Prefer an ounce of opium. Celestials. Rank heresy for them.

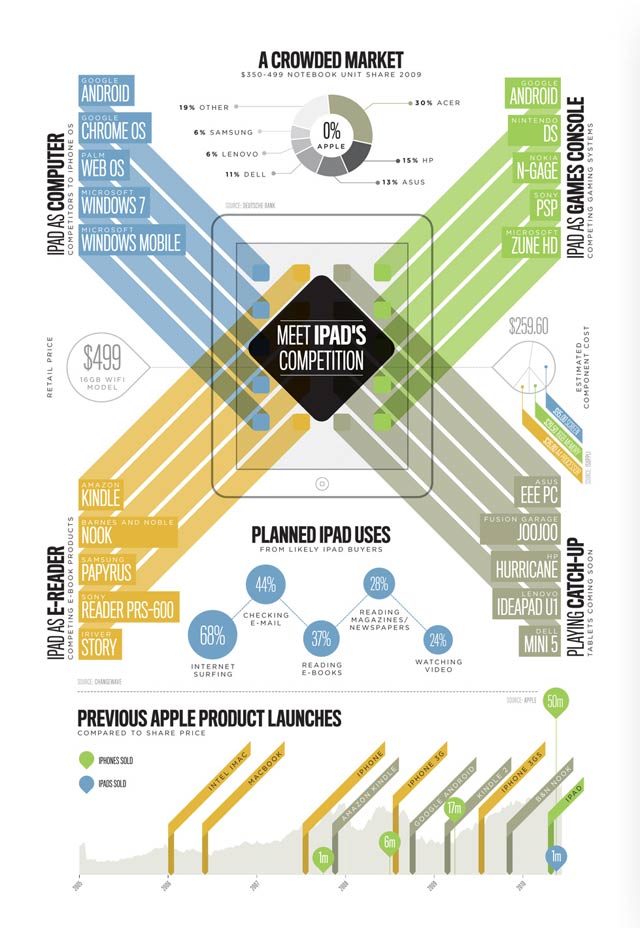

There’s a puzzle at the heart of our economy that has troubled economists for decades. The question is this: why do people work hard in environments where they are poorly monitored and paid a fixed wage, rather than a performance-related one. Surely any rational worker would do the bare minimum to get by.

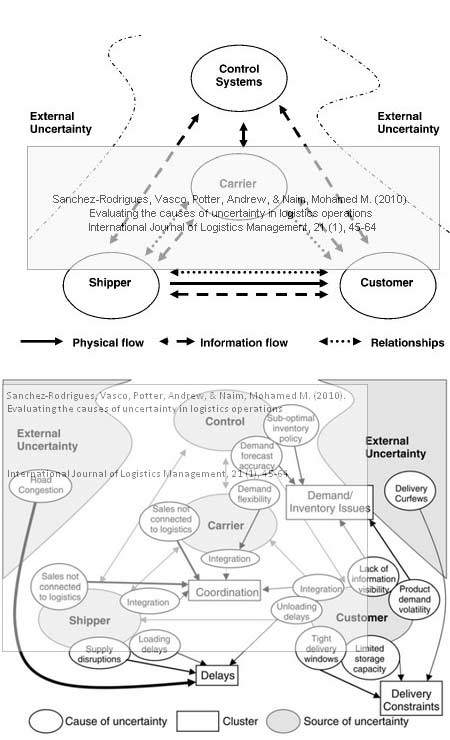

One line of thinking focuses on the relationship between the workers and their employer, which can be influenced by contracts set out in writing and by personal relationships between workers and their managers.

That suggests that one way for an employer to improve productivity would be to perfect its employment contracts.

Another line of thinking is that peer pressure plays an important role. The people around you may affect the way you work. For example, good workers, leading by example, might raise the quality of everybody’s work. On the other hand, bad apples may make the good ones rotten.

But working out which of these effects wins out is hard. Peer pressure is hard to quantify and the various results in this area are somewhat contradictory, suggesting that they may depend on the environment too.

But a new tool is emerging that can help, according to John Horton at Harvard University who says the recent development of online marketplaces, in which people can buy and sell services over the web, provides a fascinating laboratory in which to test these ideas. (…)

Horton’s work raises many questions, not least because it contradicts other work suggesting that it is possible to improve poor workers’ output by pairing them with good workers. By contrast, Horton found that “the bad apples ruined the good apples, and the good apples did nothing for the bad.”

This kind of work fascinates psychologists, economists and managers because it raises the possibility that productivity in the workplace can be manipulated by clever management rather than by expensive financial incentives.

photo { Cory Kennedy and friends }