Olympic gold medals contain only 1% gold — would cost $25,000 if pure

You know, someone invented the XIV ETN. And someone invented the VIX, and VIX futures. And when you read the technical specifications for all of those things, it is clear that they are not trivial feats of engineering. Teams of marketers and traders and quants and technologists and lawyers put many hours into getting them just right, so that they would work as intended. They are technologies, highly engineered tools designed to help customers do things that they couldn’t have done before. They are financial technologies, built not out of screens and circuit boards but out of formulas and hedging strategies and legal documents, but that is what you’d expect: Financial firms ought to innovate in financial technology.

Yesterday Goldman Sachs Group Inc. Chief Executive Officer Lloyd Blankfein presented at the Credit Suisse Financial Services Conference, and his presentation is kind of a weird read. The running theme is that Goldman is doing technology stuff to win business. “Engineering underpins our growth initiatives,” says a summary page, and it doesn’t mean financial engineering. In fixed income, currencies and commodities, engineers are 25 percent of headcount, and the presentation touts growth in Marquee (its client-facing software platform) and “systematic market making.” In equities, Goldman touts its quant relationships. In consumer banking (now a thing!), the centerpiece is Marcus, Goldman’s online savings and lending platform. And in investment banking, “Engineering enhances client engagement through apps, machine learning and big data analytics.” […]

Instead of developing new financial technologies, Goldman is developing new computer technologies for its financial clients.

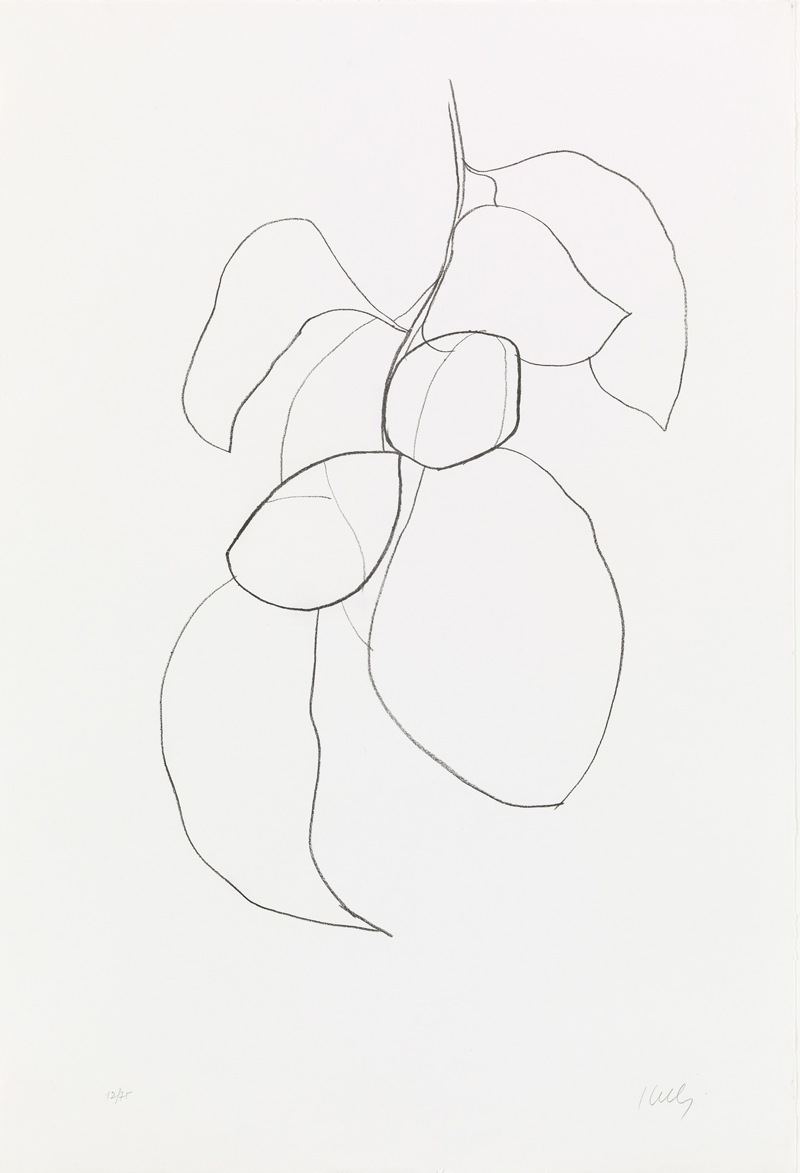

lithograph { Ellsworth Kelly, Camellia III, 1964–65 }