economics

Since September 7, .XXX domains are for sale. (That is, if you own a porn site or a trademark to protect – the rest of us have to wait till December 6 and hope nobody scoops our name first).

But the arrival of .XXX begs the question: How much of the internet is actually for porn? (…) In 2010, out of the million most popular (most trafficked) websites in the world, 42,337 were sex-related sites. That’s about 4% of sites.

{ Forbes | Continue reading }

photo { Roger Moore as James Bond, with Barbara Bach as Agent XXX, aka Major Anya Amasova }

economics, sex-oriented, technology | November 3rd, 2011 4:52 pm

We have the rise of the two-earner household and so previously if you just had the head of household working, and the head of household lost his job, it was less of an issue to move. Now if you have both members of the couple working and one of them loses their job, it’s very problematic to try to locate and try to find a better opportunity for both people. That’s one of the things that’s sort of been supporting large cities. If you look at what the data says–there’s been kind of a lot of work on this in the past two decades–it suggests, especially in recent decades, density has become quite important for improving productivity. (…) When a particular industry has a lot of participants in one geographical location, the whole industry gets better. It’s not just that there’s more competition, although that’s part of it, but that there’s a lot of cross-pollination of ideas between the participants, new spin-offs get started; so many aspects of that process take place in Silicon Valley, one of the examples you use, Boston, and other places like that; or in New York, the finance sector–some of them not so healthy–but a lot of innovations taking place that are harder to take place in geographically disparate locations. (…)

Places like New York, Boston, Washington, the Bay area–these are places that have been incredibly economically successful over the last ten years, and I think a lot of that is due to the way a lot of new technology has supported the high levels of human capital that they have. Made those places more productive. What’s striking is that this economic success, growth in wages, employment, to some extent, has not translated into a lot of population growth. In fact, quite the opposite. There has been some population growth there but most of that is due to natural increase or immigration. (…)

There’s been some interesting research on this lately which is that essentially there was no surplus labor in Silicon Valley in the late 1990s. Pretty low unemployment rate, like 2-3%. That was great for the workers who could afford to be there. Salaries were skyrocketing. But it was very difficult to attract new people. You wonder why, if salaries are going up so much, why wouldn’t people just be flooding into this market and taking advantage of that; and that’s because housing prices were growing even faster than compensation. So even as the tech industry was booming, people were leaving Silicon Valley. I think what’s interesting about that is that it put a chill on entrepreneurship; made it very lucrative to stay at a place that was established, to keep piling up stock options. It was much better to be a salaried worker than to be self-employed, so the rate of entrepreneurship in Silicon Valley at this point was much lower than the national average. You have a place that’s producing some of the best ideas; it’s a center for innovation; and it’s important that we start new businesses in the center of innovation–that’s what the research tells us. And yet it was very unattractive to start a new business at that point because the labor market was so tight, thanks to the tightness of the housing market.

{ Ryan Avent/EconTalk | Continue reading }

U.S., economics, ideas, new york | October 31st, 2011 3:17 pm

It’s now been a couple of weeks since Siri debuted as part of Apple’s iPhone 4S. (…)

Siri is hard to copy. For anyone who doesn’t understand voice applications, it’s easy to think that Siri will be easy to copy. It won’t. There are 2 parts to making a successful voice app: the voice rec technology which has improved a lot but is basically a commodity and the app itself, which is a combination of art and artificial intelligence. It’s that 2nd part that’s so tough to replicate and that’s why Apple bought Siri last year. It’s true Google has experience in the voice rec space and doing some simple voice apps but they do not have the personality and AI of Siri and that will be very difficult to copy — especially for a company that doesn’t sit at the intersection of the humanities and technology.

