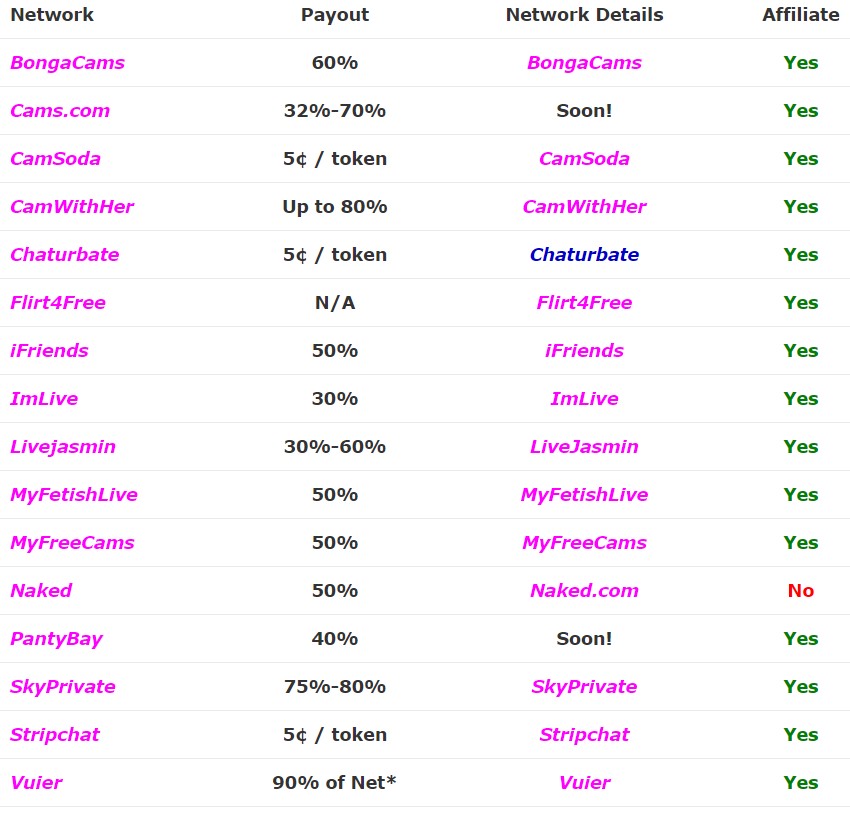

I was a camgirl for five years. My highest earning month was $50,000. […] The ceiling on cam income is very high — top-range models make around $200/hr, and the super-high end ones can make $1000+/hr. The average income is roughly $40/hr, based on around 200 girls I surveyed a few years ago. […]

Nearly every camgirl I’ve seen has used logitech webcams.

{ Knowingless | Continue reading }

Chaturbate takes forty to fifty percent depending on the amount of tokens purchased by users (see below), and pays the rest to the broadcaster, leaving the broadcaster with exactly $5 per one hundred tokens.

{ Cam Model Plaza | Continue reading }

{ Kink Closet | Continue reading }

previously { How camgirls are making thousands of dollars on Snapchat }

still { Ingmar Bergman, Summer with Monika, 1953 }

economics, porn | December 4th, 2018 7:16 am

From 1936-1972, approximately 50,000 lobotomies were performed in the US. The majority of these occurred during the “lobotomy boom” which occurred in the late 1940s and early 1950s. Curiously, the lobotomy’s popularity coincided with a consensus within the medical community that it was ineffective. […]

Physician Walter Freeman performed approximately 10% of all US lobotomies during his medical career (El-Hai 2005). Although the procedure was widely used, it swiftly fell out of favor when the FDA approved the first antipsychotic drug in 1954. […]

In this paper, we propose the lobotomy’s popularity and longevity in the US was the result of the incentives generated by the institutional structure of mental health provision. Primarily, we note that funding for public mental hospitals and asylums were provided by state and federal governments on a very low per capita basis. This served to constrained revenues. Lobotomized patients were easier to manage (their brain damage often made them docile), and the procedure was comparatively cheaper than other treatment methods. These factors, in conjunction with little incentive to effectively treat patients provided by bureaucratic oversight, motivated physicians to perform cost and conflict minimizing treatment.

In contrast, physicians operating in private mental hospitals and asylums were funded by the patients, their caregivers, or through philanthropic donations. […] [L]obotomy was less used in private mental hospitals.

