economics

A subtle, but significant tweak to Florida’s rules regarding traffic signals has allowed local cities and counties to shorten yellow light intervals, resulting in millions of dollars in additional red light camera fines.

{ 10 News | Continue reading }

U.S., economics, motorpsycho | May 14th, 2013 2:29 pm

In February 2012, a number of hedge fund traders noted one particular index–CDX IG 9–that seemed to be underpriced. It seemed to be cheaper to buy credit default protection on the 125 companies that made the index by buying the index than by buying protection on the 125 companies one by one. This was an obvious short-term moneymaking opportunity: Buy the index, sell its component short, in short order either the index will rise or the components will fall in value, and then you will be able to quickly close out your position with a large profit.

But February passed, and March passed, and April rolled in, and the gap between the price of CDX IG 9 and what the hedge fund traders thought it should be grew. And their bosses asked them questions, like: “Shouldn’t this trade have converged by now?” “Have you missed something?” […]

So the hedge fund traders began asking who their counterparty was. It seemed that they all had the same counterparty. And so they began calling their counterparty “the London Whale.” They kept buying. And the London Whale kept selling. And so they had no opportunity to even begin to liquidate their positions and their mark-to-market losses grew, and the risk they had exposed their firms to grew.

So they got annoyed. And they went public, hoping that they could induce the bosses of the London Whale to force him to unwind his possession, in which case they would profit immensely not just when the value of CDX IG 9 returned to its fundamental but by price pressure as the London Whale had to find people to transact with. And so we had ‘London Whale’ Rattles Debt Market, and similar stories.

The London Whale was Bruno Iksil [a trader working for the London office of JPMorgan Chase]. He had been losing, and rolling double or nothing, and losing again for months. His boss, Ina Drew, took a look at his positions. They found they had a choice: they could hold the portfolio and thus go all-in, or they could fold. They could hold CDX IG 9 until maturity–make a fortune if a fewer-than-expected number of its 125 companies went bankrupt, and lose J.P. Morgan Chase entirely to bankruptcy if more did. Or they could take their $6 billion loss and go home. What could they do if the bet went wrong and they had to eat losses at maturity? J.P. Morgan Chase couldn’t print money. So Drew stood Iksil down, and the hedge fund traders had their happy ending.

[…]

“Why did the interest rate on the Ten-Year Treasury peak at 4%? And why has it gone down since then? And why won’t it go back to its 5%-7% fundamental.” And they looked around. And they found Ben Bernanke. The Washington Super-Whale. […] From my perspective, of course, the hedge fundies’ analogy between the London Whale and the Washington Super-Whale is all wrong.

{ Brad DeLong | Continue reading }

traders | May 13th, 2013 12:27 pm

After a test showed that Kathleen didn’t have the BRCA breast cancer gene, her surgeon, Dr. Sonya Sharpless, suggested that environmental factors might be implicated. […] Did a lifetime of using cosmetics cause or contribute to Kathleen’s breast cancer? We don’t know. But here are some facts that every American woman and her loved ones should absorb.

The European Union bans nearly 1,400 chemicals from personal care products because they are carcinogenic, mutagenic, or toxic to reproduction. But in the United States, the Food and Drug Administration entrusts safety regulation of cosmetics to a private entity that is housed and funded by the industry’s trade association. To date, this entity has found only eleven chemicals to be “unsafe for use in cosmetics.” The FDA has no oversight of cosmetics products before they come on the market and, unlike the EU, leaves it to the cosmetics industry to determine which ingredients should be banned.

{ The Investigative Fund | Continue reading }

related { Disclosures reveal that corporations and lobbying firms award six-figure bonuses to staff who leave to take powerful positions on Capitol Hill. }

economics, health | May 12th, 2013 2:09 pm

Skipping meals can sabotage your shopping – and your diet, according to a new Cornell study. Even short term food deprivation not only increases overall grocery shopping, but leads shoppers to buy 31% more high calorie foods.

{ EurekAlert | Continue reading }

economics, food, drinks, restaurants, health | May 7th, 2013 10:12 am

economics, guns | May 7th, 2013 7:07 am

The four are members of a new idol group, Machikado Keiki Japan, and stocks play an important part in their performances.

“We base our costumes on the price of the Nikkei average of the day. For example, when the index falls below 10,000 points, we go on stage with really long skirts,” Mori explained.

The higher stocks rise, the shorter their dresses get. With the Nikkei index ending above 13,000, the four went without skirts altogether on the day of their interview with The Japan Times, instead wearing only lacy shorts.