{ Forbes | Continue reading }

related { Apple gets Siri-ous about TV }

economics, robots & ai, technology | October 31st, 2011 12:00 pm

{ One of the film’s 210,000 extras | Five years ago, a relatively unknown (and unhinged) director began one of the wildest experiments in film history. Armed with total creative control, he invaded a Ukrainian city, marshaled a cast of thousands and thousands, and constructed a totalitarian society in which the cameras are always rolling and the actors never go home. | GQ | full story }

economics, showbiz | October 30th, 2011 2:25 pm

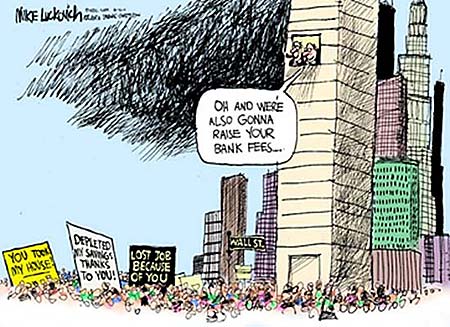

This article examines the role of storytelling in the process of making sense of the financial crisis.

Taken for granted assumptions were suddenly open to question. Financial products and practices that were once assumed to be sustainable sources of economic growth and prosperity swiftly became de-legitimized. Highly respected individuals and institutions (bankers, regulators) suddenly became widely detested.

The moral stories crafted during a public hearing in the UK that was designed to uncover ‘what (or who) went wrong’ during the recent financial crisis are examined. Micro-linguistic tools were used to build different emplotments of the ‘story’ of the financial crisis and paint a picture of the key characters, for example as ‘villains’ or ‘victims.’ The stories told by the bankers had assigned responsibility for the crisis and what should be done about it. These stories shaped both public opinion and policy responses.

The study illustrates when a crisis of sensemaking occurs, and the dominant and well-established storyline is no longer plausible a new story must be crafted to make sense of what happened and why.

The plot and characters of a story start to form a meaningful story only when discursive devices (linguistic styles, phrases, tropes and figures of speech) build up a moral landscape within which the events unfold.

{ Bankers in the dock: Moral storytelling in action | SAGE | full article }

economics, ideas | October 28th, 2011 12:00 pm

If you want to know why the Beastie Boys album Paul’s Boutique includes a sample from the White Album, while no subsequent piece of music has ever legally included a sample from the Beatles, the answer is copyright law. When sampling was new, the recording industry didn’t realize it could make money off samples, and they weren’t covered by copyright. Then the age of hip-hop mega-sellers arrived, and the holders of rights to pop classics discovered they could make more money on the remix than the original track ever pulled down.

The results of this licensing orgy are that it’s now almost impossible for a DJ or producer to license a sample for a reasonable amount of money. The odds of getting every artist sampled to OK the use of their work, and the resulting fees, preclude music like this from ever being sold; that’s why artists like Girl Talk simply give it away.

Legitmix, a track licensing platform, is here to cut the Gordian Knot of making tracks available to other musicians while getting artists paid for the use of their music. Its core innovation is the replacement of the old process — lawyers, contracts, permissions — with a straightforward API.

{ Mims’s Bits | Continue reading }

related { The key ingredient for a hit pop song? Reproductive messages. }

economics, music | October 28th, 2011 11:22 am

Something unexpected has happened at Apple, once known as the tech industry’s high-price leader. Over the last several years it began beating rivals on price. (…) Apple’s new pricing strategy is a big change from the 1990s, when consumers regarded Apple as a producer of overpriced tech baubles, unable to compete effectively with its Macintosh family of computers against the far cheaper Windows PCs. (…)

The aggressive pricing, analysts say, reflects Apple’s ability to use its growing manufacturing scale to push down costs for the crucial parts that make up its devices. Apple has also shown a willingness to tap into its huge war chest — $82 billion in cash and marketable securities last quarter — to take big gambles by locking up supplies of parts for years, as it did in 2005 when it struck a five-year, $1.25 billion deal with manufacturers to secure flash memory chips for its iPods and other devices.