{ North Dakota State University Public Choice & Private Enterprise Research Paper Series | Continue reading }

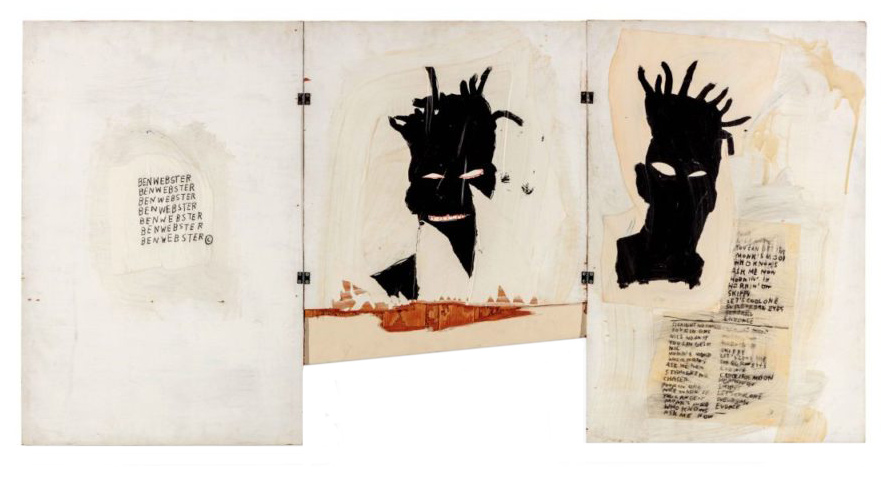

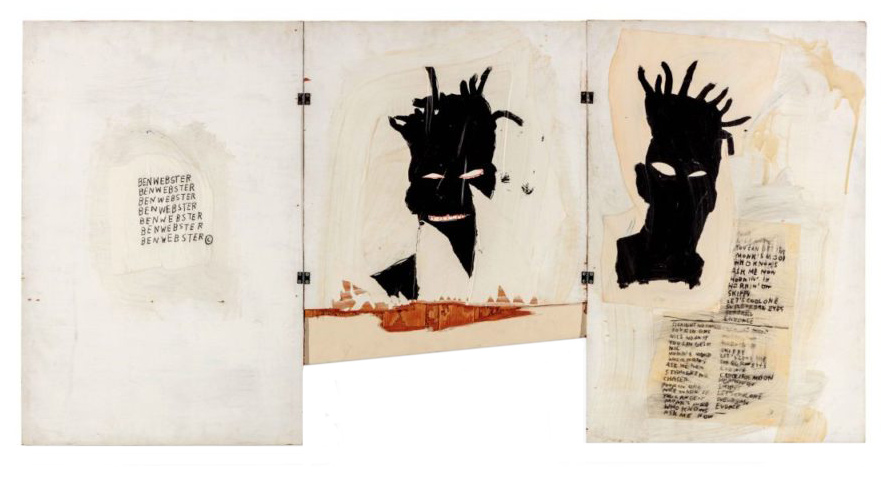

acrylic, oil, oilstick and paper collage on three hinged wooden panels { Jean-Michel Basquiat, Self-Portrait, 1981 }

economics, health, psychology | November 28th, 2018 9:07 am

“Amazon is not too big to fail,” Bezos said, in a recording of the meeting that CNBC has heard. “In fact, I predict one day Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespans tend to be 30-plus years, not a hundred-plus years.”

{ CNBC | Continue reading }

economics, technology | November 16th, 2018 9:56 am

Brooklyn-based blockchain software technology startup and Ethereum development studio ConsenSys has acquired asteroid mining company Planetary Resources, Inc. through an asset-purchase agreement. […]

ConsenSys is a production studio that creates enterprises in a wide range of business areas based on the Etherium platform for cryptocurrency and other blockchain applications. It has spawned 50 ventures, or “spokes,” including an online poker site, a legal services site and a “transmedia universe integrated with blockchain technology” called Cellarius. […]

Planetary Resources was founded in its present form in 2012, with initial backing from billionaires including Larry Page, Eric Schmidt, Ross Perot Jr. and Charles Simonyi. Its original mission was to identify and mine near-Earth asteroids for valuable resources, ranging from water that could be converted into rocket fuel to platinum-group metals that could conceivably be sent back to Earth.

Over the course of six years, the venture raised tens of millions of dollars and explored other potential revenue streams, including space telescope manufacturing, space selfies and an Earth-observation constellation called Ceres. […] But an anticipated funding round failed to come together, leading to a wave of staff cutbacks.

