economics

‘We favor the simple expression of complex thought.’ –Mark Rothko

Mark Rothko, born Marcus Rothkowitz (September 25, 1903 – February 25, 1970), was a Russian-American painter. He is classified as an abstract expressionist, although he himself rejected this label, and even resisted classification as an “abstract painter.” […]

A rise of Nazi sympathy in the United States heightened Rothko’s fears of anti-Semitism, and in January 1940, he abbreviated his name from “Marcus Rothkowitz” to “Mark Rothko.” The name “Roth,” a common abbreviation, had become, as a result of its commonality, identifiably Jewish, therefore he settled upon “Rothko.” […]

He apparently stopped painting altogether for the length of 1940. […] The most crucial philosophical influence on Rothko in this period was Friedrich Nietzsche’s The Birth of Tragedy. […]

The year 1946 saw the creation of Rothko’s transitional “multiform” paintings. The term “multiform” has been applied by art critics; this word was never used by Rothko himself, yet it is an accurate description of these paintings. […] For Rothko, these blurred blocks of various colors, devoid of landscape or human figure, let alone myth and symbol, possessed their own life force. They contained a “breath of life” he found lacking in most figurative painting of the era. […]

By the mid 1950’s however, close to a decade after the completion of the first “multiforms,” Rothko began to employ dark blues and greens; for many critics of his work this shift in colors was representative of a growing darkness within Rothko’s personal life. […]

In the spring of 1968, Rothko was diagnosed with a mild aortic aneurysm (defect in the arterial wall, that gradually leads to outpouching of the vessel and at times frank rupture). Ignoring doctor’s orders, Rothko continued to drink and smoke heavily, avoided exercise, and maintained an unhealthy diet. However, he did follow the medical advice given not to paint pictures larger than a yard in height, and turned his attention to smaller, less physically strenuous formats, including acrylics on paper. Meanwhile, Rothko’s marriage had become increasingly troubled, and his poor health and impotence resulting from the aneurysm compounded his feeling of estrangement in the relationship. Rothko and his wife Mell separated on New Year’s Day 1969, and he moved into his studio.

On February 25, 1970, Oliver Steindecker, Rothko’s assistant, found the artist in his kitchen, lying dead on the floor in front of the sink, covered in blood. He had sliced his arms with a razor found lying at his side. During autopsy it was discovered he had also overdosed on anti-depressants.

artwork { Mark Rothko, Orange Red Yellow, 1961 | sold for $86,882,500 yesterday at Christie’s, a new auction record for post-war art }

‘Fuck your library.’ –Malcolm Harris

This system is enriching patent trolls—companies that buy patents in order to extort money from innovators. These trolls are like a modern day mafia. […]

The larger players can afford to buy patents to deter the trolls, but the smaller players—the innovative startups—can’t. Instead, they have to settle out of court. Patent trolls take advantage of this weakness. […]

In the smartphone market alone, $15-20 billion has already been spent by technology companies on building defenses, says Stanford Law School professor Mark Lemley. For example, Google bought Motorola Mobility for $12.5 billion—mostly for its patents. An Apple-Microsoft-Oracle-Nokia consortium bought Nortel’s patent portfolio for $4.5 billion. Microsoft bought Novell’s patent portfolio for $450 million and some of AOL’s patents for $1 billion. Facebook bought some of Microsoft’s new AOL patents for $550 million. Lemley estimates that more than $500 million has been squandered on legal fees—and battles are just beginning. This is money that could have been spent, instead, on R&D. […]

Clearly, the laws need revision. Feld says that software patents should be completely abolished—that in the modern era of computing, the best defense is speed to market, execution, and continuous innovation.

photo { Harry Callahan }

‘My experiment of walking up to a random production catering truck in New York and getting myself a free latte just worked.’ –Tim Geoghegan

Team-building exercises, simulation games, educational games, puzzle-solving activities, office parties, themed dress-down days, and colorful, aesthetically-stimulating workplaces are notable examples of this trend. […]

This is a relatively new conception of the relation between work and play. Until very recently, play was seen as the antithesis of work (see Kavanagh, this issue). Classical industrial theory, for example, hinges on a fundamental distinction between waged labour and recreation. Play at work is thought to pose a threat not only to labour discipline, but also to the very basis of the wage bargain: In exchange for a day’s pay, workers are expected to leave their pleasures at home. […]

When employees are urged to reach out to their ‘inner child,’ it becomes clear that the distinction between work and play is increasingly difficult to maintain in practice.