By buying up manufacturing capacity ahead of time, Apple forces its competitors to scramble for the parts that are still available, raising costs for their products, analysts say. Apple is the biggest buyer of flash memory chips in the world, according to the research firm iSuppli.

{ NY Times | Continue reading }

I will spend my last dying breath if I need to, and I will spend every penny of Apple’s $40 billion in the bank, to right this wrong,” Jobs said. “I’m going to destroy Android, because it’s a stolen product. I’m willing to go thermonuclear war on this.”

{ Me & Her | Continue reading }

I watched the 60 Minutes interview with Steve Jobs’ biographer last night (video here), and I was aghast at something I learned: After Jobs learned of his pancreatic cancer, he delayed surgery by 9 months.

That decision was met with a massive push back from his friends and family. It was horrifyingly bad judgment. And, it likely cost him his life. He came to realize this towards the end of his life, according to his biographer.

{ Barry Ritholtz | Continue reading }

economics, technology | October 25th, 2011 2:21 pm

“When you sell a stock,” I asked him, “who buys it?” He answered with a wave in the vague direction of the window, indicating that he expected the buyer to be someone else very much like him. That was odd: because most buyers and sellers know that they have the same information as one another, what made one person buy and the other sell? Buyers think the price is too low and likely to rise; sellers think the price is high and likely to drop. The puzzle is why buyers and sellers alike think that the current price is wrong. (…)

In a paper titled “Trading Is Hazardous to Your Wealth,” Odean and his colleague Brad Barber showed that, on average, the most active traders had the poorest results, while those who traded the least earned the highest returns. (…)

Individual investors like to lock in their gains; they sell “winners,” stocks whose prices have gone up, and they hang on to their losers. Unfortunately for them, in the short run going forward recent winners tend to do better than recent losers, so individuals sell the wrong stocks. They also buy the wrong stocks. Individual investors predictably flock to stocks in companies that are in the news. Professional investors are more selective in responding to news. These findings provide some justification for the label of “smart money” that finance professionals apply to themselves.

Although professionals are able to extract a considerable amount of wealth from amateurs, few stock pickers, if any, have the skill needed to beat the market consistently, year after year. (…) At least two out of every three mutual funds underperform the overall market in any given year.

{ NY Times | Continue reading }

economics, psychology | October 24th, 2011 7:00 am

He is one of New York’s busiest casting directors, yet very few know of his work. (…)

For some 15 years, Mr. Weston has been providing the New York Police Department with “fillers” — the five decoys who accompany the suspect in police lineups.

Detectives often find fillers on their own, combing homeless shelters and street corners for willing participants. In a pinch, police officers can shed their uniforms and fill in. But in the Bronx, detectives often pay Mr. Weston $10 to find fillers for them.

A short man with a pencil-thin beard, Mr. Weston seems a rather unlikely candidate for having a working relationship with the Police Department, even an informal one. He is frequently profane, talks of beating up anyone who crosses him, and spends quite a bit of his money on coconut-flavored liquor.

But Mr. Weston points out that he has never failed to produce lineups when asked, no matter what time of night. “I never say no to money,” he said.

Across the nation, police lineups are under a fresh round of legal scrutiny, as recent studies have suggested that mistaken identifications in lineups are a leading cause of wrongful convictions, and that witnesses can be steered toward selecting the suspect arrested by the police.

But for all the attention that lineups attract in legal circles, Mr. Weston’s role in finding lineup fillers is largely unknown. Few defense lawyers and prosecutors, though they spar over the admissibility of lineups in court, have heard of him.

{ NY Times | Continue reading }

economics, law, new york | October 17th, 2011 1:48 pm

The genius behind the square tree was Robert Falls, who in the late 1980s was a PhD candidate in the U. of B.C. botany department. Falls noticed that some tree trunks exposed to high winds had become less round in cross section — they’d grown thicker on their leeward and windward sides to buttress themselves. Falls theorized that flexing of the bark by the wind encouraged the cambium— the layer of growth cells just beneath the bark — to produce extra wood. To test his theory, Falls subjected trees to what he thought might be comparable stress by scarring them with surgical tools. Sure enough, more wood grew at the site of the scars.