{ GeekWire | Continue reading }

related { Cryptocurrency Pump-and-Dump Schemes }

photo { Model of a Tyrannosaurus Rex, 1936 }

cryptocurrency, economics, space | November 5th, 2018 10:39 am

In 2017, the United States imported approximately 10.14 million barrels per day (MMb/d) of petroleum from about 84 countries. Petroleum includes crude oil, hydrocarbon gas liquids, refined petroleum products such as gasoline and diesel fuel, and biofuels including ethanol and biodiesel. Crude oil accounted for about 79% of U.S. gross petroleum imports in 2017 and non-crude oil petroleum accounted for about 21% of gross petroleum imports.

In 2017, the United States exported about 6.38 MMb/d of petroleum to 186 countries, of which about 18% was crude oil and 82% was non-crude oil petroleum.

The resulting net imports (imports minus exports) of petroleum were about 3.77 MMb/d.

The top five source countries of U.S. petroleum imports in 2017 were Canada (40%), Saudi Arabia (9%), Mexico (7%), Venezuela (7%), and Iraq (6%).

The top five destination countries of U.S. petroleum exports in 2017 were Mexico (17%), Canada (14%), China (7%), Brazil (6%), Japan (5%).

{ EIA | Continue reading }

still { The Oily Maniac, 1976 }

U.S., economics, oil | October 25th, 2018 6:42 pm

30 years ago, Spy magazine sent “refund” checks for $1.11 to 58 rich people.

The 26 who cashed those got another check, for $.64.

The 13 who cashed those each got a check for $.13.

Two people cashed the $.13 checks—Donald Trump and Jamal Khashoggi’s arms-dealer uncle Annan.

{ Kurt Andersen | Spy, July, 1990 p. 84 + full issue }

buffoons, economics, press | October 22nd, 2018 2:38 pm

Nauru is an island country in Micronesia, a subregion of Oceania, in the Central Pacific.

With 11,347 residents in a 21-square-kilometre (8.1 sq mi) area, Nauru is the third-smallest state by area in the world, behind only Vatican City and Monaco.

The Nauruan economy peaked in the mid-1970s to early-1980s, when the phosphate deposits that originate from the droppings of sea birds began to be depleted. At its peak, Nauru’s GDP per capita was estimated to be US$50,000, second only to Saudi Arabia.

In anticipation of the exhaustion of its phosphate deposits, substantial amounts of the income from phosphates were invested in trust funds aimed to help cushion the transition and provide for Nauru’s economic future. However, because of mismanagement, including some wasteful foreign investment activities, the government is now facing virtual bankruptcy.

The phosphate reserves on Nauru are now almost entirely depleted. Phosphate mining in the central plateau has left a barren terrain of jagged limestone pinnacles up to 15 metres (49 ft) high. Mining has stripped and devastated about 80 per cent of Nauru’s land area leaving it uninhabitable, and has also affected the surrounding exclusive economic zone; 40 per cent of marine life is estimated to have been killed by silt and phosphate runoff.

In the 1990s, Nauru became an illegal money laundering centre, a tax haven and offered passports to foreign nationals for a fee. During the 1990s, it was possible to establish a licensed bank in Nauru for only US$25,000 with no other requirements. Under pressure from FATF, Nauru introduced anti-avoidance legislation in 2003, after which foreign hot money left the country.

{ Wikipedia | Continue reading }

drone photo { Aydın Büyüktaş }

economics, oceania | October 10th, 2018 1:11 pm

[W]hy are some societies more religious than others? One answer is religious coping: Individuals turn to religion to deal with unbearable and unpredictable life events. To investigate whether coping can explain global differences in religiosity, I combine a global dataset on individual-level religiosity with spatial data on natural disasters. Individuals become more religious if an earthquake recently hit close by. Even though the effect decreases after a while, data on children of immigrants reveal a persistent effect across generations.

{ J. S. Bentzen | PDF }

acrylic on canvas, in four parts { Keith Haring, Untitled, 1984 }

economics, incidents | September 23rd, 2018 1:32 pm

The value of the art market, which actually hasn’t changed that much over the past 10 years or so, is in the region of $60 billion a year, which sounds like a lot, but actually compared to other industries is not that huge. It hasn’t shifted very much in the last 10 years, but what has changed is the composition of the figure, with the top end much stronger and the middle weaker. […]

There is a concentration on about 25 artists in the art market. Studies (which I cite in my book) have shown that whether we are talking about the impressionists, postwar and contemporary art sales, the highest prices are concentrated on just a few artists. […]

you need to distinguish here between private museums that belong to a very rich person, a billionaire generally these days, and a state museum. In America, a museum like MOCA or LACMA is, in theory, a private museum, and they get their funding from donors on the whole, although they sometimes get it from the local municipality as well, so it’s not a hard and fast distinction, but it’s still worth considering who is behind a given institution.