With such blurring of work and play, the traditional boundary between economic and artistic production also disappears. In much of the business literature on play, the entrepreneur and the artist melt into one figure. […]

Yet while contemporary organizations have colonized play for profit-seeking purposes, this inevitably has unforeseen consequences. Play may turn back against the organization and disrupt its smooth functioning; the managers who open a game in the organization may find that they lose control over it and come to realize that play is occasionally able to usurp work rather than stimulate it. Play serves organizational objectives only insofar as it is kept within certain ludic limits. […]

This special issue emerged from an ephemera conference on ‘Work, Play and Boredom’ held at the University of St Andrews in May 2010. At the heart of the conference was the idea that ‘boredom’ might be an appropriate concept for rethinking the interconnections between work and play in present-day organizations.

{ ephemera | PDF }

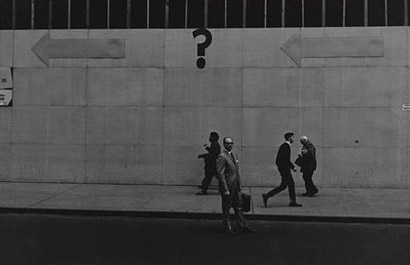

photo { Lee Friedlander, New York City, 1962 }

The poisonous mushroom that makes the fearless vomit

Adscend Media agreed not to spam Facebook users and pay US$100,000 in court and attorney fees, according to the settlement. […] Adscend Media’s spamming generated up to $20 million a year.

The body without organs

On December 25, 2011, however, headlines were ablaze with the news: China and Japan had reached an agreement to use their own currencies in trade and financial transactions. Their governments would establish a market for direct exchange of yuan and yen, avoiding the convoluted process in which a bank or firm in one country must first sell its national currency for dollars and then use them to buy the currency of the other. As part of the same agreement, Japan’s central bank agreed to hold more of its foreign currency reserves, most of which are in dollars, in yuan instead. (…)

A first thing to say is that the dollar, like the United States, isn’t going anywhere. The United States still accounts for nearly a quarter of global GDP when the output of other countries is valued at market exchange rates (which is the appropriate metric when one is concerned with international transactions). By this measure, the United States is still nearly three times the economic size of both China and Japan. Its financial markets are deep and liquid. The market in U.S. Treasury bonds—the principal instrument that foreign central banks hold as reserves—is the single largest financial market in the world. The fact that there exists a huge volume of currency transactions involving dollars allows investors to buy them in substantial quantities without driving up their price and to sell them without driving that price down. In the competition with other currencies, in other words, the dollar enjoys the advantages of incumbency.

photo { Brian Finke }

Smoke mermaids, coolest whiff of all. Hair streaming: lovelorn. For some man. For Raoul.

In a Dutch study performed by Pieter van Baal and colleagues, the authors compared the annual and lifetime health care costs of three cohorts, namely the obese, the smokers, and the healthy living people. […]

The lifetime costs for an obese person amounted to € 399,000, compared to which the smoker comes at a 14% discount of € 341,000, but the healthy living person with a 17% premium at € 468,000.

artwork { Dan Voinea }

‘They always say that time changes things, but you actually have to change them yourself.’ –Andy Warhol

One of the most important things to remember when thinking about pitching is that there are huge numbers of pitches in the world. Venture capitalists hear quite a few of them. And they find the process frustrating because it is such a low yield activity (a tiny fraction of first pitches lead to subsequent diligence and even fewer of those lead to a deal). So if you want VCs to listen to you, you need to force them to listen—to break through the clutter. Doing so requires you to hack into the VC mind.

Conceptually, pitching sounds easy. You are smart. You have a great idea and you tell people with money that great idea. They’re rational; they give it to you.

But it’s not that easy. What you essentially have to do is convince a reasonably smart person to exchange his capital for your piece of paper (a stock certificate) that is really nothing more than a promise about something that may be valuable later but, on a blind statistical basis, probably won’t be. It turns out that this is difficult.