Hearing the news, a professor in the university’s wood science department suggested Falls try using this discovery to grow trees with a square cross section. Square trees would be a boon to the lumber industry. Since boards are flat and trees are round, only 55 to 60 percent of the average log can be sawed into lumber — the rest winds up getting turned into paper pulp and the like, or just gets thrown away. So Falls obligingly scarred seedlings of several species (western redcedar, black cottonwood, and redwood) at 90-degree intervals around their trunks. The trees responded as hoped, becoming “unmistakably squarish,” he tells me. (…)

Square trees were just the start. In 1989 Falls was awarded a Canadian patent for an “Expanded Wood Growing Process,” a bland title that fails to capture the revolutionary nature of the concept. Square trees by comparison are a mere novelty. The young scientist had come up with a way to grow boards.

{ The Straight Dope | Continue reading }

image { Bo Young Jung & Emmanuel Wolfs, Square Tree Trunk stool II, 2009 | bronze }

Dendrology, economics | October 14th, 2011 1:06 pm

Placing a value on a company is always a tricky business. History is filled with examples of disastrous valuations that are hard to credit in retrospect. The dotcom bubble of the late 90s is one of the best known examples.

And yet crazy valuations continue apace. One current bubble involves social media companies such as LinkedIn, Twitter, Groupon and, of course, Facebook. In July, the latter announced that it had 750 million users, an astronomical number that is dwarfed only by the company’s valuation which stands at anything from $65 billion to north of $100 billion.

By that measure, the company’s current and future users will each have to generate a remarkable amount of income for the company, numbers that reek of the boom and bust economics of the dotcom era.

So how much is Facebook really worth? Today, Peter Cauwels and Didier Sornette, econophysicists at the Swiss Federal Institute of Technology in Zurich, inject a little sanity into the debate. They argue that it is actually easier to value social media companies than other firmS because their revenue is so obviously based on a singe simple metric: the number of users.

All that is required is a reasonable model of user growth and a good understanding of the profit each user can generate.

For Facebook, user growth is pretty straightforward. Cauwels and Sornette argue that although Facebook’s growth has been exponential in the past, this cannot continue if only because of the finite number of people on the planet. Instead, Facebook user numbers will eventually level off, following a classic s-shaped curve.

Indeed, they say Facebook’s growth has already changed. In 2010, they say it switched from exponential to s-shaped.

The only question now is how high it will reach. Cauwels and Sornette offer three scenarios in which Facebook eventually plateaus at a base case of 840 million, a high growth case of 1.1 billion or a case of extreme growth reaching 1.8 billion users within a few years.

Cauwels and Sornette then calculate a value for the company based on the prospect of each user generating $1 profit per year, the approximate average over the last five years. This gives a value in the base case of $15 billion, in the high growth case of $20 billion and in the extreme growth case of $33 billion.

{ The Physics arXiv Blog | Continue reading }

economics, social networks | October 14th, 2011 12:00 pm

economics, haha, new york | October 13th, 2011 10:41 am

The Federal Reserve Bank of St. Louis and Harvard researchers both independently studied the correlation between believing in hell and economic development. Each analyzed years of data from dozens of countries, and in each case the results were the same: The more a population believes in hell, the less corrupt and more prosperous their country’s economy is.

{ Cracked | The 5 Weirdest Things That Control the Global Economy | Continue reading }

economics | October 13th, 2011 7:15 am

But this misconception about what is a reasonable commute is probably the biggest thing that is keeping most people in the US and Canada poor.

Let’s take a typical day’s drive for this self-destructive couple. Adding 38 miles of round-trip driving at the IRS’s estimate of total driving cost of $0.51 per mile, there’s $19 per day of direct driving and car ownership costs. It is possible to drive for less, but these people happen to have fairly new cars, bought on credit, so they are wasting the full amount.