What has definitely driven the contemporary art market has been the phenomenal growth of private museums who all concentrate on the same contemporary art basically.

{ Five Books | Continue reading }

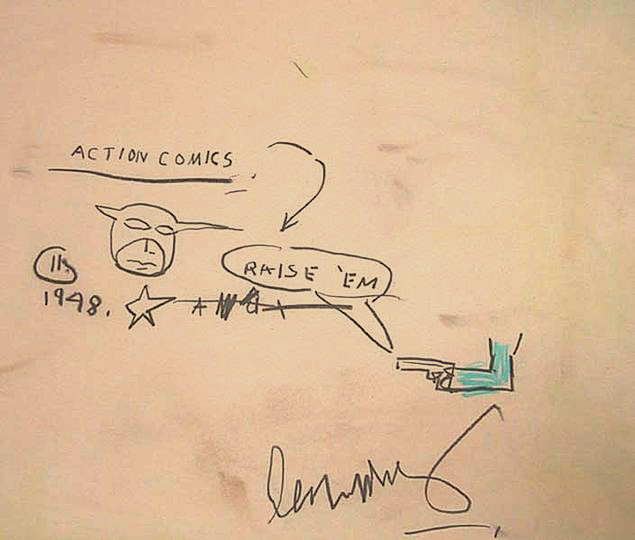

oilstick on paper { Jean-Michel Basquiat, Action comics, 1986–1987 }

art, economics | August 30th, 2018 7:20 am

“What are the odds, if everything is random?” Wang wondered.

In a new paper, Wang investigates whether “hot-streak” periods are more than just a lucky coincidence. […]

Looking at the career histories of thousands of scientists, artists, and film directors, the team found evidence that hot streaks are both real and ubiquitous, with virtually everyone experiencing one at some point in their career. While the timing of an individual’s greatest successes is indeed random, their top hits are highly likely to appear in close proximity. […]

“If we know where your best work is, then we know very well where your second-best work is, and your third,” he says, “because they’re just around the corner.”

{ Kellogg School of Management | Continue reading }

economics, strategy | August 20th, 2018 4:29 am

The ATM-busting technique, known as jackpotting, has been around for almost a decade […] ATM jackpotting is both riskier and more complicated than card-skimming. For starters, scammers have to hack into the computer that governs the cash dispenser, which usually involves physically breaking into the machine itself; once they’re in, they install malware that tells the ATM to release all of its cash, just like a jackpot at a slot machine. These obstacles mean the process takes quite a bit longer than installing a card skimmer, which means more time in front of the ATM’s security cameras and jackpotters triggering an alarm in the bank’s control center at every step. But as chip-and-PIN becomes the standard in the U.S., would-be ATM thieves are running out of other options. […]

It was the Secret Service’s financial crimes division that spotted the series of attacks on multiple locations of the same bank in Florida in December and January, and put out a bulletin to financial institutions, law enforcement, and the public about the new style of ATM theft. The two major global ATM manufacturers, Diebold Nixdorfand NCR, also alerted the public and issued security patches within a few days. Banks started monitoring their ATMs around the clock. Less than 24 hours after the Secret Service’s public alert, Citizens Financial Group, a regional bank with branches all over the northeast, notified the local police that its security folks noticed one of its ATMs go off line. The police contacted the Secret Service, which made its first arrest on the scene.

{ Bloomberg | Continue reading }

photo { Jerome Liebling, Union Square, New York City, 1948 }

economics, scams and heists, spy & security | July 9th, 2018 5:19 am

In 1985, Tony Schwartz, a writer for New York magazine, was sitting in Donald Trump’s office in Trump Tower interviewing him for a story. Trump told him he had agreed to write a book for Random House. “Well, if you’re going to write a book,” Schwartz said, recalling this interaction in a speech he gave last fall at the University of Michigan, “you ought to call it The Art of the Deal.”

“I like that,” Trump said. “Do you want to write it?”

These sorts of arrangements typically are not that generous for the writer. “Most writers for hire receive a flat fee, or a relatively modest percentage of any money the book earns,” Schwartz said in the speech. Schwartz, by contrast, got from Trump an almost unheard-of half of the $500,000 advance from Random House and also half of the royalties. And it didn’t even take a lot of haggling.

“He basically just agreed,” Schwartz told me in an email, meaning Schwartz ever since has brought in millions of dollars more of royalties and Trump has brought in millions of dollars less.

