Doyle Lonnegan: I put it all on Lucky Dan; half a million dollars to win.

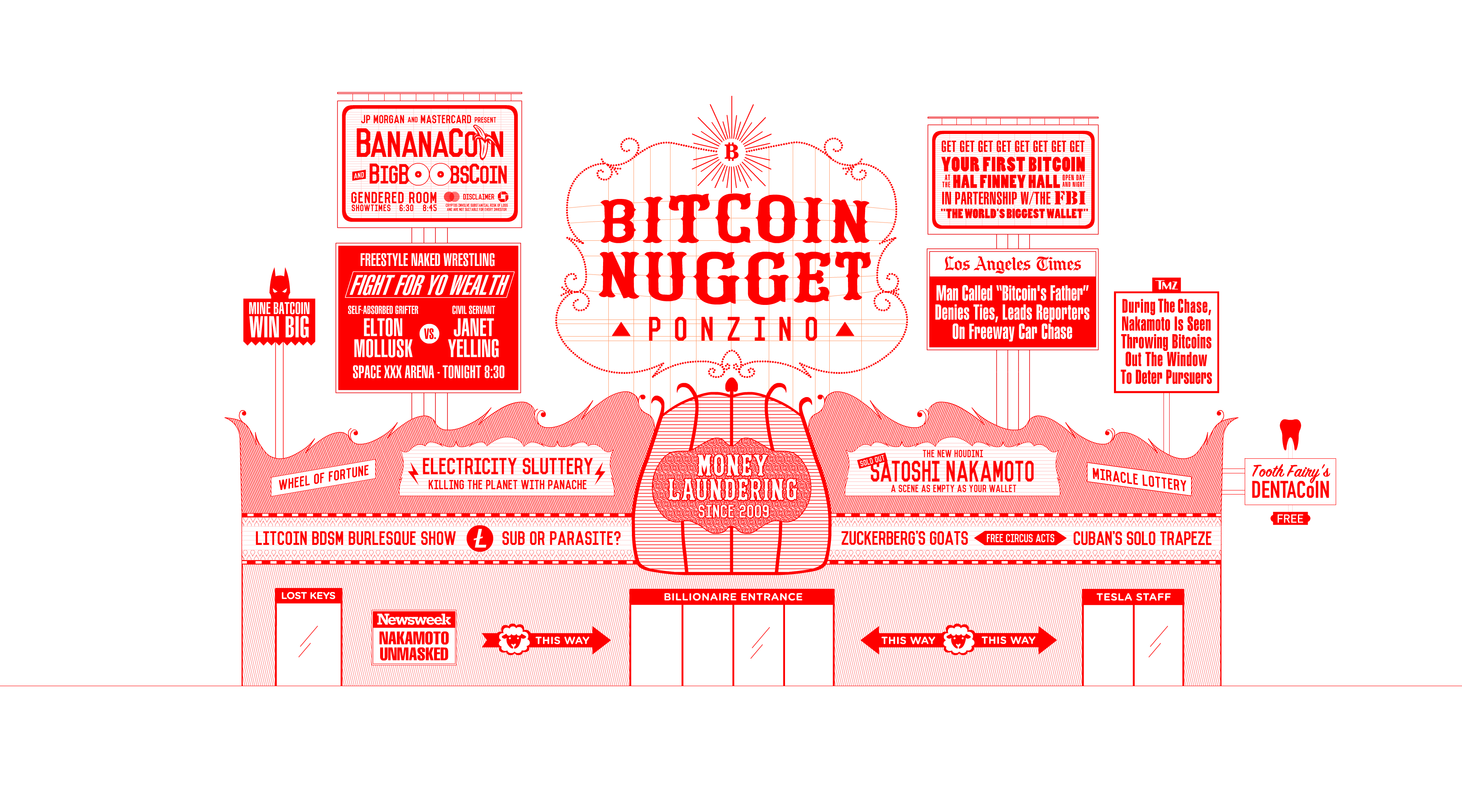

The simplest form of investment scam is that you promise people some attractive return on their investment […] There are two basic approaches, which are:

A reasonable return, or

An insane return.The first approach was made famous by Bernie Madoff […] The advantage of this approach is that it can attract sophisticated investors: Madoff was able to raise money from rich people and funds-of-funds because, in their obviously flawed due diligence, they concluded that the returns he promised were plausible. […]

The second approach […] you mostly don’t want sophisticated investors. It is plausibly harder to trick sophisticated investors than it is to trick unsophisticated ones. This is like why advance-fee scam emails have lots of typos: “By sending an initial email that’s obvious in its shortcomings, the scammers are isolating the most gullible targets.” Promising a 1,000,000% return ensures that you never end up talking to anyone but the most gullible possible marks. […] Here’s a good Securities and Exchange Commission enforcement action against an alleged vaguely crypto-ish fraud: […]

According to the SEC’s complaint filed in the U.S. District Court for the Eastern District of Michigan, Chandran, Davidson, Glaspie, Knott, and Mossel falsely claimed that investors could generate extravagant returns by investing in a blockchain technology called CoinDeal that would be sold for trillions of dollars to a group of prominent and wealthy buyers. […]

Chandran, a recidivist securities law violator and convicted felon, claimed to own a unique blockchain technology that was on the verge of being sold for trillions of dollars to a group of reputable billionaire buyers (“CoinDeal”). Chandran further claimed his business required interim financial support until the sale transaction closed. Together with and through other named Defendants, Chandran targeted mostly unsophisticated investors with false and misleading promises and representations that investments in CoinDeal would soon yield extremely high returns from the imminent sale of his business. Ultimately, there was no sale, and no distribution of proceeds, because CoinDeal was a sham. […]

Chandran typically provided status updates on the supposed deal, including but not limited to: the involvement of foreign central banks and the United States Department of Homeland Security; the latest board meetings of the consortium of wealthy buyers; the role of certain political figures; and the causes of “temporary” delays to the sale closing. These updates were designed to lull investors and induce them to continue investing in CoinDeal. […]

Then of course the “deal” would not close and there would be excuses, which included “the engineer … called in sick yesterday” and “the bank wants a new set of documents.” […] My favorite part, though, might be the section about Linda Knott. According to the SEC complaint, she didn’t know these people, and wasn’t in any real sense a part of their alleged scam. She just used their alleged scam as a substrate to run her own alleged scam:

In February 2021, Knott learned of CoinDeal through one of Glaspie’s teleconferences […] Knott started collecting funds for CoinDeal through an investor group called Together We Profit. Together We Profit was a loose arrangement of individuals interested in participating in CoinDeal. … Knott facilitated investment by lowering the barrier to entry for CoinDeal by allowing prospective investors to participate for as little as $27, which was lower than the amounts permitted by Glaspie. […] While Knott assured investors she would transmit all of their funds to CoinDeal, that was false. She enriched herself by misappropriating approximately $79,000 or more for personal use and purposes unrelated to CoinDeal.