{ Japan Times | Continue reading }

asia, economics, fashion | May 6th, 2013 10:41 am

“What people do in cities—create wealth, or murder each other—shows a relationship to the size of the city, one that isn’t tied just to one era or nation,” says Lobo. The relationship is captured by an equation in which a given parameter—employment, say—varies exponentially with population. In some cases, the exponent is 1, meaning whatever is being measured increases linearly, at the same rate as population. Household water or electrical use, for example, shows this pattern; as a city grows bigger its residents don’t use their appliances more. […]

If the population of a city doubles over time, or comparing one big city with two cities each half the size, gross domestic product more than doubles. Each individual becomes, on average, 15 percent more productive. Bettencourt describes the effect as “slightly magical,” although he and his colleagues are beginning to understand the synergies that make it possible. Physical proximity promotes collaboration and innovation, which is one reason the new CEO of Yahoo recently reversed the company’s policy of letting almost anyone work from home. […]

Remarkably, this phenomenon applies to cities all over the world, of different sizes, regardless of their particular history, culture or geography. Mumbai is different from Shanghai is different from Houston, obviously, but in relation to their own pasts, and to other cities in India, China or the U.S., they follow these laws.

{ Smithsonian | Continue reading }

art { Alex Roulette }

economics, mathematics, within the world | May 6th, 2013 6:41 am

A new molecule has been created by researchers in Chile that could make teeth ‘cavity proof’, killing the bacteria known to cause caries in less than 60 seconds.

Named ‘Keep 32′ after the number of teeth in the mouth, researchers Jose Cordova and Erich Astudillo hope the product could be used in toothpastes, mouthwashes, floss and even food. Chemical trials have shown that the cavity-causing bacteria Streptococcus mutans can be eliminated for hours with the molecule. […]

Procter & Gamble and five other chemical giants are fighting for the patent.

{ British Dental Journal | Continue reading }

economics, teeth | May 6th, 2013 6:33 am

On July 16, 2012, a painting by a little-known artist sold at Christie’s for $74,500, nearly ten times its high estimate of $8,000. The work that yielded this unexpected result — an acrylic teal-hued painting of a rocky coast called “Nob Hill” — was not the work of a 20-something artist finishing up his MFA. It was a painting created in 1965, and the artist, Llyn Foulkes, is 77 years old and has been working in relative obscurity in Los Angeles for the past 50 years. In March, the Hammer Museum in Los Angeles mounted a retrospective of his work, which will travel to the New Museum in June, marking the first time Foulkes will have had a retrospective at a New York museum. […]

The new interest in older artists isn’t just about scholarly rediscovery. The interest has less to do with the necessity of unearthing historical material to understand an artist’s career arc and more to do with feeding an insatiable market. “Unlike the past model where most galleries hosted one new exhibition every four to six weeks, many galleries now have two or more new exhibitions every turn-over,” said Todd Levin, and art advisor and director of Levin Art Group. “There’s a increasing need to fill the constantly expanding number of exhibition opportunities.”

Today, there are some 300 to 400 galleries in New York compared with the roughly 70 galleries in New York in 1970. As for the number of shows galleries mount each year, that has likewise increased: Gagosian mounted 63 last year at its galleries worldwide, David Zwirner had 14 shows at its spaces in New York and London, and Pace had 36 across its three galleries in New York, Beijing, and London.

{ Artinfo | Continue reading }

photo { Diane & Allan Arbus, Self-portrait, 1947 }

art, economics, new york | April 29th, 2013 11:11 am

The problem with human-resource managers is that they are human. They have biases; they make mistakes. But with better tools, they can make better hiring decisions, say advocates of “big data”. Software that crunches piles of information can spot things that may not be apparent to the naked eye. […]

Some insights are counter-intuitive. […] For customer-support calls, people with a criminal background actually perform a bit better.