It’s a telling example, Harvard Business School negotiating professor Deepak Malhotra said in a recent interview. “What should have been a great deal on a book about negotiation actually is one of the most interesting pieces of evidence that he’s not a good negotiator.” Malhotra pointed out Schwartz even got his name on the cover, and in same-sized text. “I don’t think there’s a better ghostwriting deal out there.”

[…]

Trump made $50,000 an episode in the first season. In the second season? “He wanted a million dollars an episode,” Jeff Zucker, the current boss of CNN and former head of NBC, told the New Yorker’s David Remnick last year. And what did Zucker give him? “Sixty thousand dollars,” Zucker said.

“We ended up paying him what we wanted to pay him.”

{ Politico | Continue reading }

brush and india ink on paper { Roy Lichtenstein, Donald Duck, 1958 }

buffoons, economics | July 8th, 2018 9:38 am

On Thursday, AT&T unveiled a service called WatchTV, a “skinny bundle” of 31 television channels, many of them under AT&T’s control after the Time Warner merger, as well as on-demand content from those channels. Subscribers to AT&T’s two new unlimited data plans get WatchTV for free, and the pricier plan includes HBO, the crown jewel of the Time Warner merger. Non-AT&T customers who want WatchTV can get it for $15 per month—but without access to John Oliver and Silicon Valley, which would cost another $15 through HBO Now. […]

Growth through acquisition is how Google and Facebook became so dominant in their respective markets. Facebook has a tool called Onavo that identifies the user bases of rival social networks so it can buy them up if they start to take off. Google bought its ad network by acquiring Doubleclick, AdMob, and other firms.