Next is the actual human time wasted. At 80 minutes per day, the self-imposed driving would be adding the equivalent of almost an entire work day to each work week – so they would now effectively be working 6 workdays per week.

After 10 years, multiplied across two cars since they have different work schedules, this decision would cost them about $125,000 in wealth (if they had for example chosen to put the $19/day into extra payments on their mortgage), and 1.3 working years worth of time, EACH, spent risking their lives daily behind the wheel.

{ Mr. Money Mustache | Continue reading }

related { New York City and Washington have average commutes of about 34 minutes }

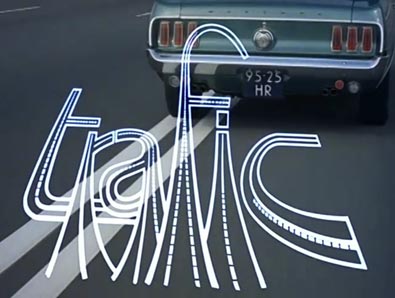

economics, transportation | October 12th, 2011 2:20 pm

Most shocking among UNICEF’s findings is that, despite pervasive discrimination against women, female-headed households in the poorest countries have, on average, better health and economic outcomes than male-headed, two-parent households. Taken together, these statistics suggest that men are nothing less than a complete waste of national resources; one might even wonder why the development community is devoting itself to such slow-motion efforts as microloans to women when the wholesale isolation or expulsion of men (after their sperm is collected and stored) could lift these countries out of poverty much faster.

{ The New Atlantis | Continue reading }

Women today are entering adulthood with more education, more achievements, more property, and, arguably, more money and ambition than their male counterparts. This is a first in human history, and its implications for both sexes are far from simple.

{ CATO Unbound | Continue reading }

photo { Garry Winogrand, Opening, Frank Stella Exhibition, The Museum of Modern Art, 1970 }

economics, genders, within the world | October 10th, 2011 10:30 am

The patent world is undergoing a change of seismic proportions. A small number of entities have been quietly amassing vast treasuries of patents. These are not the typical patent trolls that we have come to expect. Rather, these entities have investors such Apple, Google, Microsoft, Sony, the World Bank, and non-profit institutions. The largest and most secretive of these has accumulated a staggering 30,000-60,000 patents.

{ SSRN | Continue reading }

images { 1 | 2 }

economics, technology | September 27th, 2011 4:04 pm

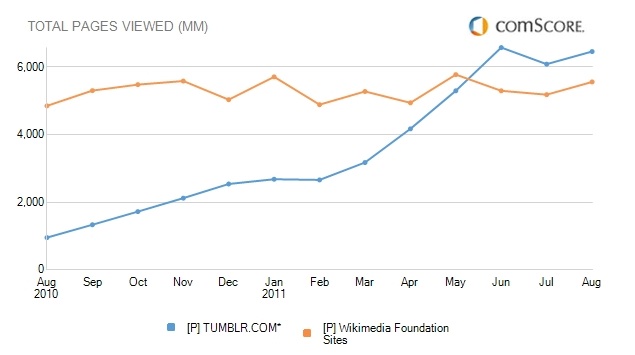

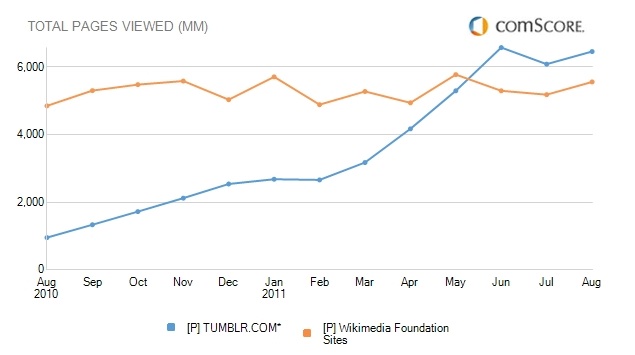

{ If you are wondering why Tumblr just raised $85 million, all you have to do is look at its pageviews. | Tumblr, Now Bigger Than Wikipedia | The Porn and Spam Behind Tumblr’s Meteoric Rise }

