‘Most people, including the author of this article, think it is not worth the trouble to be concerned about who the author is. They are happy not to know his identity, for then they have only the book to deal with, without being bothered or distracted by his personality.’ –Kierkegaard

Mysterious and possibly nefarious trading algorithms are operating every minute of every day in the nation’s stock exchanges.

What they do doesn’t show up in Google Finance, let alone in the pages of the Wall Street Journal. No one really knows how they operate or why. But over the past few weeks, Nanex, a data services firm has dragged some of the odder algorithm specimens into the light.

The trading bots visualized in the stock charts in this story aren’t doing anything that could be construed to help the market. Unknown entities for unknown reasons are sending thousands of orders a second through the electronic stock exchanges with no intent to actually trade. Often, the buy or sell prices that they are offering are so far from the market price that there’s no way they’d ever be part of a trade. The bots sketch out odd patterns with their orders, leaving patterns in the data that are largely invisible to market participants.

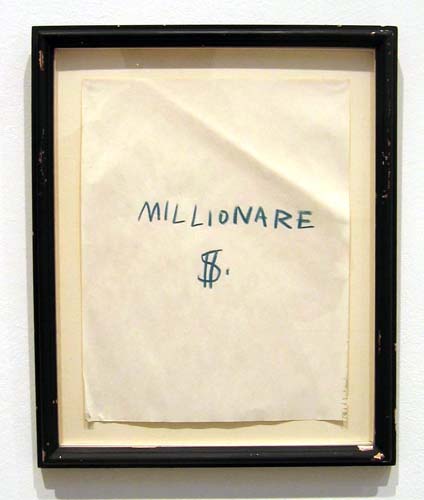

artwork { Jean-Michel Basquiat }

related { Quants: The Alchemists of Wall Street | video | Thanks Douglas }