{ New Republic | Continue reading }

economics, media | July 1st, 2018 12:34 pm

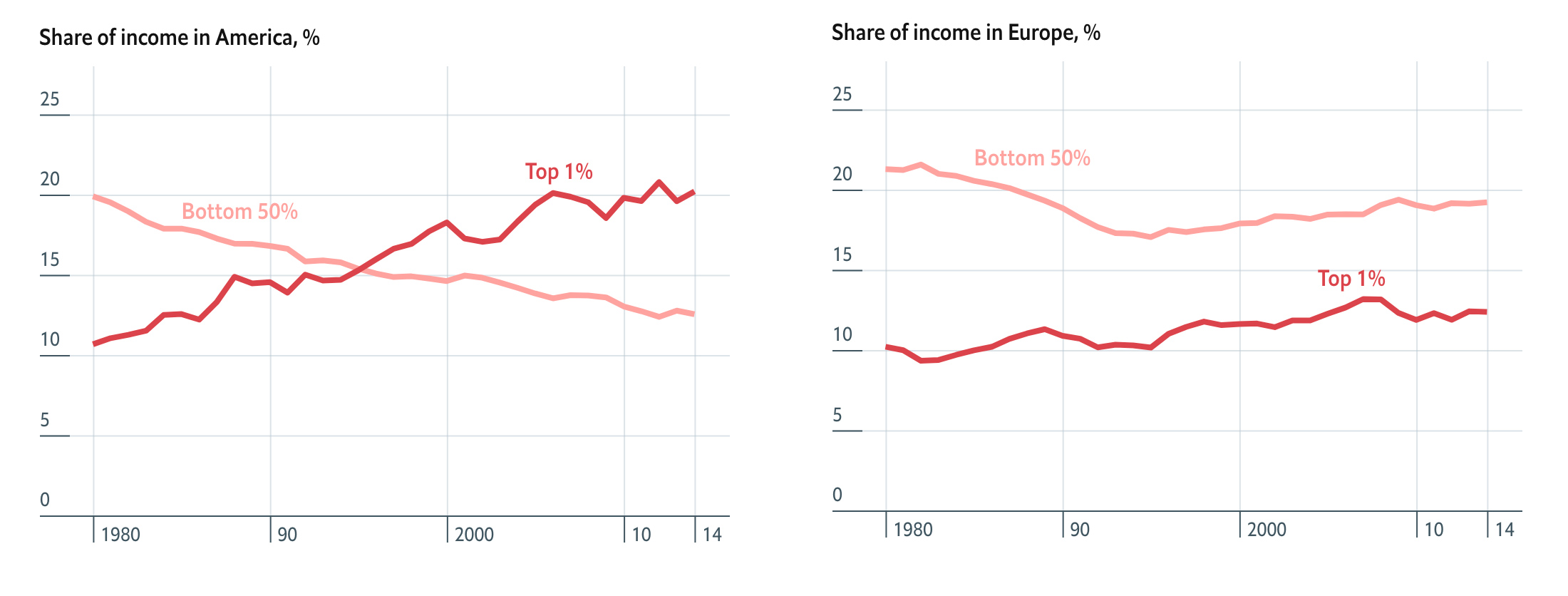

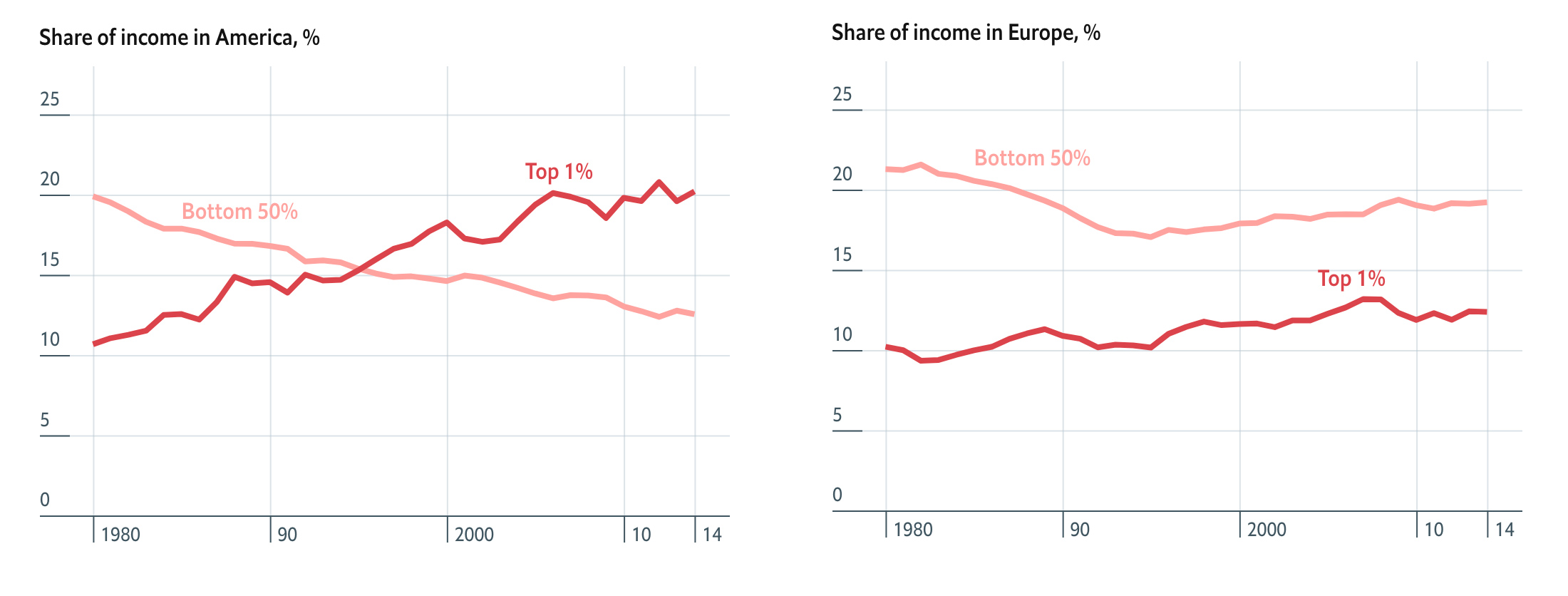

{ while ordinary people are struggling, those at the top are doing just fine. Income and wealth inequality have shot up. The top 1% of Americans command nearly twice the amount of income as the bottom 50%. The situation is more equitable in Europe, though the top 1% have had a good few decades. | The Economist | full story }