{ Economist | Continue reading }

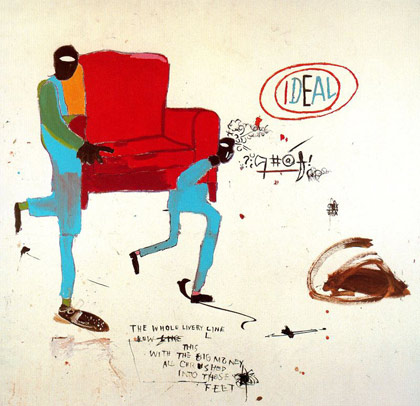

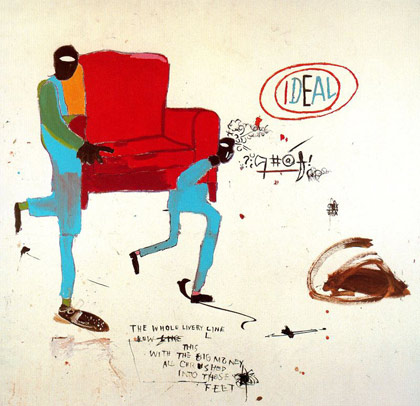

acrylic and oilstick on canvas { Jean-Michel Basquiat, Light Blue Movers, 1987}

economics, technology | April 24th, 2013 6:09 am

drugs, economics | April 21st, 2013 4:47 pm

Did you know Disney created its own confetti called ‘Flutterfetti,’ which was actually engineered to ‘flutter’ in the air better? Or that the parks will pump out a vanilla scent on Main Street because the smell triggers fond memories?

{ The Credits | Continue reading }

economics, kids | April 19th, 2013 1:12 pm

From assembly line robots to ATMs and self-checkout terminals, each year intelligent machines take over more jobs formerly held by humans; and experts predict this trend will not stop anytime soon. […]

“By 2015, robots should be able to assist teachers in the classroom. By 2018, they should be able to teach on their own, and this will cause many teachers to lose their jobs.” […]

The ultimate tool to replace doctors could be the nanorobot, a tiny microscopic-size machine that can whiz through veins replacing aging and damaged cells with new youthful ones. This nanowonder with expected development time of mid-to-late 2030s could eliminate nearly all need for human doctors. […]

Experts estimate by 2035, 50 million jobs will be lost to machines […] and by the end of the century, or possibly much sooner, all jobs will disappear. Some believe the final solution will take the form of a Basic Income Guarantee, made available as a fundamental right for everyone. […] America should create a $25,000 annual stipend for every U.S. adult, Brain says, which would be phased in over two-to-three decades. The payments could be paid for by ending welfare programs, taxing automated systems, adding a consumption tax, allowing ads on currency, and other creative ideas.

{ IEET | Continue reading }

economics, future, ideas, robots & ai | April 17th, 2013 1:51 pm

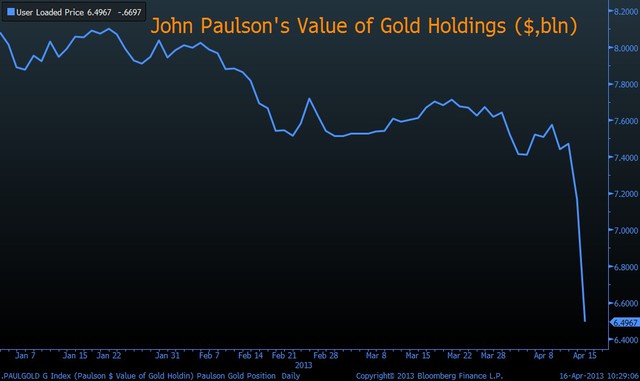

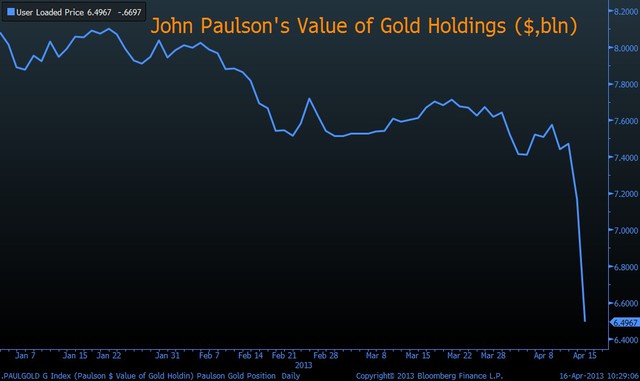

{ Hedge-fund manager John Paulson’s wager on gold wiped out almost $1 billion of his personal wealth in the past two trading days as the precious metal plummeted 13 percent. Paulson started the year with about $9.5 billion invested across his hedge funds, of which 85 percent was in gold share classes. | Businessweek | full story }

traders | April 16th, 2013 6:54 am

traders | April 15th, 2013 1:31 pm

The US Congress has severely scaled back the Stock Act, the law to stop lawmakers and their staff from trading on insider information, in under-the-radar votes that have been sharply criticised by advocates of political transparency.