economics, porn, technology | September 27th, 2011 3:04 pm

With each passing day bringing us new predictions in the form of research reports, white papers, analyses, and plain old rants on what a Greek default would mean for the Eurozone, for the Euro, for markets, and for the world in general, it is clear that absolutely nobody knows what will happen. Alas, since this topic will be with us for a while until the can kicking finally fails, many more such prognostications will be forthcoming. Today, we present three different pieces, one from Reuters, which gives a 30,000 foot perspective, one a slightly more technical from Citi, looking at a Greek default from a rates point of view, and lastly, a primer from Goldman’s Huw Pill, looking at the aftermath of the current situation for the euro area, with or without a Greek bankruptcy. While we have no idea what will happen to global markets should Greece default, and it will, we are 100% certain that we will present many more such analyses in the future as more and more people piggyback on the Cassandra bandwagon.

{ Zero Hedge | Continue reading }

related { Six reasons why Greece should default }

economics | September 25th, 2011 7:56 pm

I predict that if we were to poll professional economists a century from now about who is the intellectual founder of the discipline, I say we’d get a majority responding by naming Charles Darwin, not Adam Smith. Smith, of course, would be the name out of 99% of economists if you asked the same question today. My claim behind that prediction is that in time, not next year, we’ll recognize that Darwin’s vision of the competitive process was just a lot more accurate and descriptive than Smith’s was. I say Smith’s–I really mean Smith’s modern disciples. Neoclassical economists. I think Smith was amazed that when you turn selfish people loose and let them seek their own interests, you often get good results for society as a whole from that process. I don’t think anybody had quite captured the logic of that narrative anywhere near as clearly as Smith had before he wrote. So, it’s a hugely important contribution. Smith, however, didn’t say you always got good results. He was quite circumspect about the claim. (…)

You go back and read Smith–it’s amazing his insights all across the spectrum have held up. Where I think he missed, or at any rate his modern disciples have missed a key feature of competition was–he saw clearly in a way that I don’t think others do yet, that competition favors individual actors. That’s what it does. Correct. Sometimes in the process it helps the larger group, but there are lots and lots of instances in which competition acts against the interests of the larger group. (…)

Familiar example from the Darwinian domain is the kinds of traits that have evolved to help individual animals do battle with one another for resources that are important. Think about polygynous mating species, the vertebrates; for the most part the males take more than one mate if they can. Obviously the qualifier is important; if some get more than one mate, you’ve got others left with none; and that’s the ultimate loser position in the Darwinian scheme. You don’t pass your stuff along into the next generation. So, of course the males fight with each other. If who wins the fights gets the mates, then mutations will be favored that help you win fights. So, male body mass starts to grow. Not without limit, but well beyond the point that would be optimal for males as a group.

{ Robert Frank/EconTalk | Continue reading }

economics, ideas | September 25th, 2011 7:55 pm

Whenever we get a day like today — down more than 500 points on the Dow at one point — my phone begins ringing with inquiries from various media.

They always ask the same question: What should investors be doing NOW?

That is the wrong question. The proper one is: What should investors have done in the past to prepare for an event like TODAY?

The bottom line remains that investing is a proactive — not reactive — endeavor. If you respond to every twitch, every news story, each turn of the wheel, you will become whipsawed.

That is no way to invest. And its no way to live life, stressing out over things that are out of your control.

What you can do is anticipate events that are cyclical in nature. These major shudders repeat every few years, so we should not be surprised by them. Construct a plan that allows you to ride out these events without panic or forced errors. You need a plan that anticipates these regular occurrences.

{ Barry Ritholtz | Continue reading }

economics, ideas, traders | September 22nd, 2011 8:26 pm