If you’re not inside, you’re outside, okay?

Mergers-and-acquisitions bankers make lists of companies that should do mergers or acquisitions, equity capital markets bankers make lists of companies that should issue stock, debt capital markets bankers make lists of companies that should issue bonds, etc. Once you have made the lists you get on planes (in normal times) and meet with the companies on the lists to explain to them why they should do mergers or issue stock or whatever. Occasionally they say “hmm you are right we should do a merger” and hire you to do the merger; then you will spend some time actually doing the merger, and you’ll get paid lots of money. But the top of the funnel consists of making lists.

You have to call them and say “hi it would help a lot with your company if you would do a merger.” For that, you need some finance. You need to say “you have a division that is underperforming and if you sold it the rest of your company would be better, so let me sell it for you and take a commission.” Or “there’s this company out there whose CEO wants to retire so you could buy it cheap and it would integrate really well with your widgets business and be accretive to earnings.” Or whatever. The list-making exercise requires some financial analysis. Not a whole ton: This is the top of the funnel, and you do not necessarily need a deep and nuanced understanding of all aspects of the company’s business and competitive landscape in order to come up with some acquisitions and divestitures it could do, though that does help. But, some financial analysis.

This can be creative interesting work, or it can be kind of sterile tedious work; in any case it tends to be unrewarding work, in the sense that if you come up with 100 possible deals and end up executing one of them that’s a pretty good hit rate. A lot of targeting begins with junior bankers making spreadsheets of companies that might be plausible targets based on some crude financial criteria; the senior bankers who have actually met with the companies whittle the spreadsheet down to the realistic targets, and then try to set up meetings with those companies to pitch ideas that still have a low probability of leading to a deal.

What if you could outsource all that work to the companies themselves? What if you built a targeting app that identifies plausible deals based on some crude financial criteria, then sent it to all the companies and said “hey maybe you should do M&A, this app will tell you, if it does then definitely give us a call.” Goldman Sachs Group Inc. has an app now.

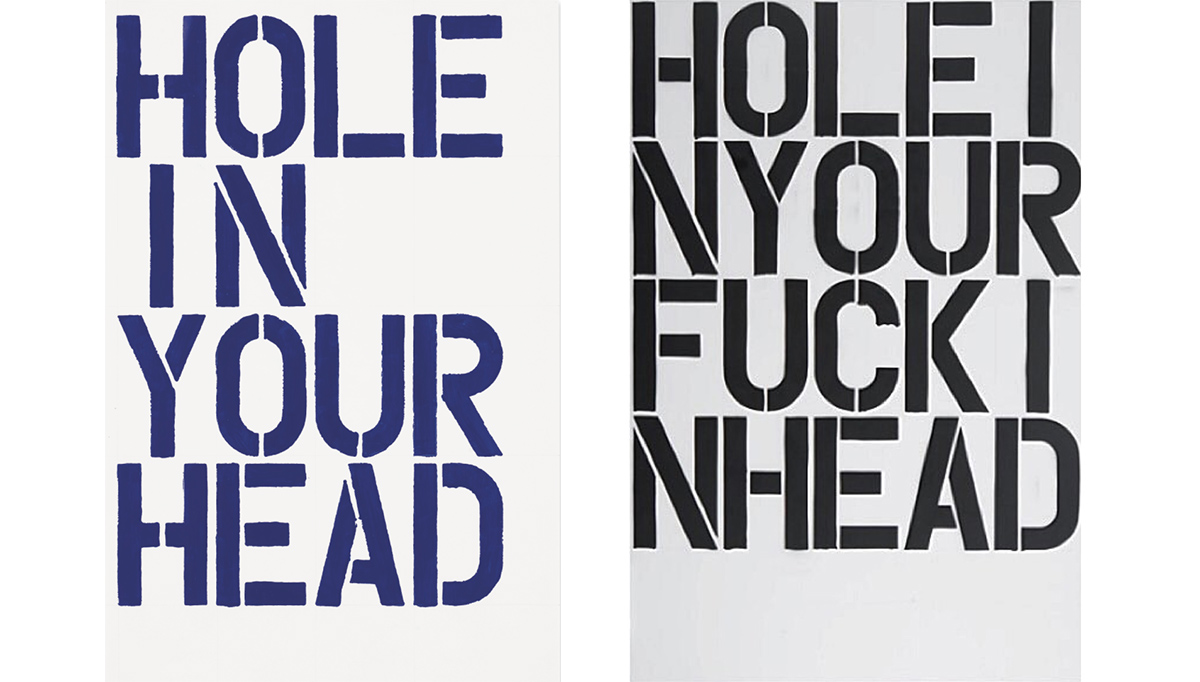

art { Christopher Wool, Untitled, 1992 | Christopher Wool, Hole in Your Fuckin Head, 1992 }