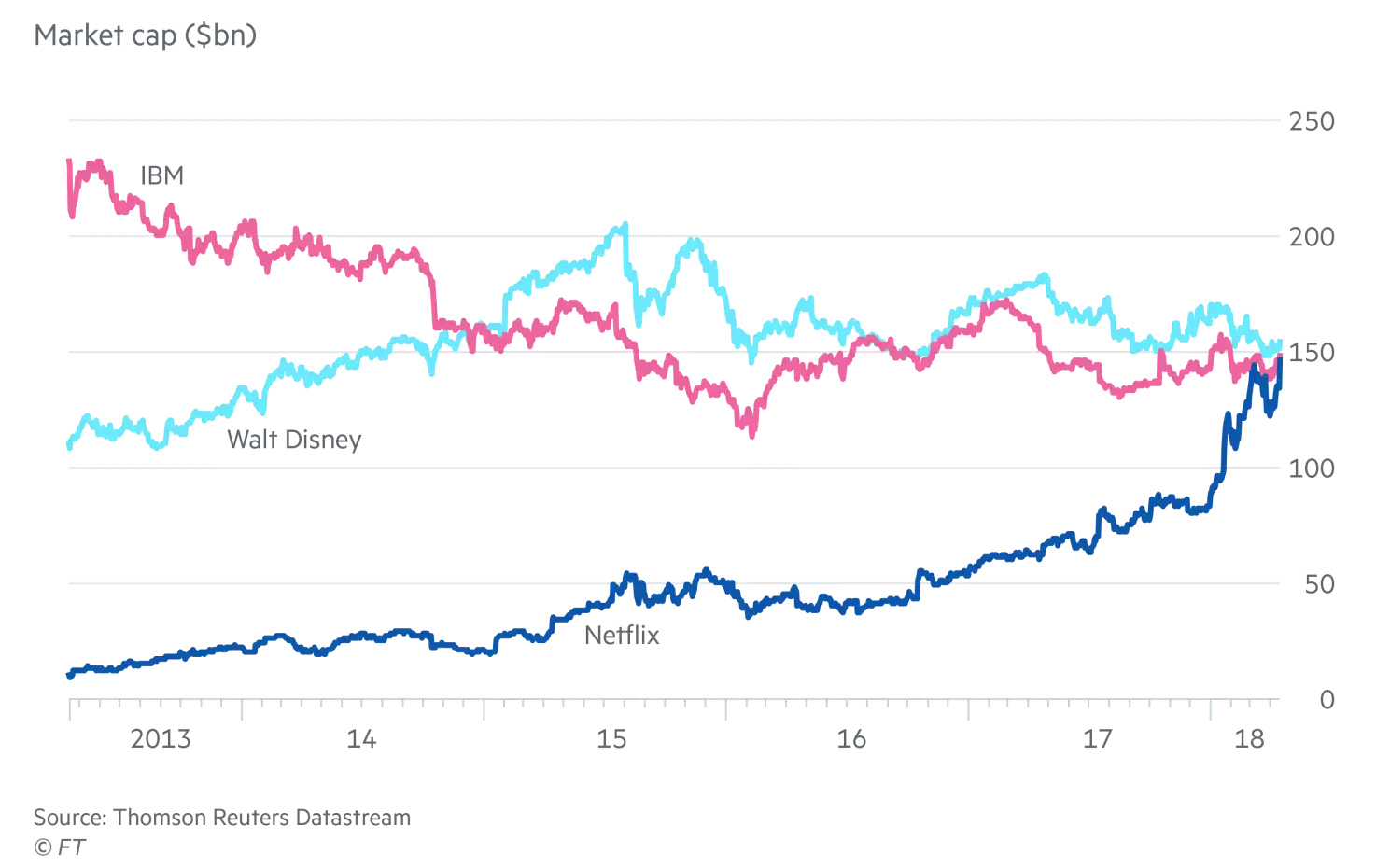

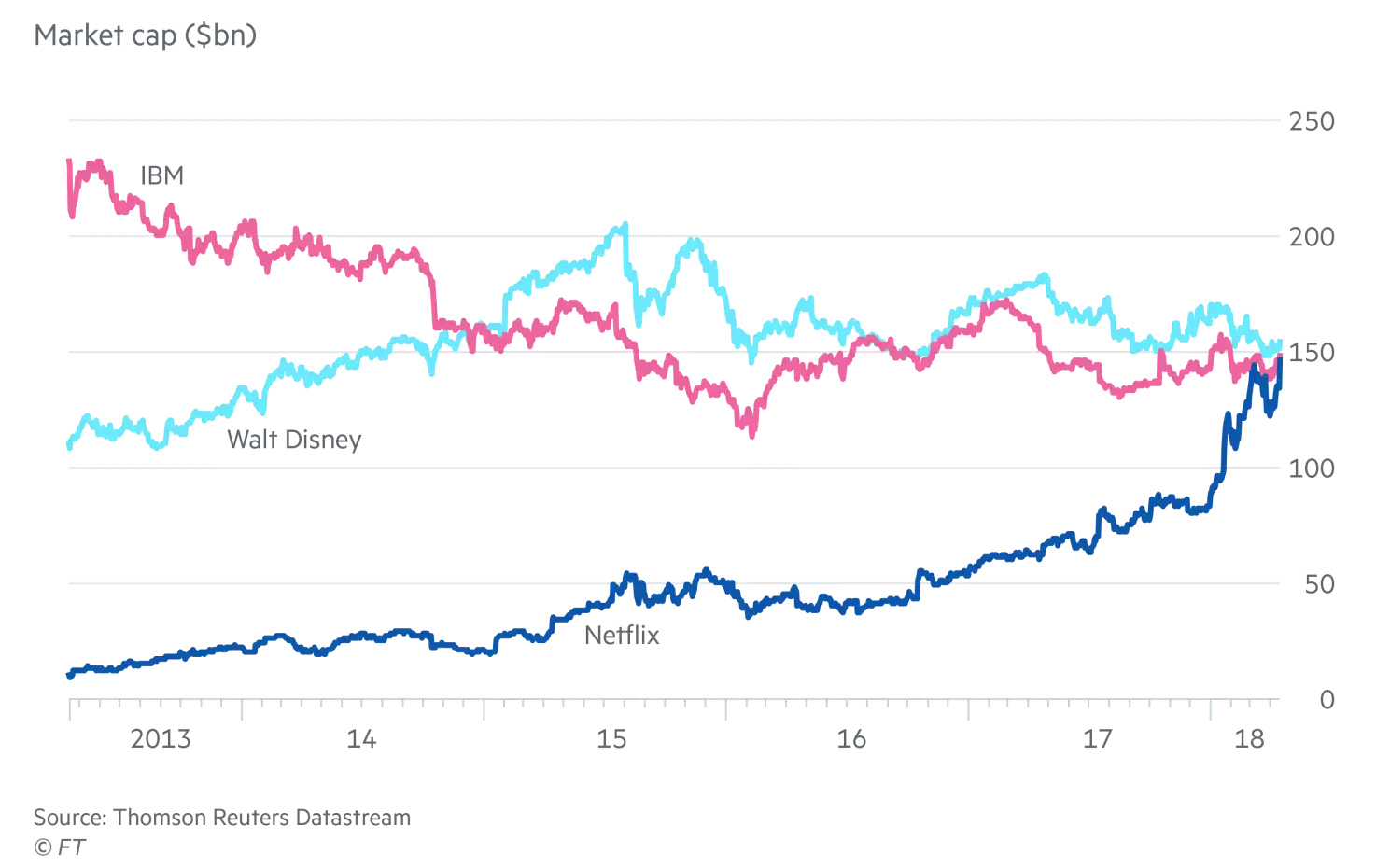

{ Netflix performance burns hedge fund short sellers }

economics, showbiz, traders | April 18th, 2018 10:12 am

Twelve years ago, my now-Bloomberg colleague Joe Weisenthal proposed that startups that planned to disrupt an established industry should short the stock of the incumbents in that industry. That way, if they were right — if they were able to undercut big established public companies — then they’d get rich as those public companies declined. […] Their profits would come from the incumbents’ shrinking.

Weisenthal’s proposal was for disruptors offering a free product; the idea was that the entire business model would consist of (1) offering a free service that public companies offer for money and (2) paying for the service by shorting the public companies. But there’s a more boring and more widely generalizable — yet still vanishingly rare — version of this approach in which it just augments the disruptors’ business model: You sell better widgets cheaper and make a profit that way, while doubling down by also shorting your competitors. It’s a more leveraged way to do the business you were going to do anyway, an extra vote of confidence in yourself.

{ Bloomberg | Continue reading }

economics, traders | April 16th, 2018 10:33 am

It is often claimed that negative events carry a larger weight than positive events. Loss aversion is the manifestation of this argument in monetary outcomes. In this review, we examine early studies of the utility function of gains and losses, and in particular the original evidence for loss aversion reported by Kahneman and Tversky (Econometrica 47:263–291, 1979). We suggest that loss aversion proponents have over-interpreted these findings.

{ Psychological Research | Continue reading }

economics, psychology | April 16th, 2018 10:15 am

2017 was a big year for Norway’s sovereign wealth fund, already the largest in the world. After surpassing $1 trillion in assets, the fund announced today that it made an annual return of 1,028 billion kroner ($131 billion), the largest amount in the fund’s 20-year history. […]

how many stocks this fund already owns: 1.4% of all listed stocks in the world […] its biggest boost last year came from Apple. It has a 0.9% stake in the US tech company […]

The fund has now made more money in investment returns than was put into it […] since inception in 1997

{ Quartz | Continue reading }

art { Jan van Eyck, The Arnolfini Portrait, 1434 }

economics, oil | February 27th, 2018 12:05 pm