The changes mean Congressional and White House staff members will not have to post details of their shareholdings online. They will also make online filing optional for the president, vice-president, members of Congress and congressional candidates. […]

The Stop Trading On Congressional Knowledge – or “Stock” – Act prohibited them from buying or selling stocks, commodities or futures based on non-public information they obtain during the course of their work. It also banned them from disseminating non-public information regarding pending legislation that could be used for investment purposes. […]

Political watchdogs were dismayed. “Are we going to return to the days when public can use the internet to research everything except what their government is doing?” asked Lisa Rosenberg of the Sunlight Foundation, which monitors money in politics.

{ Financial Times | Continue reading }

The Federal Reserve said early Wednesday that it inadvertently e-mailed the minutes of its March policy meeting a day early to some congressional staffers and trade groups.

Late this afternoon, the central bank released to reporters a list of more than 150 e-mail addresses that it says received the early e-mail on Tuesday afternoon. (The minutes had been scheduled for release a day later.) The list includes e-mail addresses for dozens of congressional staffers, along with contacts — many of them government-relations executives — at major banks, lobbying firms and trade groups.

{ WSJ | Continue reading }

We will provide the full list of people who manipulate and cheat the market shortly, but for now we are curious to see how the Fed will spin that EVERYONE got an advance notice of its minutes a day in advance without this becoming a material issue with the regulators, and just how many billions in hush money it will take to push this all under the rug.

{ Zero Hedge | Continue reading }

U.S., economics, law, scams and heists | April 15th, 2013 6:06 am

I think one of the things that make planning (and living) life so hard is the combination of the facts that

Its end date is uncertain;

It is rather highly likely that one’s faculties will be duller towards the end.

If it was certain that when we sleep on our 40th birthday, we wouldn’t wake up, how different would the world be?

[…]

There will be considerable pressure to have kids at age eighteen or so. […] Other people would attempt to maintain a collegiate lifestyle through their death at age forty. […]

The likelihood of warfare would rise, if only because the sage elderly won’t be around and male hormones will run rampant. […]

Credit would be harder to come by and the rate of home ownership would fall.

{ Tyler Cowen | Continue reading }

economics, ideas | April 12th, 2013 1:17 pm

A real-estate agent keeps her own home on the market an average of ten days longer [than she would for a client] and sells it for an extra 3-plus percent, or $10,000 on a $300,000 house. When she sells her own house, an agent holds out for the best offer; when she sells yours, she encourages you to take the first decent offer that comes along.

{ via Overcoming Bias | Continue reading }

buffoons, housing | April 12th, 2013 1:00 pm

economics, psychology | April 11th, 2013 5:57 am

As I reported a couple of weeks ago, a recent Senate bill came with a nice bonus for the genetically modified seed industry: a rider, wholly unrelated to the underlying bill, that compels the USDA to ignore federal court decisions that block the agency’s approvals of new GM crops. I explained in this post why such a provision, which the industry has been pushing for over a year, is so important to Monsanto and its few peers in the GMO seed industry. […]

Sen. Roy Blunt (R-Mo.) has revealed to Politico’s ace reporter David Rogers that he’s the responsible party. Blunt even told Rogers that he “worked with” GMO seed giant Monsanto to craft the rider.

{ Mother Jones | Continue reading }

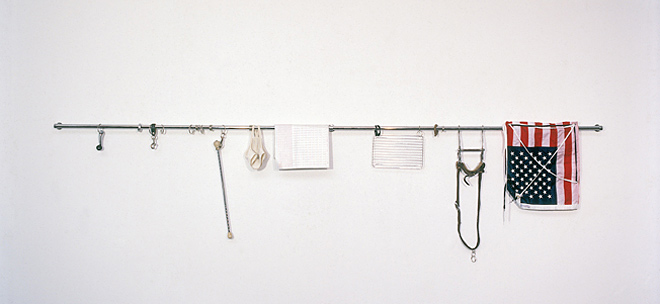

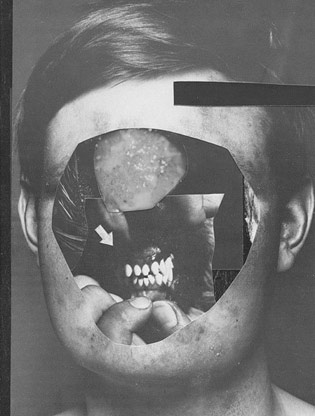

art { Cady Noland, Mutated Pipe, 1989 }

U.S., economics, food, drinks, restaurants, horror, law | April 5th, 2013 5:59 am