Humans are massively cognitively biased in favor of near-term thinking. VCs are no different. That’s curious, because you’d think they would have overcome it, since good long-term thinking is sort of the entire nature of venture capital. But humans are humans. VCs are just sacks of meat with the same cognitive biases as everyone else. (…)

You must address both sides of their brains; you have to convince VCs that your proposal is economically rational, and then you must exploit their reptilian brains by persuading their emotional selves into doing the deal and overcoming cognitive biases (like near-term focus) against the deal. You should also offer VCs entertainment. They see several pitches a day (most bad) and that gets boring. Be funny and help your cause. In the tech community, even one joke will suffice.

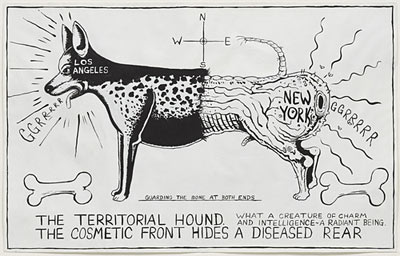

synthetic polymer paint on paper { Mike Kelley }

It’s very important not to embellish on your order. No extraneous comments. No questions. No compliments.

How much is a recipe worth? About $1.8 million, according to the owner of Kay Lee Roast Meat Joint, who boosted the sale price of her Singapore eatery by that amount when she put it on the market this year.

Betty Kong and her husband want S$3.5 million ($2.8 million) for their 60-plastic-stool establishment, a premium over the S$1.25 million assessed value of the site. The price includes the property, their recipe for roasting duck, pork ribs and crispy pig skin as well as other Cantonese-style classics, plus three months of cooking lessons — and, presumably, the loyal clientele that lines up outside, sometimes for more than an hour. (…)

While the food may be good, a buyer could find better things to do with the more than S$2 million premium than become the owner of some roast-pork recipes, writes Singaporean food blogger, K.F. Seetoh.

photo { Brian Finke }

Twas the prudent member gave me the wheeze

To justify its sky-high valuation, Facebook will have to increase its profit per user at rates that seem unlikely, even by the most generous predictions. Last year, we looked at just how unlikely this is.

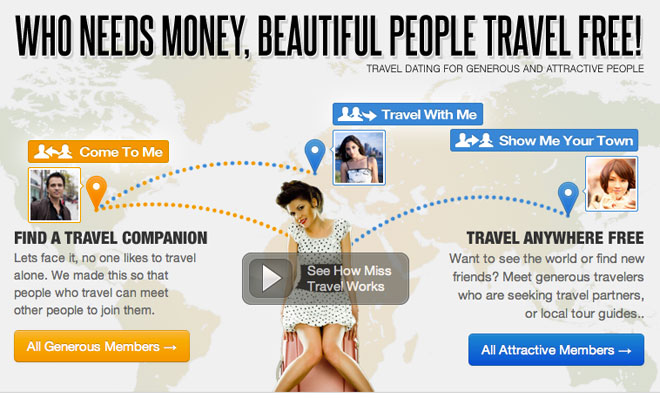

The issue that concerns many Facebook users is this. The company is set to profit from selling user data but the users whose data is being traded do not get paid at all. That seems unfair.

Today, Bernardo Huberman and Christina Aperjis at HP Labs in Palo Alto, say there is an alternative. Why not pay individuals for their data? (…)

If buyers choose only the cheapest data, the sample will be biased in favour of those who price their data cheaply. And if buyers pay everyone the highest price, they will be overpaying.

drawing { Tracey Emin, Sad Shower in New York, 1995 }

But look! The bright stars fade.

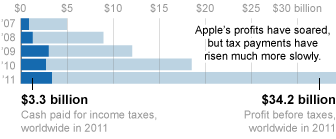

The New York Times dropped another bomb on Apple’s “iEconomy” this weekend with an expose that shows how the world’s biggest corporation evades billions of dollars in taxes by creating subsidiaries in low-tax states and countries like Nevada, Ireland, the Netherlands, Luxembourg, and the British Virgin Islands. (…)

According to the Center for Responsive Politics, Apple spent $2.3 million on lobbying last year and its lobbying expenditures have been steadily increasing over the past decade – in 2000, it only spent $360,000 on lobbying.

A big chunk of this is spent lobbying specifically on tax policy, especially repatriation legislation, which lets firms bring profits held overseas back to the United States at a cheaper tax rate. One bill in particular, the Freedom to Invest Act of 2011, would save companies like Apple, Google, and Cisco $78.7 billion, paid for by the American people.

‘The way you can go isn’t the real way.’ –Lao Tse

The first perspective produces legislative atrocities like the proposed New York City bill that would have penalized taxi drivers for transporting prostitutes. (…)

I’m in favor of legalizing all forms of sex work for adults—not because I think it’s necessarily such great work, but because I think being a legal worker is better than being an illegal worker.

Lehman owes its 10 largest unsecured creditors more than $157 billion

How awesome is this treasure trove of emails, documents, files et al. placed online by the NY Fed?

Some of the emails between Lehman execs are laughable — naive, silly, hubristic, childish.

But my favorite piece simply has to be the Morgan Stanley research report from June 30, 2008 “Overweight Rating” on Lehman Brothers — “Bruised, Not Broken, Poised for Profitability.” 60 days later, Lehman Brothers filed what was then the largest bankruptcy in the United States.

hatchet { Christopher Roth }

In nineteen minutes, this area’s gonna be a cloud of vapor the size of Nebraska

In the summer of 2007, Apple released the iPhone, in an exclusive partnership with A.T. & T. George Hotz, a seventeen-year-old from Glen Rock, New Jersey, was a T-Mobile subscriber. He wanted an iPhone, but he also wanted to make calls using his existing network, so he decided to hack the phone. (…)

Hotz’s YouTube video received nearly two million views and made him the most famous hacker in the world. The media loved the story of the teen-age Jersey geek who beat Apple. (…)

Steve Wozniak, the co-founder of Apple, who hacked telephone systems early in his career, sent Hotz a congratulatory e-mail. (…)

Hotz continued to “jailbreak,” or unlock, subsequent versions of the iPhone until, two years later, he turned to his next target: one of the world’s biggest entertainment companies, Sony. He wanted to conquer the purportedly impenetrable PlayStation 3 gaming console. (…)

But many were angry at Hotz, not at Sony. “Congratulations geohot, the asshole who sits at home doing nothing than ruining the experience for others,” one post read. Someone posted Hotz’s phone number online, and harassing calls ensued.

People who are unhappy with Facebook’s updates should go to Zuckerberg’s house and rearrange all his furniture while he is away

The buy, driven entirely by Zuckerberg, was made because Facebook’s CEO was petrified of Instagram becoming a Twitter-owned property.

Zuckerberg, we’re told, lives in perpetual anxiety, preoccupied by the fear of Facebook losing its place, terrified that youngsters will get their social networking fix from other services. That fear served as the catalyst behind his decision to buy Instagram and keep it out of the hands of a cross-town competitor.

This type of paranoia is relatively normal at Silicon Valley’s largest technology companies.

See? she said. Say it’s turn six. In here, see.

Women differ from men in circulating levels of certain hormones, and some of those hormones change across the menstrual cycle. Estradiol, progesterone, the lutenizing hormone, and the follicle-stimulating hormone all change over the menstrual cycle. (…)

We find that naturally cycling women bid significantly higher than men and earn significantly lower profits than men except during the midcycle when fecundity is highest. We suggest an evolutionary hypothesis according to which women are predisposed by hormones to generally behave more riskily during their fecund phase of their menstrual cycle in order to increase the probability of conception, quality of offspring, and genetic variety. We also find that women on hormonal contraceptives bid significantly higher and earn substantially lower profits than men. This may be due to progestins contained in hormonal contraceptives or a selection effect.

related { The Impact of Female Sex Hormones on Competitiveness }

photos { Raymond Meeks }

It’s amazing how much more money I have when I’m drunk

Lots and lots of papers have now studied this question and the evidence is rather clear: the types of austerity that are most-likely to a) cut the debt and b) not kill the economy are those that are heavily weighted toward spending reductions and not tax increases. I am aware of not one study that found the opposite. In fact, we know more. The most successful reforms are those that go after the most politically sensitive items: government employment and entitlement programs.

photo { Nick Meek }